Understanding the Concept and Significance of a Financial Aid Letter

When navigating the complex world of higher education, many individuals find themselves exploring various options for monetary assistance. It’s a common journey for students and families who seek to ease the burden of tuition fees and other related costs. This support notification plays a vital role in clarifying what type of financial resources are available and how they can be utilized effectively.

Receiving this document can be a game-changer, providing essential insights into the types of funding you may qualify for. Its contents can often dictate the terms of your contribution towards school expenses, offering valuable details about grants, loans, and scholarships. Understanding this communication goes a long way in planning one’s educational finances, making it an important aspect of the overall experience.

In essence, this notification serves as a roadmap, guiding you through the various opportunities for funding your educational pursuits. Grasping its nuances can empower you to make informed decisions and take confident steps toward achieving your academic goals. Let’s dive deeper into what to expect and how to interpret this critical document effectively.

Understanding the Financial Aid Letter

When it comes to funding higher education, you’ll likely receive a document that outlines the support you can expect. This communication is essential for navigating your options and planning your journey. It provides clarity on what resources are available and helps you make informed decisions about your tuition and other related expenses.

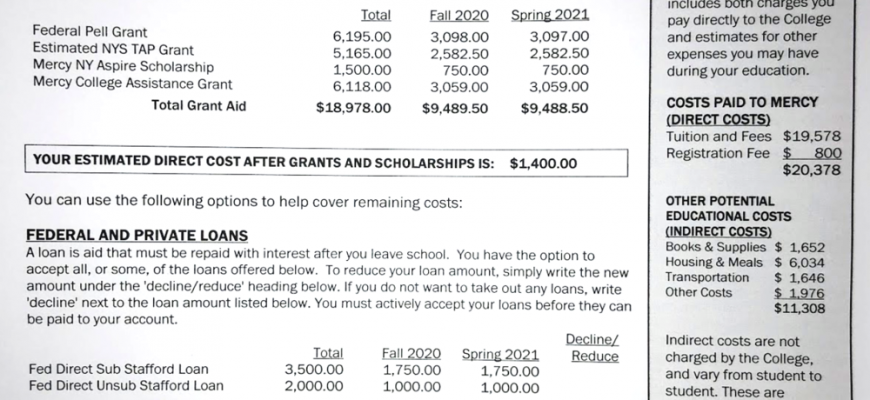

Typically, this correspondence contains various forms of assistance, including scholarships, grants, and loans. Each type carries its own set of conditions and repayment terms. It’s crucial to dissect this information carefully to understand not only how much you’ll receive but also any obligations you might have moving forward.

You may also come across terms that indicate the expected contributions from you or your family. These expectations can influence your overall strategy for managing costs. By analyzing the details presented, you can weigh your choices and determine the best path for your educational investment.

Take your time to review the supplied data thoroughly. Don’t hesitate to reach out to the institution if any part seems confusing. Being proactive in clarifying your position can make a significant difference in your funding journey. Ultimately, being well-informed empowers you to take control of your educational financing, leading to a more seamless experience.

Types of Assistance Available

When exploring options for support in pursuing education, it’s important to understand the variety of resources that can help lighten the financial burden. Different kinds of support exist to cater to varying needs and situations, ensuring that students can find something that aligns with their goals and circumstances.

One prominent category includes grants, which are typically awarded based on need and don’t require repayment. Scholarships, on the other hand, serve as merit-based recognition and can be awarded for academic achievements, talents, or specific interests. These two forms of support can significantly reduce tuition costs and make higher education more accessible.

Loans represent another avenue, allowing individuals to borrow funds that are paid back over time, often with interest. While this option provides necessary resources upfront, careful consideration is essential to understand the implications of debt. Furthermore, work-study programs offer students the chance to earn income while attending school, allowing them to balance studies with hands-on experience.

Lastly, institutional support can vary widely among colleges and universities. Some offer unique packages tailored to their student population, enhancing the financial options available. By exploring all these resources, students can construct a comprehensive strategy to navigate their educational journey with greater ease.

Interpreting Your Financial Aid Package

Understanding the components of your funding package can be a bit overwhelming at first, but breaking it down will help clarify what you’ve been offered and how it all fits into your educational journey. Each element represents different types of support available for your studies, and knowing how to interpret them can make a big difference in how you plan your finances.

Here are the key components to consider:

- Grants: These are typically need-based funds that do not require repayment, making them an excellent source of monetary support.

- Scholarships: Often awarded based on merit or specific criteria, these funds also do not need to be paid back, and they can significantly ease the burden of tuition costs.

- Loans: Unlike grants and scholarships, loans require repayment with interest. It’s crucial to understand the terms and conditions associated with any borrowed funds.

- Work-study programs: These opportunities allow you to earn money through part-time employment while attending school, helping you cover some of your expenses.

When reviewing your offer, keep these tips in mind:

- Calculate your net cost: Subtract any grants and scholarships from your total tuition and fees to see what you will actually need to cover.

- Understand the repayment specifics: For any loans, be sure to read the fine print regarding interest rates and repayment schedules.

- Explore other funding sources: Don’t hesitate to look for community scholarships or part-time job opportunities to supplement your package.

- Ask for help if needed: Use resources available to you, like financial services offices or advisors, to get clarification on any confusing points.

Taking the time to analyze your funding options will empower you to make informed decisions about your education. It’s all about finding the right balance and ensuring that you can focus on learning without excessive financial strain.