Understanding the Concept of Financial Aid Interest Rates and Their Impact on Borrowers

When navigating the landscape of educational assistance, it’s crucial to comprehend how the costs associated with borrowed funds can impact your financial journey. Proper knowledge in this area can make a significant difference in planning for your educational expenses. This section will break down the elements that define the pricing of loans and how they affect your overall financial health.

Many individuals often overlook the nuances related to expenses connected to borrowed money. These elements not only influence your monthly payments but also your long-term financial commitments. It’s essential to know how these factors interplay and what they mean for your budgeting as you embark on your academic pursuits.

As you delve deeper into this topic, you’ll uncover various elements that contribute to determining your overall repayment obligations. Gaining insight into these components will empower you to make informed decisions, allowing you to focus on what truly matters–your educational experience and future aspirations.

Understanding Financial Aid Interest Rates

Navigating the world of educational funding can feel overwhelming, particularly when it comes to managing costs. One of the crucial components in this landscape is the expense associated with borrowed funds. Knowing how these charges operate can greatly influence your decision-making process and financial strategy.

Charges on borrowed money can significantly impact the total sum you’ll repay over time. These expenses are typically expressed as a percentage, and different programs offer varying conditions. Understanding these differences is essential for making informed choices.

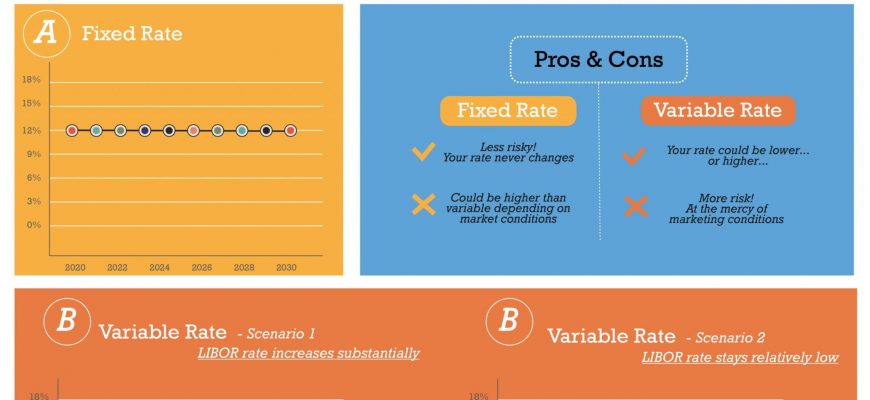

Many lenders provide a range of options, including fixed and variable expenses. Fixed amounts remain unchanged throughout the life of the loan, while variable amounts can fluctuate based on economic conditions. Each option comes with its own set of advantages and disadvantages, which can affect your future financial situation.

Additionally, some funding opportunities may offer subsidized charges, where the cost is temporarily covered while you’re in school. This can make a significant difference in how much you owe once you graduate. Therefore, it’s critical to evaluate your circumstances and compare the potential costs associated with different financial products.

In conclusion, grasping the nuances of borrowed funds can empower you to make better choices for your educational journey. Take the time to research, ask questions, and understand the implications of these financial commitments.

Types of Support and Costs

When it comes to pursuing education, there are various forms of assistance available to help ease the financial burden. Understanding these options can significantly impact your decision-making process. Different categories offer unique benefits and terms, revealing the diverse landscape of funding aimed at students.

One prominent form of support is a scholarship, which often doesn’t require repayment. These funds reward achievement or talent and can be offered by institutions, organizations, or even private donors. On the other hand, grants also provide monetary help without repayment obligations, typically awarded based on need. Various governmental and institutional programs contribute to this segment, ensuring accessibility for those who qualify.

For individuals looking at loans, there are several varieties, including subsidized and unsubsidized options. In a subsidized arrangement, the borrower typically sees the interest covered while studying, which can lead to lower overall expenses. Unsubsidized loans, while also providing necessary funds, start accruing charges immediately, making it crucial to consider the long-term impact on finances.

Lastly, work-study programs can offer both a source of income and valuable experience. These enable students to earn while learning, often related to their field of study, striking a balance between gaining skills and managing costs. Each type of assistance comes with its own set of rules and expectations, so it’s vital to weigh the advantages and drawbacks thoroughly before making commitments.

How Borrowers Are Affected by Rates

When individuals take out loans, the cost of borrowing can fluctuate significantly, heavily influencing their overall financial well-being. The nuances of these costs can transform how much one pays over time, impacting everything from monthly budgets to long-term savings. Understanding this dynamic is crucial for anyone looking to navigate the lending landscape effectively.

Higher charges usually mean increased monthly payments, which can strain a borrower’s budget. This scenario may lead to tough choices like cutting back on other expenses or even rethinking big-ticket purchases. Conversely, lower costs can ease financial pressure, allowing borrowers to allocate funds elsewhere, possibly toward investments or savings which could enhance their financial future.

The duration of the loan also plays a vital role. Longer terms with elevated charges can result in borrowers paying much more over the life of the loan compared to shorter terms, even if the monthly payments appear manageable. This aspect emphasizes the importance of considering both the immediate and long-term implications of borrowing arrangements.

Staying informed about how these costs fluctuate with market conditions can empower borrowers to make better decisions. Timing can be everything; seizing a favorable moment can lead to substantial savings. Ultimately, knowledge about borrowing expenses equips individuals to navigate their financial journeys with greater confidence and foresight.