Understanding the Financial Aid Index and Its Impact on Students

In today’s world, pursuing higher education often comes with a hefty price tag, making it essential for students to explore various avenues of support. Navigating the financial landscape can feel overwhelming, especially with a myriad of options available. This section delves into a central concept that serves as a crucial tool in determining the level of support one may receive, making the journey toward educational attainment more accessible.

The essence of this concept lies in its ability to evaluate the financial circumstances of individuals seeking help, allowing institutions to tailor their offerings accordingly. By taking into account various aspects of a person’s finances, this mechanism aims to ensure that assistance is distributed fairly, thereby empowering students from diverse backgrounds to pursue their academic goals without undue hardship.

As we dive deeper into this topic, we’ll uncover how this assessment not only influences the resources available to students but also shapes their overall academic experience. Understanding how this score operates can better prepare individuals to make informed decisions about their educational pursuits and financial responsibilities.

Understanding the Financial Aid Index

When navigating the world of higher education, many people come across a crucial measure that helps determine the support available to students. This concept plays a vital role in ensuring that opportunities for learning are accessible to everyone, regardless of their financial situation. It’s essential to grasp how this system operates to make informed decisions about college funding.

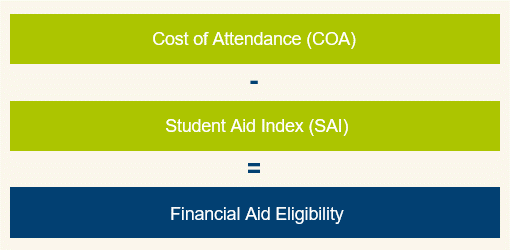

This measurement combines various personal and family financial details, creating a comprehensive picture of a student’s financial standing. Institutions utilize this information to assess eligibility for various funding options, which can significantly ease the burden of tuition and other expenses. Understanding how this process works can empower students and their families to take control of their educational financing.

The calculation typically considers factors such as income, savings, and other resources, as well as the size of the household and number of dependents. By interpreting these elements, schools can develop nuanced profiles that reflect the unique circumstances of each applicant. This approach aims to ensure that assistance is directed to those who truly need it, leveling the playing field for all prospective learners.

While it may seem complicated, grasping this framework opens the door to making strategic choices about funding. It encourages open communication with educational institutions, where students are often provided with guidance on how to maximize their potential support. Ultimately, being informed about this assessment can make a significant difference in managing the costs associated with pursuing higher education.

Factors Influencing Assistance Calculations

When it comes to determining how much support one can receive for educational purposes, several key elements come into play. These components shape the decisions made by institutions and contribute to the overall picture of support available to students. Understanding these factors can provide insights into the equation behind the numbers.

Income Levels play a significant role in the assessment process. The higher the earnings, the lesser the likelihood of receiving substantial help. This may seem straightforward, but various nuances exist, such as the income of parents, which can also impact the overall calculation significantly.

Family Size is another crucial aspect. A larger family may mean more dependents, which could lead to increased qualification for support. Institutions often consider how many individuals depend on the primary breadwinner, thus creating a more comprehensive understanding of financial needs.

Assets, including savings and property, also factor into the equation. While some institutions may limit the type of assets evaluated, the overall wealth can still affect the amount of assistance awarded. It’s essential to remember that not all assets are treated equally, and certain types may be exempt from scrutiny.

Educational Expenses, such as tuition and additional fees, are vital to consider as well. Each institution has its own cost structure, and understanding what expenses are included helps in gauging the potential support. By focusing on these costs, applicants can get a clearer idea of how much assistance they may realistically receive.

Lastly, Special Circumstances are worth mentioning. Factors like job loss, medical expenses, or other unexpected events may impact a family’s ability to contribute to educational costs. Many institutions allow for adjustments to be made in such situations, acknowledging that life can be unpredictable.

In summary, several interconnected factors influence the calculations made for educational support. By assessing income, family size, assets, educational expenses, and special circumstances, a more tailored approach is created to assist students in need.

How to Use Your Funding Assessment

Understanding your funding score can be a game changer when it comes to planning for your education expenses. It essentially provides a clearer picture of how much help you can expect based on your unique financial standing. Knowing how to leverage this score is crucial for making informed decisions about your schooling journey.

First, take a close look at the details behind your assessment. This number is influenced by various factors such as family income, household size, and savings. By familiarizing yourself with these elements, you can identify areas where you might improve your eligibility for assistance. For instance, if there are significant changes in your financial situation, it’s worth reporting them to the appropriate institutions so you can receive a more accurate evaluation.

Next, use your score to research available resources. Different programs and scholarships weigh financial circumstances differently, so understanding your position can help you target those that align best with your needs. Utilize online tools and databases to find options that cater specifically to your profile.

Additionally, don’t hesitate to discuss your situation with a financial guide or advisor at your school. They can provide insights tailored to your circumstances and help you navigate the often-complex landscape of funding opportunities. Remember, asking for help shows initiative and can open doors you might not have considered on your own.

Finally, keep an eye on deadlines. Many resources have specific timeframes for applications, and being proactive can significantly enhance your chances of receiving support. Stay organized, and don’t miss out on opportunities that could lighten your financial burden.