Understanding the Concept of Financial Aid in the United States and Its Importance for Students

Embarking on a journey through higher learning can feel like stepping into a labyrinth, with numerous paths and choices ahead. For many, the cost associated with this pursuit presents a substantial barrier. However, there is a silver lining. A variety of programs and resources are available to help students navigate these financial hurdles.

In an environment where tuition can be daunting, understanding the options for assistance becomes crucial. Various institutions, organizations, and government entities are dedicated to ensuring that students have the opportunity to thrive academically without being overwhelmed by expenses. These supportive measures come in different forms, enhancing access to knowledge and skills for all individuals.

Whether you’re a recent high school graduate or a non-traditional learner looking to advance your education, exploring these supportive avenues can empower you to realize your aspirations. The landscape of educational funding is diverse, offering numerous possibilities tailored to fit different needs and circumstances.

Types of Financial Assistance Available

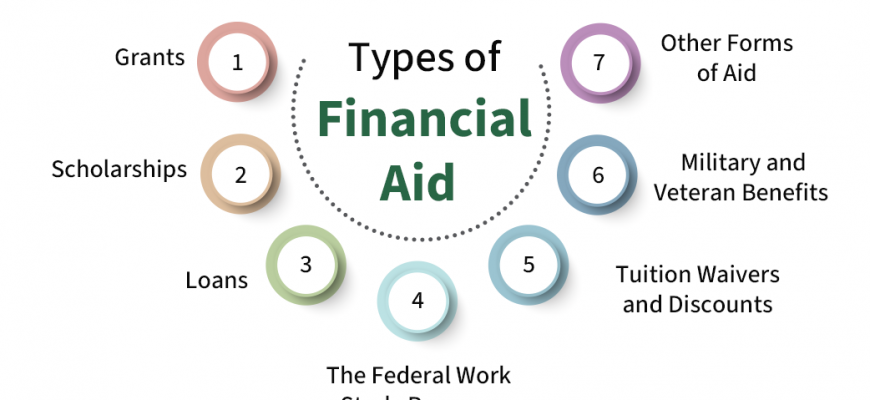

Navigating the various options for support can be quite overwhelming, but understanding the different forms can make a big difference in achieving educational goals. Numerous avenues exist for individuals seeking relief when it comes to the costs associated with schooling, each catering to unique circumstances and needs.

One popular choice is grants, which are funds that do not require repayment. These are typically awarded based on financial necessity and can come from the government or educational institutions. Scholarships, another common form of assistance, are often merit-based, recognizing academic achievement or special talents, also requiring no repayment.

Then, there are loans, which provide essential funds that students must pay back over time, usually with interest. These can come from private lenders or government programs, and understanding the terms is crucial for responsible borrowing. Additionally, work-study programs offer a practical way to earn money while studying, enabling students to balance work with their educational endeavors.

Lastly, some specific organizations and companies provide resources to particular demographics or those pursuing certain fields of study. Each type of support plays its own role in helping individuals overcome financial barriers, making education more accessible to everyone.

Eligibility Requirements for Financial Support

Understanding who qualifies for assistance can help students navigate the complexities of higher education funding. Several factors determine eligibility, and being aware of these can significantly impact the options available to prospective college-goers.

First and foremost, the applicant’s enrollment status plays a crucial role. Generally, individuals must be enrolled at least half-time in an accredited institution to qualify for various types of support. Additionally, the program of study may also influence eligibility, as some funding sources are limited to specific fields or degrees.

Another critical aspect is the financial situation of the applicant and their family. Most programs require the submission of detailed financial information to assess need. This usually involves filling out a comprehensive application to showcase income levels, assets, and other relevant factors that could affect support availability.

Citizenship status is also a determining factor. Typically, only U.S. citizens and eligible non-citizens are considered for many forms of funding. Institutions may have specific guidelines regarding residency, so it’s essential to check those as well.

Age and past academic performance can impact eligibility, too. Some forms of support prioritize students who are entering college for the first time, while others might favor those who demonstrate consistent academic success. It’s wise to maintain good grades and stay informed about institutional requirements.

How to Apply for Funding

Navigating the journey to secure resources for your education can feel overwhelming, but breaking it down into manageable steps makes it easier. Identifying the right opportunities and understanding the process will help you get closer to your goals.

Here’s a straightforward guide to help you through the application process:

- Research Available Options

Start by exploring different types of support, such as scholarships, grants, and loans. Each option has its own eligibility criteria and application methods.

- Gather Your Documents

Prepare important paperwork that may be needed, including:

- Transcripts from previous studies

- Letters of recommendation

- Personal statements or essays

- Tax returns and financial information

- Fill Out Applications

Complete the necessary forms for each type of support you’re seeking. Ensure you provide accurate and honest information.

- Meet Deadlines

Pay attention to submission dates. Missing a deadline can cost you an opportunity, so organize your time efficiently.

- Follow Up

After submitting your applications, don’t hesitate to check on their status. Communicating with organizations can be beneficial.

With a bit of diligence and organization, you can successfully navigate the funding landscape for your studies. Good luck!