Understanding Financial Aid Options for University Students

As the journey of pursuing higher education unfolds, many individuals encounter the pressing need for various assistance programs. These services play a crucial role in helping students navigate the often complex world of tuition fees, living expenses, and academic materials. By offering support, they pave the way towards achieving educational goals without being overwhelmed by financial burdens.

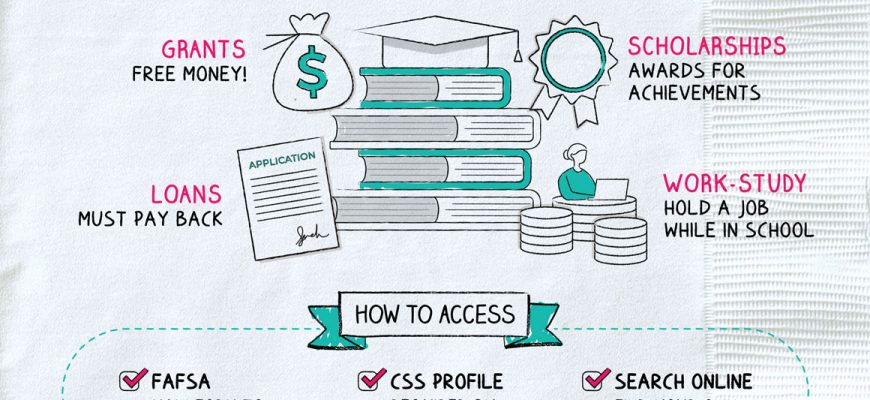

It’s important to recognize that these resources come in various forms, including grants, scholarships, and loans. Each option serves a unique purpose, catering to diverse needs and circumstances. Exploring these opportunities can significantly ease the transition into the academic realm, making it more accessible for aspiring scholars from all walks of life.

Taking advantage of these programs not only enhances educational experiences but also empowers students to focus on their studies, engage in extracurricular activities, and build lasting connections. Ultimately, understanding the landscape of available support options can transform a challenging endeavor into an enriching and fulfilling adventure.

Understanding Financial Aid Options

When it comes to pursuing higher education, navigating the multitude of funding opportunities can be quite the adventure. Many individuals may find themselves overwhelmed by the various forms of financial support available. It’s essential to explore and comprehend these resources, as they can significantly alleviate the burden of educational expenses.

Many students have access to grants, scholarships, loans, and work-study programs, each offering unique advantages. Grants typically do not require repayment and are often need-based, while scholarships reward academic or extracurricular achievements. On the other hand, loans are borrowed funds that require repayment after graduation, sometimes with interest. Work-study programs provide students with part-time employment to earn money for their studies, giving them valuable work experience alongside their academic commitments.

Understanding eligibility criteria for these resources is crucial. The process often involves completing specific applications, such as the FAFSA, to assess financial needs and determine which options best suit individual circumstances. Each type of assistance has its own set of requirements, and being aware of these can save time and effort during the pursuit of educational funding.

In conclusion, grasping the different types of financial support is key to making informed decisions about funding your educational journey. Taking the time to research and understand these options can open doors to possibilities that might otherwise seem out of reach.

The Role of Scholarships in Education

When it comes to pursuing higher learning, having the right support can make all the difference. One of the most impactful ways to ease the financial burden is through scholarships. These awards not only help cover tuition fees but also open doors to opportunities that might otherwise be out of reach.

Scholarships can empower students by providing them the resources needed to focus on their studies without the constant worry of how to pay for their education. They promote accessibility, allowing talented individuals from various backgrounds to pursue their dreams. With less financial stress, students can dedicate their time and energy to learning and personal development.

Moreover, receiving such awards can enhance a student’s resume and provide an edge in the competitive job market. Employers often recognize determination and academic excellence, which are evident in scholarship recipients. These accolades can signal a strong work ethic and commitment to achieving goals.

In addition, scholarships foster a sense of community. Many organizations and institutions offer these funding opportunities not just to support individual students but also to encourage a diverse and inclusive atmosphere within academic settings. This diversity enriches the learning experience for everyone involved, creating a vibrant educational environment.

Ultimately, scholarships play a crucial part in shaping the educational landscape. By providing necessary resources, they help nurture talent and inspire future leaders, making a lasting impact on individuals and society as a whole.

Navigating Student Loans and Repayment

Stepping into higher education often comes with a hefty price tag, and many students find themselves exploring the world of borrowing to cover their tuition and living expenses. Understanding how to manage these loans and repayment options can make a world of difference in achieving your academic goals without sinking into financial stress.

First things first, it’s essential to choose the right type of borrowing. There are various options available, and each comes with its pros and cons. Some might offer lower interest rates, while others could provide more flexible repayment schedules. Take the time to research and weigh your options. This can save you from headaches later on.

Once you’ve secured funding, keeping track of your borrowing will help you stay organized. Keep records of all the amounts, interest rates, and any correspondence you have with lenders. This knowledge will empower you as you navigate through school and beyond. Also, don’t forget about the grace period that often comes after graduation; it allows you some breathing room before payments kick in.

As repayment approaches, consider exploring different plans. Many lenders offer various repayment strategies that can cater to your financial situation. For instance, income-driven plans can adjust your monthly payments based on your earnings, ensuring you won’t feel overwhelmed. This flexibility can make a noticeable difference in your monthly budget.

Lastly, don’t hesitate to seek assistance if you run into difficulties. Organizations and counselors can provide guidance tailored to your circumstances. Remember, you’re not alone in this journey. Taking proactive steps now can lead to smoother sailing in your financial future.