Understanding Financial Aid Options Available in the United States

Many students in the country seek assistance to help manage the expenses associated with their studies. The journey through higher education can often feel overwhelming when faced with tuition, books, and living expenses. Fortunately, there are various resources designed to make this path a bit smoother, allowing individuals to focus on their academic pursuits without being burdened by financial stress.

Numerous programs and initiatives serve as a safety net for those aiming to achieve their educational goals. These opportunities not only relieve some of the monetary pressures but also empower learners to pursue their passions and ambitions. From scholarships that reward merit to need-based programs, there is a range of options available to support a diverse group of aspiring scholars.

In this discussion, we will explore these essential resources that play a critical role in shaping the educational landscape. Understanding how to navigate this realm can open doors and provide much-needed encouragement for many who dream of enhancing their knowledge and skills.

Understanding Financial Aid Options

Exploring support options for education can feel overwhelming, but it’s essential to know there are various resources out there to help. Whether you’re a high school graduate or an experienced professional looking to enhance your skills, understanding what’s available can make a significant difference in pursuing your academic goals.

Scholarships are one of the most sought-after types of assistance. These are funds that do not have to be repaid and can be awarded based on various criteria such as academic merit, talent, or community involvement. Many organizations and institutions offer scholarships, making them accessible to a wide range of individuals.

Another popular route includes grants, which are typically awarded based on financial need. These funds also do not require repayment, allowing students to focus on their studies without the burden of debt. Different sources provide these, including government entities and private foundations, each with its own eligibility criteria.

Work-study programs present an opportunity for students to gain practical experience while earning money to help cover their educational expenses. These programs often allow participants to work part-time in jobs related to their field of study, providing both financial support and valuable experience.

Lastly, loans serve as an option for those who need additional financial support. Unlike scholarships and grants, loans must be repaid, often with interest. It’s crucial to research different types of loans available, as they come with varying terms and conditions.

In summary, whether you choose scholarships, grants, work opportunities, or loans, understanding your options is vital for making informed decisions. Taking the time to explore these avenues can lead to a much smoother educational journey.

Types of Assistance Available

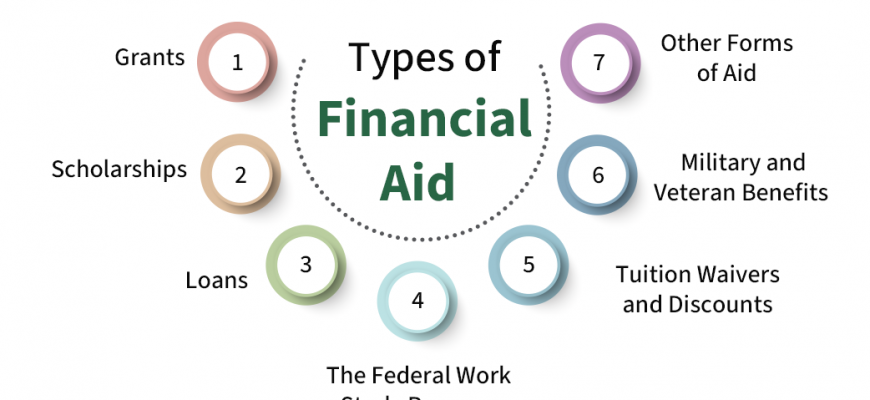

When you’re looking for ways to support your education journey, you’ll discover a variety of resources ready to help lighten the financial burden. Different options come in various forms, each with its own set of benefits and requirements. Understanding these resources can empower you to make informed decisions as you navigate your educational path.

One popular type involves scholarships, which are essentially funds that do not require repayment. These can be awarded based on merit, financial need, or specific talent areas, offering a fantastic incentive for academic achievement or extracurricular involvement.

Another option is grants, similar to scholarships but often tied more closely to demonstrated financial circumstances. These funds also come without repayment requirements, making them an attractive choice for many students facing financial challenges.

For those who may require additional support, loans are available that provide funds now with the expectation of future repayment. While these can be helpful in bridging the gap, it’s essential to be aware of the terms and conditions to avoid overwhelming debt later on.

Lastly, work-study programs allow students to earn money while studying. Participating in part-time jobs related to their field of study not only offers financial support but also valuable work experience. Exploring these diverse options can significantly enhance your educational experience while ensuring that financial concerns don’t hold you back.

How to Apply for Support

Applying for assistance can seem overwhelming at first, but breaking it down into manageable steps makes the process much simpler. Understanding what documents you need and where to submit everything can help you feel more confident as you navigate through this journey.

Here’s a quick guide to get you started:

- Gather necessary documents:

- Identification proof (such as a driver’s license or passport)

- Income verification (W-2 forms, pay stubs)

- Enrollment information from your institution

- Fill out the application:

- Access the appropriate form online or through your institution

- Completing the form accurately is crucial, so take your time

- Submit your application:

- Check the deadlines for submission carefully

- Ensure that all required documents are included

- Follow up:

- Keep track of your application status by contacting the relevant office

- Stay organized to avoid missing any additional requests for information

By taking these steps, you’ll enhance your chances of receiving the support you need. Remember, every journey is unique, so don’t hesitate to seek guidance along the way!