Understanding the Concept of Financial Aid in Higher Education Institutions

Getting a higher education can often feel like an uphill battle, especially when it comes to managing the costs involved. Many young adults share the dream of pursuing their studies and gaining the experience needed for their future careers, but the financial burden can be overwhelming. Fortunately, resources have been established to help ease this pressure and make education more accessible to everyone.

There are various types of resources available that can assist students in managing their tuition and related expenses. This support comes in many forms, including grants, scholarships, and loans, each designed to cater to different needs and circumstances. Navigating the options might seem daunting, but understanding these opportunities can significantly impact the educational journey and pave the way for success.

Embracing these opportunities not only helps alleviate the stress of financial limitations but also empowers students to focus on what truly matters: their studies and personal growth. In this discussion, we’ll delve deeper into the various sources of support and how they can influence the educational experience, making the dream of obtaining a degree more attainable.

Understanding Financial Aid Options

When it comes to funding your academic journey, there are various avenues available to help ease the financial burden. Navigating these avenues can be overwhelming, but breaking them down can make the process more manageable. Let’s explore the different types of assistance that you might encounter and how they can support your educational goals.

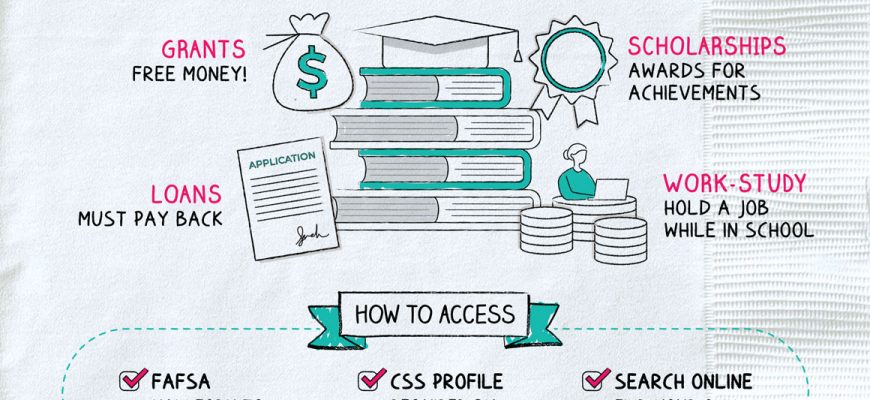

Here are some key categories to consider:

- Grants: These are funds that do not require repayment. They are usually based on financial need and can come from federal, state, or institutional sources.

- Scholarships: Similar to grants, scholarships are gifted funds. They often consider merit, academic achievement, or other criteria such as talent or community involvement.

- Work-Study Programs: These initiatives allow students to work part-time during their studies, helping to cover expenses while gaining valuable experience.

- Loans: Unlike the previous types, loans must be repaid with interest. They can be federal or private, each with specific terms and conditions that need careful consideration.

It’s vital to assess your unique circumstances and goals when exploring these options. Here are some practical steps to guide you:

- Research the options available through your institution.

- Complete required applications or forms to determine your eligibility.

- Consult with financial advisors or counselors for personalized advice.

- Keep track of deadlines to maximize your opportunities for support.

Understanding these resources can significantly aid in planning your finances and ensuring that you achieve your academic objectives without excessive debt. Taking the time to explore each option can pave the way for a successful educational experience.

Types of Assistance Available for Students

When it comes to pursuing higher education, there are various forms of support that can help lighten the financial burden. Each type has its unique features and benefits, catering to different needs and circumstances. Understanding these options can make the journey smoother for many aspiring learners.

One popular form is scholarships, which are often awarded based on merit, talent, or specific criteria. These funds don’t need to be repaid, making them an attractive choice for many. They can cover tuition fees, books, or even living expenses, allowing students to focus on their studies without worrying about finances.

Grants are another excellent resource. Typically based on financial necessity, these funds are designed to help those who demonstrate a genuine need. Like scholarships, grants do not require repayment, providing crucial support during the academic journey.

Then you have work-study programs, which offer students the chance to earn money while attending their classes. This kind of assistance allows learners to gain valuable experience and skills while alleviating some of the financial pressures associated with higher education.

Lastly, there are loans that students can secure to finance their studies. While these funds must be repaid, they can cover a significant portion of tuition and other expenses. It’s essential to carefully consider repayment terms and interest rates when opting for this type of support.

In summary, there’s a range of resources available to help students navigate their educational expenses. By exploring all these options, individuals can find the right combination of support that best fits their unique situations.

How to Apply for Assistance

When it comes to getting support for your education, knowing the right steps to take can make all the difference. Navigating the process may seem overwhelming at first, but with a bit of guidance, you can secure the help you need to make your academic journey smoother.

Start by researching the various options available for support. There are numerous resources, including government programs, institutional grants, and private scholarships. Take the time to explore what you qualify for based on your situation and background.

Your first major step will involve completing necessary forms, like the FAFSA, which is essential for many types of assistance. Gather all needed documents beforehand, such as tax returns and financial statements, to streamline the process. Accurate information will help you avoid delays in processing.

After submitting your application, keep an eye on communication from the institutions or organizations you applied to. They may request additional information or offer you different options. Be proactive and responsive to ensure you don’t miss out on any benefits.

Lastly, don’t hesitate to seek help. Reach out to your school’s support office or financial counselors who can provide insights and further resources. Remember, applying for support is a common step for many students, so you’re not alone in this process.