Understanding the Concept of Expected Family Contribution in Financial Aid Programs

When it comes to pursuing higher education, many people face the challenge of figuring out how to afford it. The cost of tuition, books, and living expenses can add up quickly, leaving students and their families searching for ways to ease the financial burden. Fortunately, there are various avenues available to help alleviate these pressures, allowing individuals to focus more on their studies and less on their wallets.

One key concept in this realm revolves around the assessment of a family’s economic standing. This evaluation plays a crucial role in determining the level of assistance that students may qualify for. By understanding this process, families can better navigate the complexities of securing the necessary resources for academic success.

The journey to uncovering potential support begins with recognizing the numerous options out there. From government programs to institutional scholarships and grants, there are many pathways to explore. It’s essential to become familiar with these resources and how they can significantly impact one’s educational journey.

Understanding Financial Support and Expected Family Contribution

When it comes to pursuing education, many individuals and families find themselves navigating a complex web of funding options. This journey often involves determining how much assistance one can receive, as well as the expected contribution from the family. Each of these elements plays a crucial role in making educational dreams a reality.

Support can come in various forms, including grants, scholarships, and loans. These resources are designed to help bridge the gap between the costs of education and what families can afford. People often have questions about how different types of support are awarded, and what factors influence the amount given to each individual. It’s essential to understand the criteria that colleges and universities use to assess eligibility for these resources.

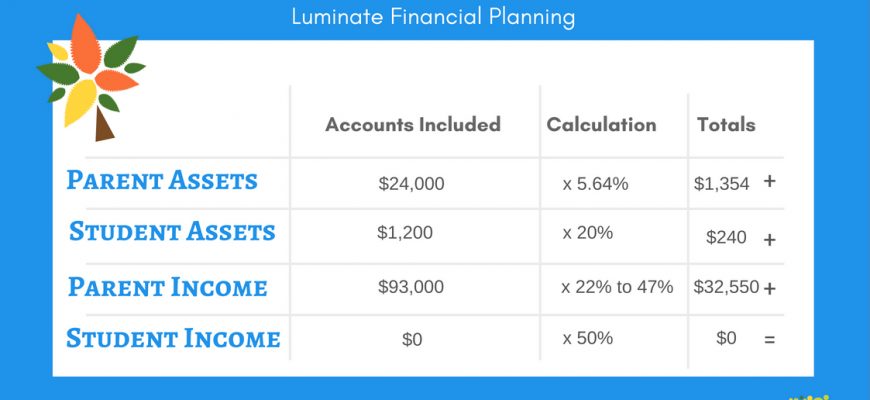

On the other hand, the family contribution is a significant piece of this puzzle. It reflects the amount that a family is expected to provide toward the education expenses. This figure takes into account various financial details, such as income and assets. Understanding how this value is calculated can help families better prepare for their educational investments and make informed decisions.

Ultimately, grasping the intricacies of assistance and family contributions will empower individuals to navigate the funding landscape more effectively. This knowledge not only aids in planning but also alleviates some of the stress associated with financing education.

Calculating Your Expected Family Contribution

Understanding how much your family can realistically contribute towards your education is essential for planning your financing strategy. This calculation helps you assess the financial obligations while keeping your goals in sight. It’s all about determining what resources are available to help you on your academic journey.

To figure this out, you’ll need to gather information about your household income, assets, and the number of family members attending college. Various formulas are used, but the focus usually revolves around assessing the financial strength of your household. This can involve looking at things like tax returns, bank statements, and even untaxed income sources.

One crucial point to remember is that this figure is not a fixed amount but rather a guideline. It reflects your family’s potential to support your higher education expenses, based on the information provided. Once you have a clearer picture, you’ll be in a better position to make informed decisions about budgeting and exploring all your options.

Ultimately, this assessment can open doors to various opportunities, helping you identify additional funding sources that might be necessary to cover your costs. Being proactive about understanding your expected contribution can set you on the right path toward achieving your academic dreams.

Types of Financial Assistance Available

There are various avenues to explore when it comes to resources that can help ease the burden of education costs. Understanding the different forms of support available can significantly impact your ability to pursue your academic goals without overwhelming debt. From government programs to private options, each type offers unique benefits tailored to individual needs.

One common form is grants, which are typically awarded based on financial necessity. These funds do not require repayment, making them a valuable resource for students looking to minimize their costs. Scholarships, on the other hand, reward academic achievement, talents, or specific interests. They can come from schools, organizations, or private entities and can provide substantial financial relief.

Loans are another option, providing funds that must be paid back over time. They often have lower interest rates than traditional loans, making them a practical choice for many learners. Additionally, work-study programs allow students to earn money while attending school, helping to cover expenses and gain work experience.

Lastly, specific assistance tailored to certain groups, such as veterans or individuals with disabilities, can further broaden the scope of financial help. By taking the time to research and apply for these possibilities, students can create a more manageable financial plan for their education journey.