Exploring the Key Factors that Determine Financial Aid Eligibility

Navigating the world of higher learning can feel overwhelming, especially when it comes to the various forms of assistance available to help cover expenses. Many individuals find themselves wondering how these resources are determined and what factors influence the support they may receive. It’s not just about the numbers; it’s about the unique circumstances of each person seeking help.

When exploring these options, it’s essential to recognize that several elements play a role in this complex landscape. From personal income levels to family size and the type of institution one wishes to attend, many aspects come into play. Those seeking support often need to delve deep into their financial situation and academic goals to ensure they fully understand the opportunities available to them.

Ultimately, it’s a matter of aligning needs with resources. With the right information and guidance, anyone can uncover the possibilities that exist and make informed decisions that pave the way for achieving their educational dreams. Emphasizing personal circumstances while navigating this landscape can create pathways to a brighter future.

Understanding the Types of Financial Aid

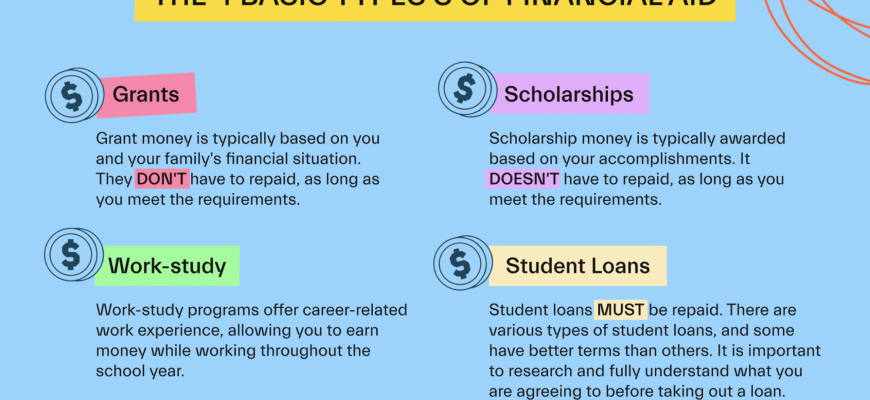

When it comes to funding your education, various options exist that can significantly alleviate the burden of costs. These forms of assistance come in different shapes and sizes, each serving a unique purpose to support students in their academic journeys. Knowing what’s available can make a big difference in how you navigate the financial landscape of higher learning.

The first category typically includes awards that do not require repayment. These resources are often merit-based or need-based, aimed at recognizing academic achievements or addressing specific financial situations. Scholarships and grants are prime examples of this type, providing essential support without the obligation of returning the funds.

On the other hand, some options will require repayment, usually involving borrowed funds. Loans are a common route for students looking to cover tuition and living expenses, allowing them to invest in their future. It’s crucial to understand the terms and conditions of these loans, as well as the implications of accruing interest over time.

Additionally, work opportunities play a vital role in assisting individuals financially. Many institutions offer programs that let students earn income while gaining practical experience. This approach not only helps with living expenses but also enhances skills and resumes, making students more competitive in the job market.

Lastly, there are specific programs tailored for particular groups of people, such as veterans, minorities, or those pursuing STEM fields. These initiatives aim to promote diversity and inclusion within educational environments, providing targeted resources for those who may face unique challenges in financing their education.

Eligibility Criteria for Financial Support

When it comes to receiving assistance for educational pursuits, there are specific benchmarks that individuals must meet. These factors often determine who qualifies for support and shape the overall process. Understanding these stipulations can play a significant role in navigating the options available.

The first aspect typically revolves around academic performance. Most programs look for evidence of strong grades or standardized test scores. This ensures that recipients have a solid academic foundation to succeed in their studies.

Another important consideration is the financial situation of the applicant or their family. Many organizations aim to provide help to those in need, so demonstrating economic necessity is crucial. Documenting income levels and other financial obligations can significantly impact one’s eligibility.

Residency status often comes into play as well. Applicants may need to show proof of their citizenship or legal residency. This criterion can vary greatly depending on the institution or organization offering support.

Lastly, involvement in community service or extracurricular activities may enhance an application. Demonstrating commitment to personal growth and community engagement can set candidates apart from others.

By meeting these requirements, individuals position themselves favorably to receive support that can greatly enhance their educational journey.

The Role of Income in Assistance Decisions

When it comes to obtaining support for education, the financial situation of a family plays a crucial role. Evaluating a household’s earnings helps determine how much help a student might receive. Naturally, if a family’s income is lower, they are typically eligible for more resources, as the need is greater. Conversely, those with higher earnings may find themselves receiving less assistance, reflecting their enhanced ability to contribute to their educational expenses.

Income also helps institutions gauge overall eligibility and set priorities for distributing their resources. Schools aim to ensure that aid is going to those who truly require it. By assessing earnings, they create a fair system that focuses on need above all else. While everyone’s situation is unique, these financial evaluations help level the playing field and make education attainable for a broader audience.

It’s important to remember that income isn’t the only factor at play. The entire context matters–expenses, number of dependents, and other financial responsibilities can all influence the final assessment. Yet, assessing income remains a foundational element in shaping the assistance landscape for students.