Exploring the Different Types of Financial Aid Options Available to Students

When it comes to pursuing higher education, many individuals encounter the challenge of affording tuition, books, and living expenses. It’s no secret that education can be a substantial financial burden, and this is where various forms of assistance come into play. Understanding the types of resources that are out there can make a world of difference in easing that heavy load.

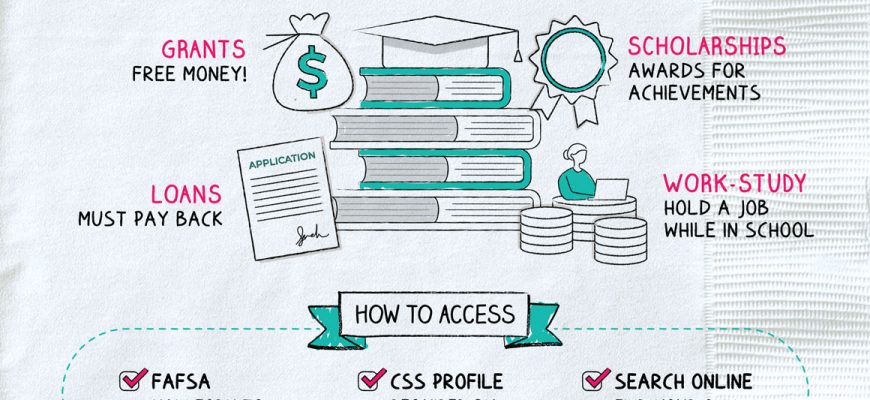

There are numerous pathways designed to lighten the financial weight for students. From scholarships that reward academic excellence and community service to varying types of low-interest loans, these tools are crafted to help individuals navigate their educational journeys. Additionally, grants serve as a wonderful opportunity, as they often do not require repayment, allowing students to focus on what truly matters – their studies.

By familiarizing oneself with the options and resources available, students can embark on their educational aspirations with greater confidence. In this discussion, we will delve into the diverse forms of assistance that can support aspiring scholars on their road to success, paving the way for a more accessible and enriching academic experience.

Understanding Types of Financial Assistance

When it comes to pursuing education or certain personal projects, many individuals find themselves in need of support. There are various forms of resources designed to alleviate the burdens associated with costs. Each type plays a unique role in helping people navigate their financial journeys, enabling them to reach their goals more easily.

One common category consists of grants, which are often provided based on specific criteria and do not require repayment. These can come from government entities, institutions, or private organizations. Another option includes scholarships, which are typically awarded based on merit, such as academic achievements or talents, and also do not need to be repaid.

Of course, loans represent another significant category; they must be paid back over time, usually with interest. These are frequently offered by banks or educational institutions and can provide substantial support. Additionally, there are work-study programs that allow students to work part-time while studying, helping to offset costs.

Understanding these distinct forms of support can empower individuals to make informed decisions and take advantage of the opportunities that best suit their needs and circumstances. With the right resources in hand, navigating the financial landscape becomes much more manageable.

Applying for Government Grants and Loans

Seeking assistance from governmental programs can be a game changer when it comes to funding your educational journey or business venture. There are numerous opportunities out there, and understanding how to navigate them effectively can make all the difference. These programs typically offer monetary support that doesn’t need to be paid back, as well as options that provide loans with favorable terms.

First things first: it’s essential to familiarize yourself with the types of programs that suit your needs. Some grants are designed specifically for students pursuing higher education, while others focus on small business owners looking to expand. The key is to identify your specific requirements and align them with the right program.

When you’re ready to apply, make sure to gather all necessary documents. This often includes financial statements, proof of eligibility, and personal identification. Each program may have unique criteria, so read the application guidelines carefully. Being thorough and proactive can greatly enhance your chances of receiving support.

After submitting your application, patience is vital. Approval processes can take time, and it’s not uncommon to face competition. Stay informed about the status of your application and be prepared to provide any additional information when requested.

Exploring these resources can lead to significant opportunities, helping you achieve your goals without the burden of excessive debt. Embrace the process, and don’t hesitate to seek assistance if you need it!

Alternative Funding Sources for Students

For many learners, the journey toward higher education can be challenging due to expenses. However, numerous options exist beyond traditional loans and scholarships that can help bridge the financial gap. Exploring these unique opportunities can open doors to achieving one’s academic goals without incurring substantial debt.

First off, community grants often target specific demographics or fields of study. Local organizations and foundations frequently offer funds to support students from their regions or those pursuing certain professions. Researching these opportunities can yield significant rewards.

Another route includes service-based programs that provide compensation in exchange for community work or teaching. Many institutions and organizations look for enthusiastic individuals willing to dedicate their time and skills, and in return, they offer stipends or tuition reimbursement.

Crowdfunding has gained popularity as a way for students to share their educational ambitions and receive support from family, friends, and even strangers. Platforms allowing individuals to create campaigns have made it easier to gather small contributions that can collectively make a meaningful impact.

Additionally, many companies have established scholarship programs aimed at supporting students pursuing careers relevant to their business. These initiatives not only assist with tuition but can also lead to internships or job placements after graduation.

Finally, consider both national and local contests that offer monetary prizes for academic achievements, artistic talents, or innovative ideas. These competitions encourage students to showcase their skills while potentially gaining financial support for their education.