Understanding Financial Aid and Its Mechanisms for Supporting Students

In today’s world, pursuing higher learning often requires navigating through a maze of expenses. Many individuals dream of advancing their education, but the financial burden can seem overwhelming. Fortunately, there are various resources available aimed at easing this challenge. These resources exist to help students achieve their academic ambitions without being solely deterred by the costs involved.

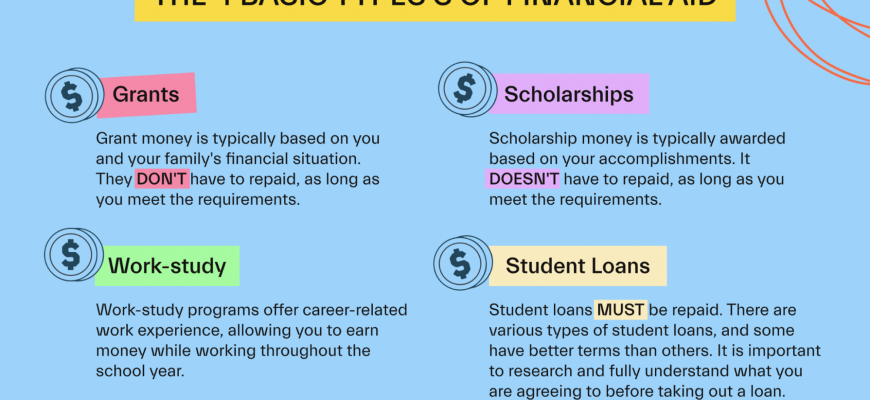

When exploring options to alleviate educational expenses, it’s crucial to grasp the different types of assistance available. Many avenues are designed to provide support, ranging from grants and scholarships to loans that can be repaid over time. Understanding the intricacies of these resources is essential for making informed choices that align with one’s goals.

By taking the time to educate oneself about this support system, students can unlock opportunities that may have previously felt out of reach. Grasping how these resources function will empower individuals to fund their studies more effectively, paving the way toward a brighter future filled with potential.

Understanding Financial Assistance Options

Exploring the world of support options available for educational pursuits can feel overwhelming. There are numerous resources designed to help ease the burden of costs associated with schooling, each with its own unique set of eligibility requirements and benefits. By familiarizing yourself with the variety of options, you can make informed decisions about which paths to consider for reducing expenses during your academic journey.

One popular type of assistance comes in the form of gifts that do not require repayment. Scholarships, typically awarded based on merit or specific criteria, are a fantastic way to fund your education without the obligation to pay back funds later. Grants also fall into this category, often aimed at individuals with financial needs, providing essential resources to help cover tuition and other related costs.

Loans, on the other hand, provide funds that you will need to repay with interest later. They can be a useful tool if managed wisely, as they allow students to access necessary resources immediately. It’s crucial to evaluate various lending options and understand the terms before committing to any agreement. This way, you can ensure that the help you receive aligns with your future financial goals.

Another aspect to consider is work-study programs, which offer students the chance to earn money through part-time employment while attending school. This arrangement not only helps with expenses but also provides valuable experience that can enhance your resume later on.

With all these different kinds of assistance available, it’s important to conduct thorough research and weigh your choices carefully. The right combination of support options can significantly impact your educational experience and overall financial future.

Types of Support Available

When it comes to pursuing education, various resources can help ease the financial burden. Each option has its own unique features and requirements, catering to different needs and circumstances. Understanding the diversity of support can empower you to make informed decisions about funding your academic journey.

- Grants: Often provided by government bodies or educational institutions, these funds do not require repayment. Eligibility is usually based on specific criteria, including income levels.

- Scholarships: These awards can come from schools, businesses, or nonprofit organizations. They are typically merit-based or need-based and do not need to be repaid, making them a highly sought-after option.

- Loans: Borrowing can be a viable route to pursue education, albeit with the expectation of repayment, often with interest. Various types are offered, with distinctions between federal and private options.

- Work-Study Programs: These initiatives allow students to work part-time while studying, providing both experience and financial support. Positions may be on-campus or related to the field of study.

- Tuition Reimbursement: Some employers offer to cover educational expenses for their employees. This can be an excellent way to further your education while working full-time.

Exploring these different avenues can help you find the right combination of resources to achieve your educational goals without overextending your finances.

The Application Process Explained

Navigating the route to obtain support for your educational expenses can feel overwhelming. Nevertheless, understanding the steps involved can make this journey much smoother. This segment will walk you through the essential stages involved in securing assistance for your studies.

To kick things off, begin by gathering all necessary information and documents. This includes your income details, tax returns, and any other financial records that may be required. Having everything in place will help streamline your submission.

Next, familiarize yourself with the specific requirements of the institutions or organizations that offer support. Each may have distinct criteria, so staying informed is key. Many will require you to fill out an online application form, where you’ll provide your personal details and educational history.

Once you’ve completed the application, double-check it for accuracy. Errors or omissions can lead to delays or even disqualification, so it’s crucial to be thorough. After submitting, keep an eye on your email or portal for updates regarding your application status.

Finally, be prepared for follow-up communications. Some organizations may request additional documentation or clarification on your financial situation. Responding promptly will demonstrate your commitment and help ensure a swift review of your application.