Understanding Financial Aid and Steps to Secure It

Navigating the world of higher education can feel overwhelming, especially when it comes to managing costs. Many individuals dream of pursuing their studies but are held back by financial constraints. Fortunately, there are various options available to help lighten the burden, ensuring that passion and talent can flourish without being stifled by monetary worries.

In this exploration, we’ll unpack the different resources available for those seeking educational support. From government programs to private scholarships, the landscape is rich with opportunities. Recognizing where to look and how to approach these options can make all the difference in turning aspirations into reality.

Whether you’re a recent graduate, a returning student, or someone looking to expand your horizons, understanding the landscape of educational assistance can empower you. With a little guidance, you’ll find that the path to your goals is not only attainable but also filled with possibilities for growth and success.

Understanding Financial Aid Options

There are various resources available to help meet educational costs, and being aware of these choices can make a significant difference. Different types of support exist, catering to diverse needs and circumstances. Whether you’re looking for assistance to cover tuition, books, or living expenses, it’s crucial to explore all possibilities.

Grants are typically awarded based on financial requirement and do not need to be repaid. They are an excellent starting point for those in need of substantial support. On the other hand, scholarships may be based on merit, such as academic achievements or special skills. These can significantly ease the burden of tuition fees.

If covering costs requires more flexibility, loans could be a viable option. These funds must be repaid after a certain period, but interest rates may vary. Understanding the terms is vital before committing. Additionally, many institutions offer work-study programs, allowing students to work part-time while studying, thus earning funds to contribute towards their expenses.

Regardless of the route taken, it’s essential to start the process early. Gathering necessary documents and researching available programs ensure a smoother journey. Every option has its own set of criteria, so careful evaluation is key. Always seek advice from financial service offices or counselors to make well-informed decisions about the resources that best fit your situation.

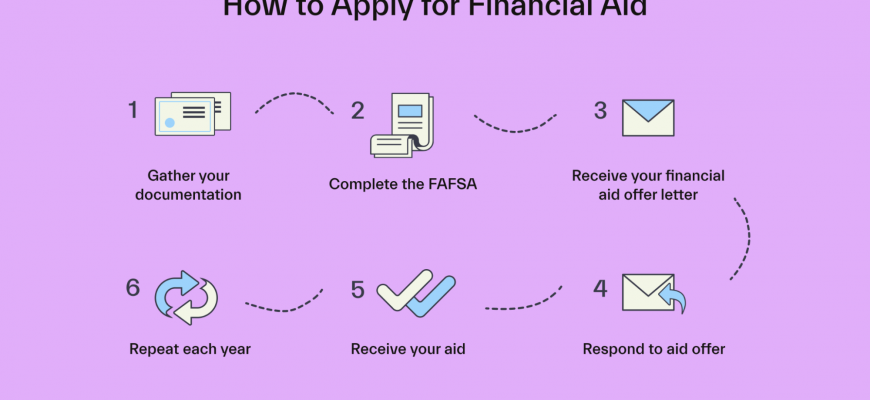

Steps to Apply for Financial Support

Navigating the journey towards receiving assistance for your educational expenses can feel daunting, but breaking it down into manageable steps can simplify the process. By following a systematic approach, you’ll be better prepared to secure the resources you need to achieve your academic goals.

The first step involves researching available programs that match your needs. Take the time to explore different options, including scholarships, grants, or loan opportunities. Each type may have varying eligibility requirements, so understanding your choices is crucial.

Once you’ve identified potential options, gather necessary documentation for your application. This usually includes personal identification, proof of income, academic records, and sometimes letters of recommendation. Ensure everything is organized and ready for submission before moving on to the next step.

After preparing your materials, it’s time to fill out the application forms. Pay careful attention to the instructions provided, as each program might have unique requirements. Providing accurate and honest information is key to avoiding any issues down the line.

Following submission, be proactive in monitoring the status of your application. Don’t hesitate to reach out to the respective organizations for updates or to clarify any uncertainties. Maintaining open communication can often aid in expediting the process.

Finally, once notified about your eligibility, review the terms and conditions associated with the support offered. Understanding the implications of acceptance will help you make informed decisions about your financial responsibilities moving forward.

Common Myths About Financial Assistance

When it comes to support for education and other expenses, there are plenty of misconceptions swirling around. Many people form opinions based on hearsay or limited experiences, leading to a series of misunderstandings. Let’s clear the air and debunk some of these prevalent myths.

- Only those with low income can receive help: Many believe that only individuals from low-income families qualify for support. In reality, there are various types available that cater to a wide range of financial situations.

- It’s all about loans: Some think that assistance solely consists of loans that need to be repaid. However, there are grants and scholarships that do not require repayment, making options more diverse.

- Applying is too complicated: The application process can seem daunting, but there are numerous resources and guides to simplify it. Many institutions also offer assistance to help navigate the steps.

- It’s only for traditional students: A common belief is that only traditional students can access these resources. In fact, non-traditional learners, like adult students and part-timers, can also benefit.

- Receiving support will take away from my independence: Many think that accepting support means sacrificing autonomy or relying too heavily on others. But in truth, it can enhance opportunities and promote personal growth.

Understanding these misconceptions can make a significant difference for anyone exploring ways to finance their education or related costs. More awareness leads to better decisions and greater access to available opportunities.