Exploring the Chase Credit Journey and Its Benefits for Your Financial Future

In today’s world, managing your financial health is more important than ever. Whether you’re planning to buy a home, start a business, or just want to stay on top of your finances, having a clear picture of your financial standing is crucial. There are tools available that can help you navigate the complexities of your monetary profile, making it easier to understand what steps you need to take to achieve your goals.

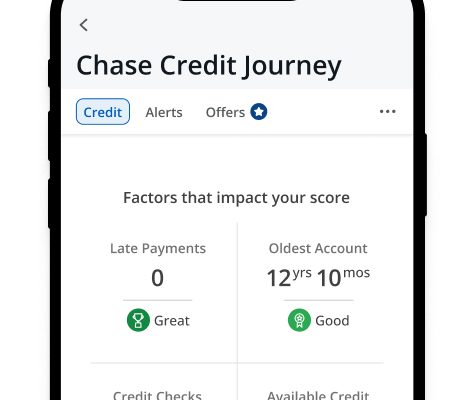

One of these tools provides an insightful platform where individuals can monitor their financial status, gain knowledge about various factors affecting their financial choices, and receive personalized recommendations. This service acts as a guide, empowering users to make informed decisions. It’s all about helping you understand where you stand and what you can do to improve your financial situation.

The platform aims to simplify the often confusing world of personal finance. It offers resources and insights that can help you decipher statements, scores, and reports. By leveraging this information, you can take charge of your finances with confidence and clarity, turning your aspirations into reality.

Understanding Your Credit Score

Your financial reputation plays a crucial role in how lenders perceive you. It’s that number that reflects your borrowing behavior and helps institutions gauge the risk involved in lending to you. Knowing this figure is vital, not just for potential loans, but for any financial dealings that may come your way.

This numerical representation hinges on various factors, ranging from your payment history to the total amount you owe. Each element has its own weight, contributing to the overall picture that lenders see. Grasping how these components interact can empower you to make informed decisions and improve your standing.

Monitoring your score regularly allows you to track progress and spot any discrepancies that might arise. Awareness can lead to proactive measures, ensuring you stay on top of your financial health. Remember, each action you take has the potential to influence this all-important number, so making smart choices is key.

Benefits of Personal Finance Exploration

Diving into personal finance management can unlock a treasure trove of advantages that enhance your financial well-being. By taking an active role in monitoring your financial standing, you equip yourself with valuable insights that can lead to smarter decisions.

One of the major perks is the ability to track your financial health effortlessly. It offers a clear view of your financial profile, helping you identify areas for improvement. This awareness can lead to better budgeting habits and increased savings over time.

Another fantastic benefit is personalized recommendations. By analyzing your unique financial situation, tailored advice can emerge, guiding you toward optimal choices. This means you can focus on products or strategies that are most suitable for your circumstances.

Staying informed about changes in your financial landscape is crucial. Regular updates keep you in the loop regarding shifts in rates or emerging offers, ensuring you’re always making well-informed decisions. This proactive approach can significantly enhance your financial trajectory.

Moreover, accessing resources and tools designed for financial literacy can empower you to enhance your knowledge. With educational materials readily available, you can develop skills to navigate complex financial matters confidently.

Lastly, fostering a sense of achievement through successful financial management cannot be overlooked. As you reach your goals, whether big or small, this progress boosts your confidence and motivates you to continue on your path to financial stability.

How to Improve Your Financial Standing

Enhancing your financial stability is a vital step toward achieving greater economic freedom. By focusing on certain habits and strategies, you can boost your financial profile significantly. The path to improvement often involves understanding the factors that contribute to your overall financial health.

First, consistency is key. Always pay your obligations on time. Late payments can have a severe impact on your financial reputation. Set up reminders or automate your payments to ensure you never miss a due date. This simple step can lead to significant improvements over time.

Next, keep an eye on your available funds. Aim to use no more than 30% of your total limit across all borrowing options. High usage can signal to lenders that you may be over-extended. Reducing this ratio can positively affect the perception of your fiscal reliability.

Building a diverse mix of accounts also plays a crucial role. Consider incorporating different types of loans and accounts, such as a mortgage, a personal loan, or a secured line, to showcase your ability to manage various financial products responsibly.

Regularly review your financial profile for inaccuracies. Obtain reports from multiple sources and dispute any incorrect entries. Maintaining a clean record is essential for presenting a trustworthy image to potential creditors.

Lastly, try to avoid excessive inquiries. Each time you apply for new borrowing options, a record is created, which can cause your standing to drop. Instead, limit your applications and research options thoroughly before making a decision.

By incorporating these strategies into your financial habits, you can create a solid foundation for long-term economic wellness and open doors to better opportunities in the future.