Exploring the Concept of Zip Credit Cards and Their Benefits in Modern Finance

In today’s fast-paced world, new financial solutions are constantly emerging to simplify our purchasing experiences. One such innovative instrument is gaining traction among savvy consumers who seek convenience and efficiency in their transactions. This advanced option allows individuals to make payments seamlessly while enjoying a range of benefits typically associated with traditional financial products.

Imagine having a handy tool that not only streamlines the checkout process but also offers unique advantages tailored to your spending habits. With this modern payment mechanism, users can enjoy a more flexible approach to managing their expenditures, whether for everyday purchases or larger investments. It’s designed to enhance your financial toolkit, making your shopping experience both enjoyable and manageable.

As we delve deeper into how this payment option works, it becomes clear that it represents more than just a method of payment; it’s a step towards a smarter way to handle your finances. Embrace this innovative solution and discover how it can elevate your purchasing power.

Understanding the Concept of Zip Credit Cards

Let’s dive into an innovative payment method that has been gaining traction. This financial tool provides a convenient way to manage purchases, allowing individuals to shop without immediate financial commitment. It acts as a bridge between traditional banking practices and modern shopping habits, making transactions smoother.

What’s intriguing is how this instrument allows users to split payments over time, making it easier to afford larger purchases without breaking the bank. Instead of paying the total upfront, one can spread the cost across a defined period. This flexibility opens up opportunities for shoppers to buy what they want when they want it, without the stress of immediate expenses.

Moreover, many places are starting to accept this payment solution, reflecting the ever-evolving landscape of commerce. It’s becoming a go-to for those seeking financial freedom and a simplified shopping experience. Just like any financial option, it’s important to approach it wisely and understand its workings and potential pitfalls.

In essence, this modern payment method reflects the shifts in consumer behavior, offering an enhanced way to navigate today’s market while keeping financial responsibility in mind. Whether you’re making small purchases or planning for bigger expenses, this tool could very well fit into your financial strategy.

Benefits of Using Zip Payment Options

Utilizing innovative payment methods can significantly enhance your shopping experience and financial management. These flexible solutions allow individuals to access funds more conveniently, providing a variety of advantages that cater to modern consumer needs.

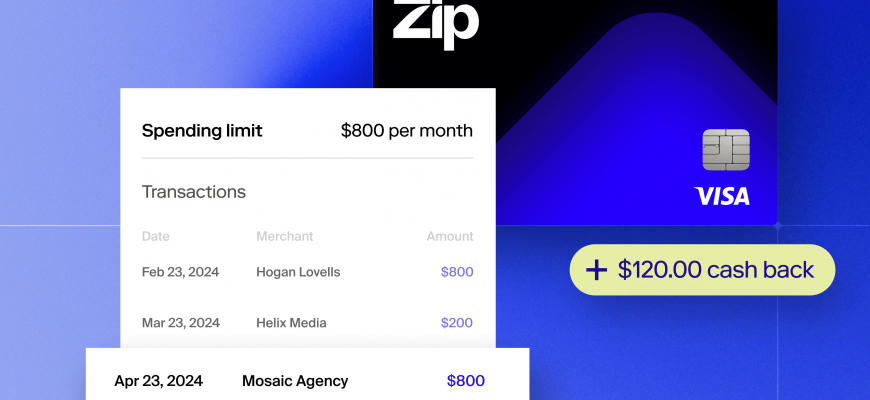

One of the most notable perks is the ease of managing expenses. With clear installments, budgeting becomes more straightforward, allowing you to plan your finances effectively. Additionally, many of these platforms often offer quick approvals, eliminating long waiting times and giving you immediate access to purchasing power.

Security is another vital aspect, as most options come with robust protection measures, ensuring your personal information remains safe. You can feel confident making transactions without the worry of fraud or identity theft.

Many users also appreciate rewards or cashback programs associated with these services. By simply using this method for everyday purchases, you could potentially earn benefits that enhance your overall shopping experience.

Moreover, the flexibility in repayment plans means that even larger expenses can be managed without straining your budget. This kind of adaptability is especially beneficial during unexpected financial demands.

In summary, embracing alternative payment solutions can lead to a more convenient, secure, and rewarding financial pathway, making shopping not just easier but also more enjoyable.

How to Apply for a Zip Card

Getting one of these financial tools can be a straightforward process if you know the steps to follow. It’s designed to offer flexibility and convenience for purchases, making it a great option for managing your expenses effectively. Let’s explore how you can get your hands on this handy solution.

First, you’ll want to visit the official website or app where applications are processed. There, you’ll usually find a button or link to start the application process. Click on it to move forward. You’ll need to provide some personal details like your name, address, and income. This information helps determine your eligibility and the limits you may receive.

Next, be prepared to share some financial background. This usually includes your banking details or other sources of income. Make sure everything you provide is accurate to avoid any delays in the approval process. Once you’ve filled out all necessary fields, review your application to ensure everything is correct before submitting it.

After submission, it’s a waiting game. Many companies will inform you of their decision quickly, sometimes within minutes. If you’re approved, you’ll receive your new financial tool by mail or digitally, depending on their processes. If you’re not approved, don’t be discouraged. You can check the reasons and possibly improve your situation for a future application.

Finally, once you get your tool, take a moment to familiarize yourself with its features and benefits. Understanding how it works will help you maximize its potential and manage your spending responsibly. Enjoy your new financial flexibility!