Understanding the Purpose and Benefits of Tax Credits

Every individual or business faces the inevitability of financial responsibilities to their respective governments. Among the multitude of strategies available to lessen the burden of these obligations, one stands out as particularly beneficial. This allows taxpayers to reduce their final amount owed, ultimately contributing to a more manageable financial situation.

People often wonder how these financial advantages work and who can take advantage of them. The concept revolves around providing relief, whether to facilitate educational pursuits, encourage energy efficiency, or support families. By grasping the nuances of these provisions, one can make informed decisions and potentially save substantial sums.

It’s also essential to understand that these advantages come in various forms, each designed for specific circumstances. Recognizing the right opportunities can illuminate pathways to enhance financial well-being. This knowledge empowers individuals to navigate their obligations more effectively, aligning with broader personal or business goals.

Understanding Tax Credits Basics

When it comes to managing finances, especially at the end of the year, many individuals find themselves navigating a complex landscape of benefits that can lighten their monetary burden. These advantages can play a significant role in how much one ultimately pays, providing valuable opportunities for savings. It’s essential to grasp the ins and outs of these financial incentives to maximize your potential advantages.

In essence, these incentives are designed to ease the financial load by reducing the overall amount owed to the government. They come in various forms and can cater to different situations, be it supporting families, encouraging education, or promoting energy efficiency. Familiarity with these offerings allows people to strategically plan their finances and potentially increase their savings.

Importantly, not all offerings are the same. Some are non-refundable, meaning they can only decrease the amount due to a minimum level, while others may provide a refund even if there’s no outstanding balance. Understanding the nuances between these types is crucial for effective financial planning.

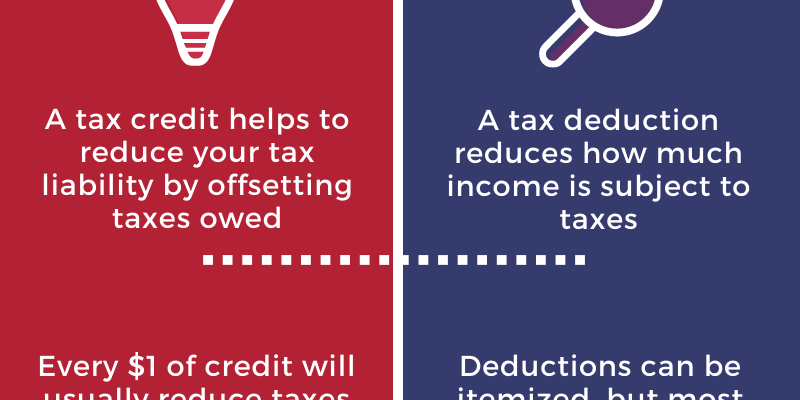

Ultimately, leveraging these assistance mechanisms can lead to a more manageable financial landscape, allowing individuals to allocate their resources more effectively. Whether it’s through deductions or incentives tailored to specific activities, becoming knowledgeable about these options can empower you in your financial journey.

Types of Tax Credits Available

There are various incentives in the financial landscape that can lighten your obligation to the government. These benefits come in many forms, each designed to assist individuals or businesses in different circumstances. Understanding these options is essential for maximizing your potential savings when it comes time to settle accounts with the tax authorities.

One popular category includes those aimed at low-income households, enabling them to reduce their burden significantly. Then there are educational offerings that support students and their families, making it more feasible to pursue higher learning without the anxiety of overwhelming costs.

Another type targets families, providing help with childcare expenses or even when welcoming a new member into the household. This can ease financial stress during significant life changes. Additionally, you’ll find environmental incentives, designed to encourage people to invest in greener technologies and practices, benefiting both their wallet and the planet.

Lastly, there are provisions for businesses that can help entrepreneurs and established companies alike to thrive, often linked to job creation or research and development initiatives. Knowing which categories you may qualify for can make a substantial difference in your financial journey.

How Incentives Affect Your Refund

When it comes to annual financial settlements, certain incentives can play a significant role in determining the amount you receive back from the government. These financial rewards can reduce your overall liabilities, effectively boosting the cash flow that you might see at the end of the year. Understanding this dynamic can make a notable difference in how you approach your finances.

Incentives generally work by decreasing the amount owed on your overall financial obligation. This means that instead of simply subtracting a fixed amount from your total debt, they can provide a percentage relief, which can lead to substantial savings. The more you qualify for, the larger your potential refund becomes, allowing you to allocate those funds toward savings, investments, or other personal goals.

For many individuals, the effect of these benefits can be transformative. Not only does this lead to a larger refund, but it also helps to alleviate some of the financial pressure many people experience throughout the year. By strategically planning and being aware of available benefits, you can maximize your returns and make the most out of your financial situation.

Moreover, the impact of these incentives is not just seen on paper. Receiving a larger sum back can provide a sense of relief and financial freedom, enabling you to cover unexpected expenses or treat yourself to something special. The cumulative effect over the years can significantly enhance your overall financial health, making it essential to stay informed about what opportunities exist.