Understanding the Implications of a Student Aid Index of Zero and Its Impact on Financial Support

When considering financial support for educational pursuits, many individuals may encounter the notion of a zero figure in the context of assistance eligibility. This number often sparks curiosity and questions about what it really signifies and how it impacts one’s journey through higher learning.

Essentially, a zero figure can indicate a particular status regarding finances that might not be immediately evident. It reflects a specific scenario where individuals may not be expected to contribute to the costs of their education in a traditional way. This can lead to various interpretations, especially regarding the resources available for pursuing academic goals.

Understanding the implications of this zero figure can greatly enhance one’s approach to financing education. Comprehending the nuances behind this symbol opens up discussions about the broader landscape of financial support and the options that might be available to those navigating the educational system.

Understanding the Student Aid Index

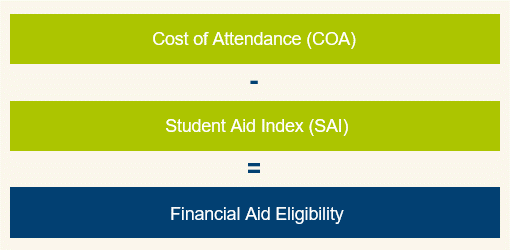

At the heart of the financial support process lies a critical measurement that reflects an individual’s ability to contribute towards their educational expenses. This figure plays a vital role in determining the assistance one can receive and is instrumental for many when navigating the complexities of funding higher education.

When this crucial number stands at zero, it indicates a particular set of circumstances. Essentially, it means that, according to the established criteria, there’s no expected contribution from the person in question. This can be a game-changer for those in need, as it opens the door to potential resources and support systems that might not otherwise be accessible. Understanding the implications of a zero score can empower individuals to make informed decisions about their educational journeys.

Beyond just being a simple numeral, this value can shape financial planning and influence the types of resources available. It’s essential to grasp how this measurement interacts with various funding opportunities, including grants and scholarships, that can alleviate the burden of tuition and associated costs.

Moreover, this score can vary based on different factors such as family income, number of dependents, and overall financial situation. Recognizing these elements provides deeper insight into how one can optimize their chances of receiving helpful support during their academic pursuits.

Implications of a Zero Score

A score of zero can bring about a multitude of consequences for individuals seeking financial assistance for their educational pursuits. This scenario often leads to a lack of eligibility for various types of support, ultimately affecting the choices available for funding one’s studies. Understanding these implications is crucial for navigating the complexities of funding education.

First and foremost, a zero score typically means that a person may not qualify for grants, scholarships, or other monetary help designed to lessen the burden of tuition costs. This can create significant financial strain, making it challenging to afford books, supplies, and living expenses while pursuing a degree. As a result, students might need to seek out loans with interest, leading to long-term debt.

Moreover, the absence of a financial backing can limit access to certain institutions or programs that require proof of financial need. This restriction can hinder an individual’s ability to enroll in their preferred courses or attend desired universities, narrowing their options considerably.

Additionally, there may be emotional and psychological effects associated with a zero score. Individuals might experience feelings of inadequacy or frustration, impacting their motivation and overall academic performance. The added stress of financial constraints can also affect personal well-being, leading to increased anxiety during their educational journey.

However, it’s important to remain informed about other avenues for assistance. Many organizations and institutions offer alternative resources or support systems that do not rely solely on financial assessments. Exploring these options can empower individuals to continue their educational journey despite the challenges presented by a zero score.

How to Improve Your Financial Support Score

Enhancing your financial support evaluation is crucial for gaining access to the resources you need for education. There are several practical steps you can take to elevate your standing and increase your chances of receiving assistance. It requires a bit of research, organization, and proactivity, but the payoff can be significant.

Start by reviewing your financial documents thoroughly. Ensure that all information is accurate and up-to-date. Errors or outdated figures can negatively impact your assessment. Gathering necessary paperwork ahead of time can make the process smoother and more efficient.

Next, consider exploring additional sources of revenue. Part-time jobs, internships, and even freelance work can boost your income, which may lead to a better classification. Look for opportunities that align with your academic pursuits; not only will you gain funds, but valuable experience as well.

Don’t overlook the power of networking. Connect with mentors, alumni, or community organizations that can offer insights or potential funding sources. Building relationships can open doors to scholarships and grants that you might not find on your own.

Finally, pay attention to your financial profile. Maintaining a good credit rating and managing debts wisely can present you as a responsible borrower, which can influence your overall evaluation favorably. Adopting sound financial habits now can lead to better resources down the line.