Understanding the Purpose and Benefits of a QuickBooks Credit Memo

Managing finances can sometimes feel overwhelming, especially when it comes to tracking various transactions and keeping everything in order. There’s a particular type of document that plays a vital role in smoothing out discrepancies in billing and ensuring that accounts reflect accurate information. This handy tool allows businesses to efficiently manage their sales and services, providing clarity in financial dealings.

At its core, this financial instrument acts as a way to adjust previously issued invoices. Whether it’s due to returned items, pricing adjustments, or promotional considerations, it ensures that both parties are on the same page regarding outstanding balances. It’s not just a piece of paper; it represents a reflection of trust and transparency in the business relationship.

By understanding this essential document, business owners and financial managers can simplify their accounting processes and enhance the accuracy of their records. It’s an indispensable resource that can make financial management not only easier but also more efficient, ensuring that every transaction aligns with the evolving realities of a dynamic market.

Understanding the Basics of Credit Memos

When managing finances, it’s crucial to keep track of adjustments that may arise from different transactions. These adjustments can occur due to returns, overpayments, or pricing errors, necessitating a system to document such instances. This concept serves as a tool helping businesses maintain accurate records and ensuring customer satisfaction.

Essentially, this document acts as a formal acknowledgment of these adjustments. It allows businesses to provide a systematic way to adjust customer balances, reflecting the true nature of sales relations. By issuing this document, companies can easily navigate through financial discrepancies and maintain transparency.

This instrument is beneficial not just for the businesses but also for customers, as it guarantees that they are treated fairly in any situation involving refunds or corrections. Understanding how to utilize this tool effectively can significantly improve the overall financial management of any organization.

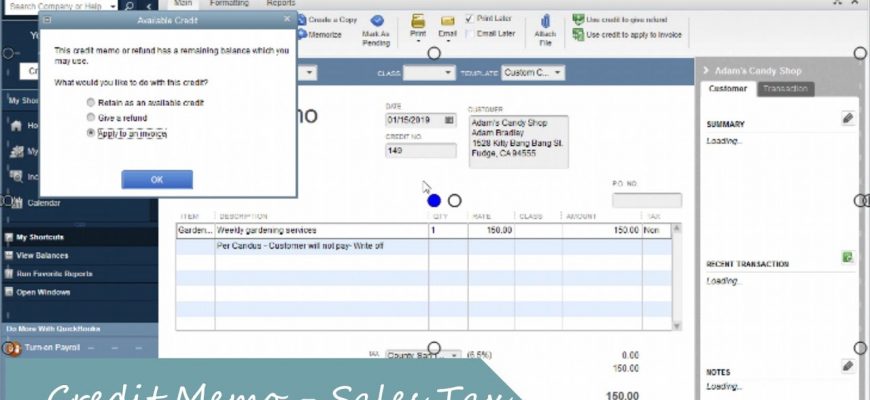

How to Create a Credit Memo

Creating an adjustment note can be a straightforward process once you know the steps involved. This document serves as a means to provide a refund or reduce an outstanding balance for your clients. Whether you’re addressing a return or simply correcting a past invoice, having the right procedure makes the task easier and more efficient.

Step 1: Access the Right Section

Start by navigating to the area where you typically manage your sales and invoices. Look for options related to documenting financial transactions.

Step 2: Choose the New Document Option

Click on the button that allows you to create a new record. This is usually labeled as “New” or “Create,” depending on your software. Make sure you select the correct type that corresponds to the adjustments you wish to make.

Step 3: Fill in Customer Information

Input the necessary details regarding the customer. This includes their name and any relevant identifiers. Accurate information ensures that the document is linked to the right account.

Step 4: Specify the Adjustment Details

Enter the specifics about the adjustment. This includes the original transaction number, the amount to be refunded or credited, and any descriptions that clarify the reason for this action. The more precise you are, the better.

Step 5: Review and Save

Before finalizing your document, take a moment to verify all the entries. Ensuring everything is accurate helps avoid future issues. Once you’ve confirmed the details, save the document. This will update your records and provide the client with the necessary notice of change.

By following these straightforward steps, you can manage financial transactions seamlessly and keep your customer relationships healthy! Making adjustments as needed will showcase your commitment to excellent service.

Common Uses and Benefits in Accounting

In the landscape of financial management, there are tools that help businesses maintain accuracy while enhancing customer relationships. One such tool serves as an essential document to adjust sales transactions, ensuring that accounting records reflect true financial standings.

These documents are frequently employed to correct billing errors, such as overcharges or miscalculated taxes. By issuing this type of document, businesses can quickly remedy mistakes and keep customers satisfied, demonstrating their commitment to transparency and fairness. Emphasizing a strong relationship with clients, this action reassures them that their concerns are valued and addressed promptly.

Another vital advantage lies in the facilitation of returns. When goods are returned, creating this type of documentation not only accounts for the returned item but can also help in processing refunds efficiently. This streamlining is beneficial for both the company and its clients, promoting a seamless experience during transactions.

Moreover, embracing this practice helps in tracking and monitoring adjustments in sales. It provides clarity for businesses when analyzing financial reports, allowing for a comprehensive view of sales data and adjustments. This clarity aids in making informed decisions, ultimately contributing to stronger financial management and enhanced operational efficiency.

In sum, leveraging this valuable instrument equips businesses with the ability to maintain accurate financial records while fostering trust and maintaining positive customer relations. By employing such practices, companies can navigate the complexities of accounting with confidence.