Understanding the Purpose and Benefits of Letters of Credit in International Trade

In the world of international commerce, navigating transactions can often feel like a complex maze. To make things smoother and more secure for both parties involved, various financial tools are utilized. These instruments serve as guarantees, ensuring that commitments are met and risks are minimized. They play a pivotal role in building trust between buyers and sellers across borders.

Imagine a situation where a business owner wants to import goods from a supplier located far away. There’s always a lingering concern about whether the supplier will deliver the goods as promised or if payment will be released without any issues. This is where a particular financial mechanism comes into play, acting as a safety net for both parties. It not only assures the seller that they will receive their payment but also gives the buyer peace of mind, knowing that the funds will only be transferred once certain conditions are fulfilled.

These financial instruments foster smoother transactions and build stronger relationships in the global market. Understanding their purpose and functionality is essential for anyone looking to engage in cross-border trade. Let’s delve deeper into how these tools work and their significance in facilitating secure and reliable business dealings.

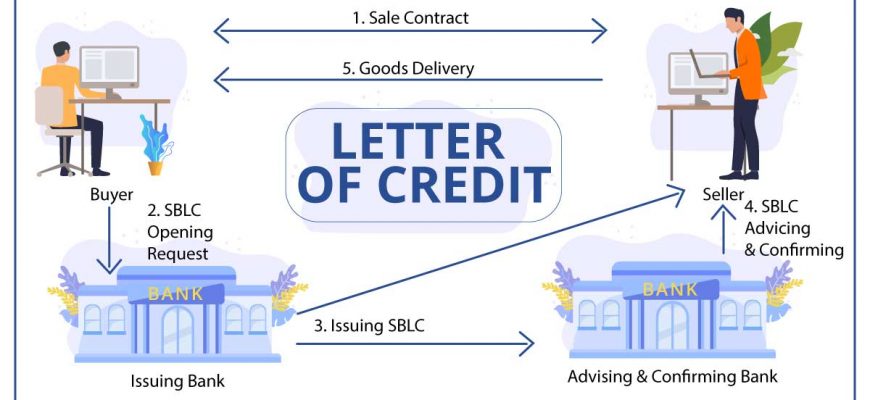

Understanding the Function of Letter of Credit

In the realm of international trade, there exists a crucial tool that facilitates secure transactions between buyers and sellers. This instrument acts as a safeguard, ensuring that obligations are met and that both parties are protected throughout the process. By providing a reliable promise of payment, it encourages trust in partnerships that span across borders.

The mechanism works by allowing a financial institution to act on behalf of the purchaser, assuring the supplier that funds will be available upon fulfilling certain conditions. This arrangement not only minimizes risk for the seller but also provides the buyer with a sense of security, knowing that payment will only be made when specified criteria are met. In essence, it streamlines transactions and fosters smoother exchanges in the global marketplace.

Moreover, this financial solution is not just a safety net; it’s a catalyst for business growth. By enabling suppliers to engage with new buyers without fear of non-payment, it opens doors to opportunities that might otherwise remain closed. Thus, it plays an instrumental role in driving commerce and enhancing relationships between trading nations.

The Benefits for International Trade Transactions

Engaging in global commerce often comes with a set of challenges, yet the right financial instruments can significantly ease those burdens. By incorporating secure payment mechanisms into trade agreements, businesses can foster trust and enable smoother transactions across borders. These solutions not only provide reassurance to both parties involved but also streamline the entire process of exchanging goods and services.

One of the standout advantages is risk mitigation. In international exchanges, the uncertainty surrounding payment and delivery can create hesitation among buyers and sellers. Utilizing a financial assurance can alleviate fears of non-payment, especially when dealing with unfamiliar partners. This sense of security encourages companies to explore new markets and expand their customer base with confidence.

Additionally, these tools facilitate better cash flow management. Organizations can confidently plan their finances when they know that payments are guaranteed upon fulfilling specific conditions. This predictability allows businesses to allocate resources efficiently and invest in growth opportunities without worrying about potential delays in receiving funds.

The global reach offered by this financial support is another critical aspect. Organizations can easily connect with international clients and suppliers, expanding their operational horizons. This widespread acceptance creates an advantageous environment for conducting business across various regions, promoting collaboration and partnership.

Furthermore, these arrangements often enhance bargaining power. With a guaranteed payment mechanism in place, sellers can negotiate more favorable terms, which can lead to reduced costs and improved profit margins. This can be particularly beneficial for smaller enterprises looking to compete in a larger marketplace.

Ultimately, leveraging these financial instruments not only simplifies transactions but also fosters long-term relationships between trading partners. By building trust and ensuring compliance with agreed-upon terms, businesses can cultivate a robust network that benefits everyone involved.

Essential Elements of a Letter of Credit

When navigating international transactions, having a reliable mechanism in place is crucial. A financial guarantee can facilitate trade by ensuring that all parties fulfill their obligations, creating a sense of security. This assurance comes in various forms, each with specific components that work together to protect both buyers and sellers.

Firstly, the issuer plays an essential role, typically a bank that provides this assurance. They are responsible for evaluating the creditworthiness of the buyer and extending the necessary support. The beneficiary, often the seller, relies on this support to ensure payment upon meeting the agreed conditions.

Another vital component is the specified amount, which outlines the maximum financial liability of the issuer. This amount is predetermined and ensures that the seller understands the extent of the financial assurance provided. Additionally, the terms of the guarantee must be clear, including the required documents that must be presented to access funds.

Furthermore, the timeframe is crucial. The validity period dictates how long the assurance remains operational, ensuring timely transactions. Clear communication regarding the location and manner of payment also enhances the efficiency of the process, preventing misunderstandings between both parties.

Lastly, the rules governing such instruments, often based on international standards, further guide the operations and responsibilities involved. Understanding these fundamental components ensures smoother transactions and fosters trust in cross-border trade.