Understanding the Concept and Importance of a Financial Support Statement

When navigating through various aspects of monetary aid, one comes across a crucial element that outlines an individual’s or entity’s financial circumstances. This documentation serves as a key tool, providing insights and clarity, essential for both the recipient and the provider. It encapsulates essential information that can significantly influence decisions and outcomes in the realm of economic aid.

Essentially, this type of documentation helps to paint a comprehensive picture of one’s monetary standing. It often includes vital details like income sources, expenditures, and overall financial health. By presenting this data clearly, individuals can better articulate their needs and justify their requests for assistance.

Moreover, such a document plays a pivotal role in fostering transparency and trust between the involved parties. It allows those offering resources or help to assess situations accurately and make informed decisions, ultimately creating a more efficient and effective support system.

Understanding the Purpose of Financial Support Statements

These documents play a crucial role in various scenarios, helping to establish the ability of an individual or organization to meet certain obligations. They’re essentially a way to convey the necessary resources available, assuring relevant parties that there is adequate backing for specific endeavors, whether it’s education, residency, or other commitments.

At the core, such records serve to instill confidence. They provide evidence that the necessary means are present to fulfill various requirements. This fosters trust between individuals and institutions or authorities, making the process smoother and ensuring that expectations are clear.

The importance of these documents is particularly evident in situations where external validation of one’s capacity is essential. For instance, when applying for educational programs abroad, demonstrating one’s financial standing can significantly influence the decision-making process. It’s not just about numbers; it’s about illustrating potential and opportunity.

Additionally, this documentation can affect eligibility for different programs, grants, or visas. Authorities need reassurance that applicants can navigate their proposed path without unforeseen difficulties. Hence, the creation of a compelling account of resources is fundamental.

In summary, understanding the role of these assurances helps individuals better prepare for various applications, ensuring that they convey the right information effectively. It’s all about bridging gaps and facilitating smoother interactions within different systems.

Key Components of Financial Support Documentation

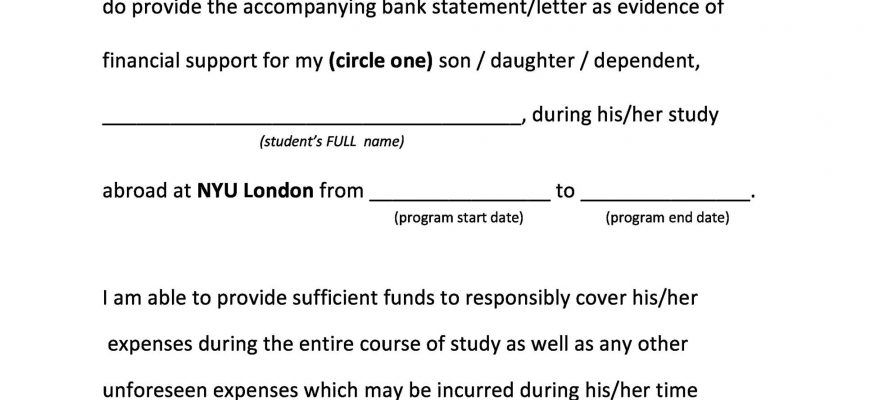

When it comes to proving your ability to provide assistance, there are several essential elements that you should include in your records. These components play a crucial role in clearly conveying your financial situation and ensuring that all parties involved have a comprehensive understanding of your resources. Having a well-organized submission can make a significant difference in the evaluation process.

Firstly, accurate income details are paramount. This includes everything from your salary to any additional revenue streams. The clearer you are about your earnings, the better the assessment will be.

Next, it’s important to have a thorough account of your expenses. Documenting regular payments, such as rent, utilities, and any other obligatory costs, allows for a transparent view of your financial commitments.

Additionally, including bank statements is highly beneficial. These snapshots of your financial activity demonstrate not only your current balance but also your spending habits over time. They can provide invaluable insight into your overall situation.

Another crucial aspect is the inclusion of assets. Be sure to list any valuable properties, investments, or savings accounts you own. This information can significantly bolster your case by showcasing your overall financial health.

Finally, consider adding any relevant financial documents that support your claims, such as tax returns or investment statements. These will provide further verification and assurance of your fiscal condition.

By carefully compiling these elements, you enhance your submission and increase the likelihood of a favorable evaluation. Each piece contributes to a complete picture of your financial landscape, making it easier for others to understand your capacity to provide aid.

How to Prepare a Financial Support Statement

Creating an assertion that showcases your ability to provide resources is essential for various applications, whether for educational programs, visas, or grants. The goal is to clearly depict your fiscal stability and ensure that you can sustain your proposed endeavors.

Start by gathering essential documents. Collect any materials that outline your income, savings, and other assets. This might include bank statements, pay stubs, investment records, or any documents that demonstrate your overall financial health. Having this information at hand will help you present a compelling picture of your situation.

Next, outline your income sources. Clearly detail where your funds come from. This could be your salary, business revenue, or any financial support you might receive from family or scholarships. Make sure to include amounts and frequency, providing a comprehensive view of your income stream.

After that, calculate your total assets. This includes not just cash but also investments, properties, or possessions of value. Be transparent about your net worth as it will bolster your assertion of stability.

When drafting the document, be concise and clear. Use simple language to explain your financial situation. Avoid jargon that might confuse the reader. Make sure your assertions are easy to understand, as clarity is crucial in portraying your situation accurately.

Finally, review and proofread. Ensure that all information is accurate and up to date. A well-organized and error-free document will leave a positive impression and strengthen your case. Remember, a polished presentation reflects your professionalism and preparedness.