Understanding the Concept of a Financial Aid Refund Check and Its Importance for Students

Many students find themselves navigating the often-complex world of educational expenses, seeking ways to cover the costs associated with their studies. As you dive into the various options available, you might stumble upon a curious phenomenon that involves receiving extra funds from your educational institution. This situation often raises questions and sparks curiosity about how it all works.

Essentially, there are times when the money allocated for your schooling exceeds the expenses directly associated with tuition and related fees. This surplus can come as a pleasant surprise, presenting an opportunity for you to manage your finances in a way that suits your personal needs. Understanding this process can help make your academic experience smoother and more informed.

As you explore what this additional amount entails, you’ll uncover the mechanisms behind it and how it can be utilized to support your journey. Whether it’s for purchasing textbooks, living expenses, or other necessities, recognizing the purpose and potential of these extra funds is key to making the most of your educational investment.

Understanding Financial Aid Refund Checks

Getting some money back after accounting for schooling costs can be a pleasant surprise for many students. This amount often comes from excess funds provided by educational assistance programs, intended to help cover living expenses and other related costs. It’s crucial to know how this reimbursement process works and what you can anticipate.

At the beginning of each term, institutions distribute support packages to help with tuition and fees. If the total support exceeds the educational expenses, the leftover balance is returned to the student. This amount can significantly alleviate the financial burden, allowing individuals to manage bills, purchase books, or even set aside savings for future needs.

However, it’s important to keep track of these funds and understand potential restrictions on their use. While it might feel like a windfall, planning ahead is key to ensuring that the money lasts throughout the term. Furthermore, being informed about your institution’s policies regarding such payments can help you avoid any surprises down the road.

How to Use Your Refund Check Wisely

Receiving an unexpected sum of money can feel exhilarating, but it’s crucial to manage it with care. Instead of splurging impulsively, consider how this amount can support your financial goals and enhance your life in the long run. Thoughtful planning can turn this bonus into a tool for future stability and growth.

Start by assessing your immediate needs. If you have any outstanding bills, especially those with high interest, prioritize paying them off. Reducing debt can alleviate stress and increase your financial freedom. Once those urgent matters are settled, think about building an emergency fund. Setting aside a portion can protect you from unexpected expenses and provide peace of mind.

Another great option is investing in your education or skills. Whether it’s taking a course to advance your career or acquiring new talents, this investment can pay off significantly in the future. Consider exploring opportunities that align with your interests and career aspirations.

If you’re already handling your essentials, think about setting aside some money for leisure or experiences. Treating yourself to a small adventure or a hobby can enhance your well-being and provide a much-needed break from routine. Just remember to balance self-care with practicality.

Lastly, consider talking to a financial advisor if you’re unsure about the best use of your funds. They can provide guidance tailored to your unique situation and help you make choices that promote lasting benefits. Taking a moment to plan wisely can transform a temporary windfall into a stepping stone toward a more secure future.

Common Issues with Financial Support Returns

Many students encounter challenges when it comes to receiving their excess funds from educational institutions. While the process is generally straightforward, there are several pitfalls that can arise along the way. Understanding these common obstacles can help you navigate the system more effectively and ensure that you receive the money you are owed.

One frequent issue students face is delays in processing. Sometimes, institutions take longer than expected to issue these payments due to administrative bottlenecks or technical problems. This can be frustrating, especially when you’re counting on the funds to cover essential expenses.

Another complication involves eligibility criteria. Misunderstandings about what expenses are covered and who qualifies can lead to unexpected outcomes. Make sure to thoroughly review the terms and conditions to avoid surprises down the line.

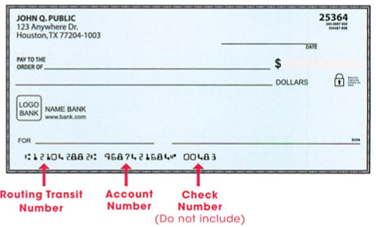

Additionally, mistakes in personal information can also create complications. If your contact details or banking information are inaccurate, it could prevent the timely distribution of funds. Always double-check your records to ensure everything is correct.

Finally, it’s possible to run into issues with the disbursement method. Some people prefer direct deposits, while others opt for paper checks. Understanding the pros and cons of each method can help you make an informed choice and potentially avoid any hiccups along the way.