Understanding the Concept of Financial Aid Loans and Their Role in Education Financing

As students embark on their academic journeys, many find themselves facing the daunting challenge of financing their education. With rising tuition fees and living expenses, the quest for resources to support one’s studies can feel overwhelming. Fortunately, there are alternative avenues available to ease this burden and make higher learning more accessible.

The concept we’re exploring revolves around monetary assistance designed specifically for individuals pursuing educational goals. These resources can help bridge the gap between personal savings and the actual costs of attending an institution. While they come with certain obligations, they also present invaluable opportunities for personal and professional growth.

By delving into this topic, we’ll uncover the various types of assistance available, how they work, and what factors to consider before committing to such arrangements. Whether you’re a fresh high school graduate or a returning adult learner, understanding these options can empower you to make informed decisions that greatly impact your educational experience.

Understanding Financial Aid Loans

Navigating the world of student funding can feel like a daunting task. The resources available to help cover educational expenses vary widely, and it’s important to grasp the basics of how these monetary options work. By exploring these financial instruments, one can make informed choices that align with future goals and aspirations.

Essentially, these monetary supports are designed to ease the burden of tuition and associated costs. They often come with different terms and conditions that vary based on the provider and the borrower’s circumstances. Understanding interest rates, repayment plans, and the implications of borrowing can significantly impact your overall educational experience.

While many might think solely about grants and scholarships, these resources provide an additional avenue for many students. It’s crucial to assess one’s current financial situation and future earning potential to determine how much assistance is genuinely needed. Being prudent during this process will help avoid unnecessary debt and stress after graduation.

The process of obtaining these resources typically involves filling out applications, verifying income, and sometimes having a credit check performed. However, knowing what documents to assemble and how to present your situation can simplify the experience. It’s always wise to stay organized and informed throughout this journey.

Ultimately, understanding these economic tools can empower students to take control of their education funding. By making educated choices, individuals can pave the way for successful academic achievements and a more secure financial future.

Types of Assistance Available

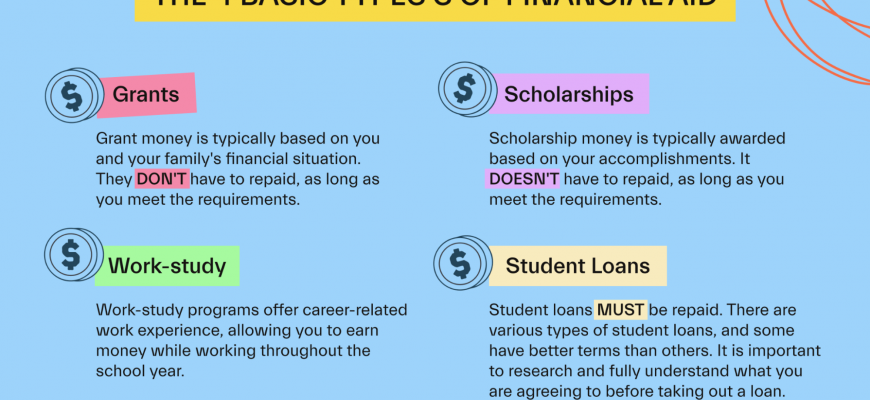

When it comes to supporting education, there are various options that can lighten the financial burden on students and their families. These different resources come in several forms, providing individuals with the opportunity to pursue their academic goals without overwhelming expenses.

Grants are often considered one of the most favorable forms of support, as they do not require repayment. Typically awarded based on need, these funds can significantly reduce tuition costs and other educational expenses.

Scholarships are another excellent option. They may be given for academic achievements, athletic abilities, or other talents. Unlike loans, recipients can receive these funds without the obligation of paying them back, making them a desirable choice for many students.

Work-study programs allow students to earn money to help cover school costs while gaining valuable work experience. This approach not only aids in financing education but also enhances a student’s resume.

Additionally, some students may turn to subsidized and unsubsidized credits. These types of borrowing have different criteria and benefits, giving students some flexibility depending on their circumstances and repayment capabilities.

Overall, exploring various resources can provide tremendous support in achieving educational aspirations while managing expenses effectively.

Benefits and Risks of Borrowing

Taking on debt can be a double-edged sword. On one hand, it provides an opportunity to access resources that might be out of reach otherwise, allowing individuals to invest in their future. However, on the flip side, borrowing comes with its own set of challenges that require careful consideration.

One notable advantage of incurring debt is the ability to fund educational pursuits or major purchases that can lead to long-term benefits. It can serve as a helpful tool for improving one’s financial standing over time, enabling individuals to build credit history and establish a foundation for future endeavors. Additionally, some credit options come with perks such as lower interest rates or flexible repayment plans, making them more manageable.

However, it’s important to remain aware of the potential hazards associated with taking on debt. Accumulating too much can lead to significant stress and financial strain, especially if unexpected challenges arise or if repayment terms are not met. It’s easy to fall into the cycle of borrowing more to pay off existing obligations, which can lead to an overwhelming burden if not carefully monitored.

Ultimately, being well-informed and maintaining a balanced perspective are crucial. Weighing the advantages against the risks can help individuals make decisions that align with their long-term financial goals.