Understanding the Concept of Financial Aid Balance and Its Importance for Students

Managing education funds can sometimes feel overwhelming, especially when trying to navigate through the different types of support available. It’s essential to grasp the overall picture when examining how much support you’re receiving and how it impacts your overall expenditures. This section aims to shed light on the intricacies involved in tracking your monetary resources and understanding their implications for your academic journey.

Many students encounter various forms of support, each with its own set of rules and benefits. As you progress through your studies, staying informed about the total amount you owe and the resources allocated to you can help in making sound financial decisions. This understanding can pave the way to better planning and preparation for your future expenses.

Additionally, keeping a keen eye on your monetary support can prevent potential surprises down the road. Whether you’re dealing with grants, scholarships, or specific programs, knowing where you stand offers peace of mind. By breaking down these elements, you’ll gain a clearer perspective on how they work together to support your educational aspirations.

Understanding Financial Aid Balances

It’s essential to grasp how funding packages work when navigating higher education expenses. Many students and families face uncertainties about the available resources to support their studies. Knowing how these contributions interact can empower you to make informed choices regarding your educational journey.

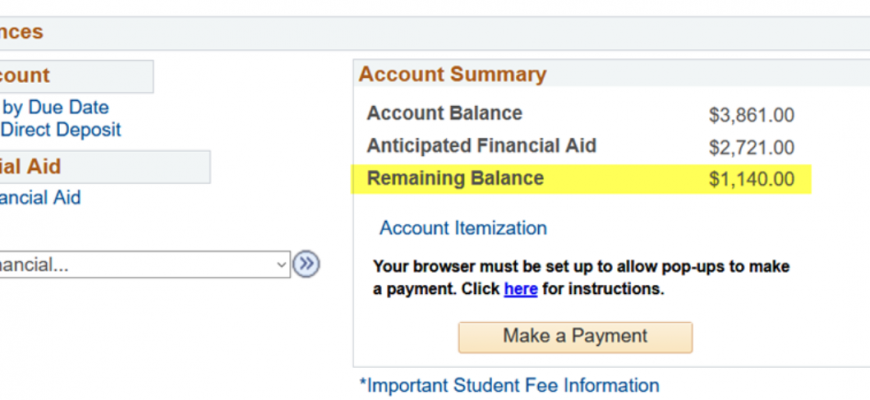

The difference between what you receive and what you owe creates a clearer picture of your situation. Often, various funds come into play, including scholarships, grants, and loans. Tracking these amounts helps ensure you’re on the right path and can manage repayments later if necessary.

Monitoring your resources also aids in planning for future terms. With a good understanding, you can determine if you’ll need additional support or if you can confidently cover upcoming tuition fees. In essence, keeping an eye on your financial contributions allows you to budget effectively, creating a more sustainable approach to your education financing.

Components of Financial Assistance Packages

Understanding the various elements that make up support packages can greatly enhance your educational experience. These components collectively work to reduce the financial burden of tuition and living expenses. Each piece plays a crucial role, contributing to the complete picture of how students can fund their studies.

One significant part is grants, which are often need-based funds that don’t require repayment. Scholarships, awarded based on merit or specific criteria, also contribute to this mix by providing additional resources for those who excel academically or meet certain qualifications. Work-study programs can be another essential element, offering a way to earn money while attending classes, thereby easing financial pressures.

Lastly, loans are typically included as well, providing borrowed funds that must be repaid after graduation, often with interest. While they can be helpful in covering costs upfront, it’s important to approach them wisely to avoid overwhelming debt. Together, these various aspects form a comprehensive support system, helping students navigate the financial challenges of higher education.

How to Manage Your Financial Assistance

Navigating the world of educational funding can feel like a rollercoaster ride, but it doesn’t have to be overwhelming. By developing a solid strategy, you can make the most of the resources available to you. The key is staying informed and organized, ensuring that you use your support wisely and effectively.

First and foremost, keep track of your resources. Create a detailed record of what you’ve received, including scholarships, loans, and grants. Knowing what’s at your disposal will help you avoid spending too much early on and allow you to make informed decisions throughout your academic journey.

Budgeting is another crucial element. Allocate your funds for tuition, living expenses, and personal needs. Set aside a portion for unexpected costs to prevent a financial scramble later. Review your budget regularly, and adjust it as necessary to stay on track.

Consider the long-term implications of your choices. For instance, while taking out loans may seem like an easy immediate solution, understanding repayment terms and future obligations can save you headaches down the road. Educate yourself about the interest rates and repayment plans to make the best choices for your situation.

Lastly, don’t hesitate to seek guidance. Utilize your school’s financial services office. They can provide valuable insights and assistance, helping you make sense of your options. Connecting with peers who have experience in managing these resources can also offer practical tips that can benefit you.

Overall, taking proactive steps to control your funding can lead to a smoother academic experience. With a little effort and planning, you’ll be better equipped to concentrate on your studies rather than your expenses.