Understanding the Differences Between Credit and Debit Transactions for Better Financial Management

In today’s fast-paced world, managing finances effectively is crucial for everyone. Whether you’re shopping in a store or paying for services online, various methods of handling your money play a key role in your financial life. Navigating these options can be confusing at times, especially with different terminologies and purposes attached to them. Let’s dive into the distinctions between two of the most commonly used methods of spending and managing funds.

When it comes to transactions, it’s essential to recognize how these methods impact your finances differently. While one method allows you to draw directly from your available balance, the other can provide a bit of leeway, letting you manage your expenses more flexibly. Understanding the nuances between them can help you make informed decisions and ultimately take charge of your financial well-being.

Getting a solid grasp of these distinctions not only empowers you to make smarter choices but also helps in planning your budget more effectively. By exploring the unique features and benefits of each method, you’ll be better prepared to decide which one suits your lifestyle and spending habits the best.

Understanding the Basics of Credit Cards

When it comes to managing your finances, having a solid grasp of certain payment methods can make a world of difference. One of the most popular options available today offers convenience and flexibility, allowing individuals to make purchases and manage expenses more efficiently. This section breaks down the essentials of how this financial tool operates and the benefits it can provide.

At its core, this form of payment allows users to borrow funds up to a set limit. When you swipe or tap your card, you’re essentially making a promise to pay back that amount, usually within a specified timeframe. The beauty of this system lies in its ability to bridge the gap between immediate needs and future payments. People can enjoy the items they want now and settle the bill later, provided they meet the outlined agreements.

Another important aspect to consider is the concept of interest rates. These rates vary by issuer and can significantly impact overall costs. If repayments are made in full and on time, there may be no added expenses; however, carrying a balance can lead to extra charges, so it’s crucial to understand how these elements interact.

Moreover, many financial institutions provide various rewards and incentives for using this payment approach. Points or cash back can be accumulated with every transaction, making it a tempting option for savvy spenders. However, it’s vital to use these perks responsibly and avoid accruing unnecessary debt.

In summary, mastering the fundamentals of this payment option equips individuals with the knowledge to make informed financial decisions. Whether you’re looking to improve your creditworthiness or simply enjoy the convenience it offers, understanding how it functions is key to navigating your personal finances effectively.

Exploring the Functions of Debit Cards

These plastic companions have become essential in our daily transactions, making money management easier and more efficient. With a simple swipe or tap, they allow individuals to access their funds directly from their bank accounts. Let’s dive into how these cards operate and the advantages they bring to users.

Immediate Access to Funds: One of the key features is the direct linkage to your bank account. When you make a purchase, the amount is instantly deducted, providing a clear view of your spending habits. No waiting for statements; you can monitor your finances in real-time.

Enhanced Security: As digital transactions grow, security measures have evolved too. Many of these cards come equipped with chip technology, which encrypts your information and minimizes the risk of fraud. Additionally, should your card be lost, you can quickly report it to your bank and minimize potential losses.

Bearing No Debt Burden: Unlike some other payment methods that may allow you to spend beyond your means, these cards encourage responsible spending. Since you can only spend what is in your account, they help users avoid unnecessary debt and foster better budgeting practices.

Convenient Online Shopping: The rise of e-commerce has made these cards a staple for online shoppers. Whether it’s purchasing clothes or booking flights, they simplify the checkout process, ensuring swift and secure transactions.

Versatility: Whether you’re at a grocery store, restaurant, or online marketplace, these cards can be utilized almost everywhere. This flexibility not only saves time but also streamlines the buying experience.

In summary, the practical applications of these plastic tools have transformed the way we handle our finances, making everyday purchases smoother and more manageable.

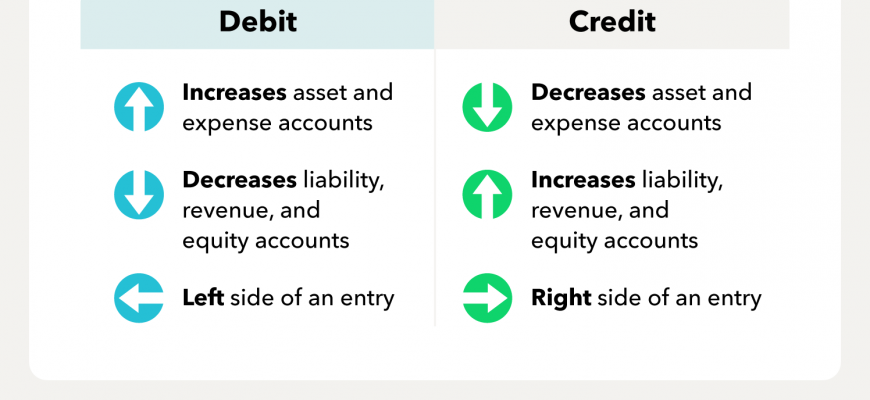

Key Differences Between Credit and Debit

Understanding the distinctions between different payment methods can make a world of difference in managing your finances. Each option comes with its own set of features, benefits, and implications that affect how you spend and save your money. By knowing these key differences, you can make smarter choices and ensure you’re using the right tools for your financial goals.

One of the primary contrasts lies in how funds are accessed. With one option, you’re spending money that you currently own, while the other allows you to borrow funds for future repayment. This fundamental difference influences not only your spending power but also how transactions are recorded and handled over time.

Another important aspect is the way these transactions impact your financial standing. Using one method can lead to potential fees for late payments or interest if balances carry over, whereas the other typically operates within your existing balance, minimizing the risk of debt accumulation.

Additionally, the security features associated with these payment methods can vary significantly. One may offer more robust fraud protection, while the other might make you more vulnerable to unauthorized charges if not managed carefully. Recognizing these nuances can empower you to navigate purchasing decisions with confidence.

Ultimately, being aware of these differences allows you to utilize each option to its fullest potential, aligning your spending habits with your overall financial strategy.