Understanding the Basics of the Credit Vantage Score and Its Importance in Financial Decisions

In today’s world, having a solid understanding of your financial reputation is crucial. This rating plays a significant role in determining your eligibility for various types of loans, credit cards, or even rental agreements. It’s a reflection of your financial behavior, and it can shine a light on how trusted you are by lenders.

Many individuals often feel overwhelmed by the plethora of terms and concepts surrounding this topic. With different systems out there evaluating your financial history, it becomes essential to know how they function and what factors influence your overall assessment. Whether you’re looking to secure a mortgage, finance a vehicle, or just aiming to improve your financial health, being informed is the first step towards making empowered decisions.

So, let’s dive deeper into the intricacies of this evaluation system. By unraveling its components and understanding its significance, you’ll be better equipped to navigate the financial landscape. Let’s explore how this evaluation can impact your financial journey and what steps you can take to enhance it.

Understanding Credit Vantage Score

In today’s financial landscape, it’s essential to have a grasp of how your financial trustworthiness is evaluated. The numerical representation of your borrowing history plays a significant role in determining various aspects of your financial life. Grasping the nuances of this rating system can empower you to make informed decisions related to loans, mortgages, and even rental agreements.

This evaluation system is widely recognized for its approach to assessing individuals based on various factors, such as payment behavior, outstanding liabilities, credit utilization, and even the length of your financial history. Each of these components contributes to the overall number, which influences how lenders perceive you. A higher figure generally equates to better terms and conditions when it comes to borrowing.

Understanding how this rating works enables you to take proactive steps to enhance it. By regularly monitoring your financial habits and being mindful of your obligations, you can positively impact the rating. Awareness of the elements that influence this figure will equip you with the tools to navigate the lending landscape effectively.

Ultimately, achieving a robust rating is not just about qualifying for loans; it reflects your reliability in managing resources. With the right knowledge and strategies, you can strive for an impressive number that heralds financial opportunities.

Components Impacting Your Vantage Score

Understanding the factors that influence your numerical representation is essential for managing your financial health. Each element plays a vital role in how lenders perceive your reliability and creditworthiness. By grasping these components, you can take informed steps to enhance your standing and improve your overall financial picture.

One significant factor is your payment history. Consistently making your payments on time demonstrates responsibility and reliability. On the other hand, missed or late payments can negatively affect your standing.

Next, consider the amount owed. This reflects how much credit you are using compared to your total available credit. Striving to keep this ratio low can positively influence your perception by lenders.

Length of credit history is another crucial element. A longer history generally provides more data points for assessing your behavior, which can be advantageous. If you’re just starting out, building a positive track record over time will help.

The types of credit accounts you hold also matter. Having a mix of revolving credit and installment loans can showcase your ability to manage different types of debt responsibly.

Finally, new credit inquiries can impact your overall standing. While it’s acceptable to explore credit options, too many inquiries within a short time can signal to lenders that you may be taking on more debt than you can handle.

Differences Between Vantage Index and FICO Metrics

When it comes to understanding how lenders evaluate financial reliability, two key systems often come up: Vantage Index and FICO Metrics. Though both aim to assess an individual’s ability to manage borrowed funds, they adopt different approaches and use varying methods to calculate their results.

Calculation Methodologies: One major distinction lies in the algorithms employed. Vantage Index typically considers newer data and can update more frequently, thereby reflecting recent financial behavior. On the other hand, FICO Metrics may rely on slightly older information, which can sometimes result in a less current picture of one’s financial habits.

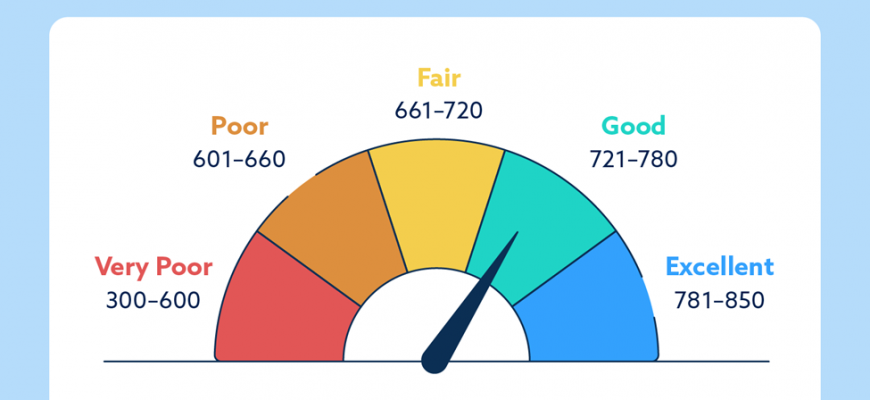

Range of Values: The scales differ as well; Vantage Index usually scores between 300 and 850, while FICO Metrics often operates on a similar yet distinct scale. This difference in range can lead to variations in how individuals perceive their financial standing, depending on which system they check.

Weighting of Factors: Another point of contrast is the way each system prioritizes various elements. For instance, Vantage Index might place greater emphasis on recent payment history, while FICO Metrics could focus more on total levels of outstanding debt. This variance can impact how individuals strategize to improve their ratings.

Usage by Lenders: Lastly, the acceptance of these systems by lenders can differ. While FICO Metrics has been the traditional standard for many years, Vantage Index is gaining traction among newer financial institutions that favor its innovative features and user-friendly updates. Understanding these differences equips individuals to better navigate their financial journeys.