Understanding the Purpose and Benefits of Credit Unions in Today’s Financial Landscape

Have you ever wondered about financial institutions that prioritize their members over profits? These community lending organizations offer unique advantages that traditional banks often overlook. They create a sense of belonging and support, making financial management feel more accessible and friendly.

These entities operate with a mission to serve individuals rather than merely maximizing earnings. Members can enjoy lower interest rates and fewer fees, all while having a say in the organization’s operations. This structure empowers individuals and encourages a collaborative approach to fiscal health.

In this discussion, we will explore the various benefits and functions of these community-focused institutions, highlighting how they can be a valuable resource for personal finance. By fostering a spirit of cooperation and shared goals, these organizations aim to enhance the financial well-being of their members in a way that feels personal and inviting.

Understanding the Role of Credit Unions

Many individuals seek out alternative financial institutions to meet their specific needs. These organizations serve as non-profit entities, aiming to provide their members with favorable terms and personalized services. Their primary focus is on the well-being of their clientele rather than maximizing profits.

Essentially, these establishments foster a sense of community among their members. They encourage saving and responsible borrowing while offering a range of products such as loans, savings accounts, and other financial tools. By emphasizing member participation and collaboration, they create a supportive atmosphere that benefits everyone involved.

In addition, these financial cooperatives often prioritize lower fees and better interest rates compared to traditional banks. This commitment to affordability allows members to achieve their financial goals more efficiently. Furthermore, the personalized service typically encountered in these settings enhances the overall experience, making it easier for individuals to seek guidance and assistance tailored to their circumstances.

Ultimately, the role of these institutions extends beyond mere transactions. They aim to empower members through education and resources, fostering financial literacy and stability. By nurturing a culture of mutual support and shared success, these organizations help build a brighter financial future for all involved.

Advantages of Membership in Cooperative Financial Institutions

Joining a cooperative financial institution brings a variety of perks that can enhance your financial journey. These establishments prioritize their members, often resulting in personalized service and better rates compared to traditional banks. Whether you’re looking to save more or borrow at a lower cost, there’s something valuable awaiting you.

One of the key benefits is lower fees. Cooperative entities typically offer fewer and lower fees than their conventional counterparts. This can include reduced charges for account maintenance, ATM withdrawals, and loan origination. Members enjoy the peace of mind knowing they’re not being hit with hidden costs.

Moreover, interest rates on savings accounts are usually more favorable. The member-focused model allows these institutions to offer higher returns on deposits, helping your savings grow faster. When it’s time to borrow, you’ll likely encounter lower interest rates on loans, making financing more accessible and affordable.

Another significant advantage is the community aspect. Being part of such an organization often means joining a network of individuals who have common interests and goals. This sense of belonging can lead to valuable connections and local support, enriching both personal and financial lives.

Finally, these financial organizations are known for exceptional customer service. With a focus on meeting the needs of their members, they often provide a more tailored experience, ensuring your concerns are addressed and your goals are supported. The dedication to member satisfaction is a hallmark of these institutions, making them a wise choice for anyone seeking a more engaging banking experience.

How These Organizations Differ from Traditional Financial Institutions

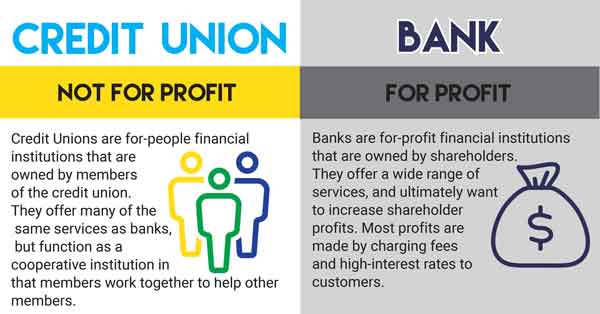

When it comes to handling finances, the differences between various types of institutions can be quite striking. While traditional establishments focus on profit and often prioritize shareholders, alternative financial cooperatives aim to serve their members’ needs. This fundamental distinction shapes everything from the services offered to membership requirements.

One of the most notable contrasts lies in ownership. In conventional banks, the profit motive drives decisions, often leaving customers with higher fees and lower returns. On the other hand, member-owned alternatives strive to provide better rates and lower costs, as excess earnings are often reinvested back into the community or returned to members in various forms.

Another key aspect is the approach to service. In traditional settings, you might feel like just another number in a long line of customers. Conversely, the member-centric model fosters a sense of community and personalized service, with a focus on understanding the unique financial goals of individuals. This personal touch can significantly enhance the overall experience.

Moreover, the range of products available also differs significantly. While established banks may offer extensive options due to their larger capital, alternative institutions often provide tailored solutions that cater specifically to the needs of their members. This means you can find offerings that align more closely with your financial aspirations, be it saving, borrowing, or investing.

Ultimately, choosing between these types of institutions involves considering what you value most: the pursuit of profits or collaboration with a community-focused entity. Each option has its own strengths, but understanding these differences can guide you toward the best fit for your financial journey.