Understanding the Concept and Importance of a Credit Number in Personal Finance

In today’s economic landscape, managing personal finance often involves a variety of codes and identifiers that play a crucial role in transactions. These unique sequences serve as keys to accessing a range of financial services. It’s essential to grasp the significance of these identifiers, as they can impact everything from borrowing to purchasing.

As individuals navigate the world of loans, credit lines, and purchases, having a grasp of these important digits becomes increasingly valuable. These codes not only reflect one’s financial health but also influence the possibilities available for making big decisions, like buying a home or investing in a car.

Understanding this concept is vital for anyone looking to improve their financial literacy. Whether it’s about getting favorable loan terms or ensuring timely payments, recognizing the implications of these identifiers can lead to informed choices and better financial outcomes.

Understanding the Concept of Credit Numbers

Many individuals rely on specific identifiers to manage their finances and track their spending. These unique sequences play a vital role in various transactions, offering convenience and security. Let’s dive deeper into what these identifiers actually represent and how they are used in everyday life.

To grasp this concept fully, consider the following key points:

- Unique Identifiers: Each sequence is crafted to be distinct, ensuring clear differentiation between various accounts.

- Transaction Facilitation: These identifiers enable smoother financial exchanges, whether online or at physical establishments.

- Security Measures: They often come with built-in protections to prevent unauthorized access and fraud.

Understanding their significance can greatly enhance your financial literacy. Here are some aspects worth exploring:

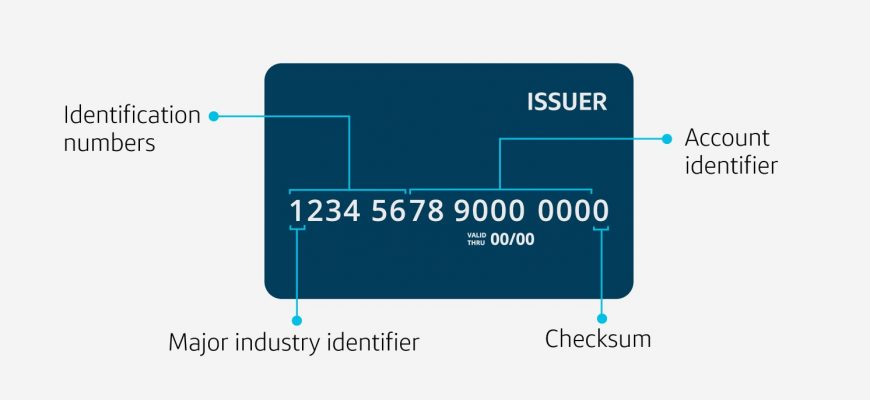

- Composition: These identifiers typically consist of numerical digits arranged in a specific format.

- Verification Processes: Institutions utilize algorithms to verify their legitimacy, adding an extra layer of safety.

- Usage Scenarios: From everyday purchases to larger financial agreements, these identifiers are indispensable.

By familiarizing yourself with how these identifiers function, you’ll be better equipped to navigate the financial landscape confidently and securely.

How Financial Identifiers Impact Transactions

In the world of finance, certain identifiers play a crucial role in shaping how we conduct our monetary exchanges. These unique sequences serve as a key to unlock the complexities of purchasing and lending, helping to ensure that every transaction proceeds smoothly and securely. Understanding the importance of these identifiers can provide valuable insights into the financial landscape.

Every time a purchase is made, this identifier allows the seller to verify the buyer’s ability to pay, while simultaneously protecting sensitive information. It acts as a bridge between the consumer and financial institutions, enabling the transfer of funds and facilitating credit evaluations. This ensures that transactions not only happen efficiently but also with a layer of safety that fosters trust among parties involved.

Additionally, these identifiers play a significant role in fraud prevention. With advanced technology, financial institutions can monitor patterns and detect irregularities in transactions. If something seems off, they can take immediate action to prevent unauthorized access, safeguarding both the consumer’s and the merchant’s interests. This provides peace of mind for users as they navigate various financial interactions.

Moreover, these sequences influence purchasing power and interest rates as well. A positive track record associated with a specific identifier can lead to better offers from lenders, impacting overall financial health. Conversely, mishandling or negative associations can limit options and increase costs for consumers. Thus, it’s essential to manage one’s financial footprint thoughtfully.

In summary, understanding the impact of these identifiers can help individuals make informed decisions when engaging in various financial activities. Whether it’s shopping online or applying for a loan, being aware of how these sequences function can lead to more responsible and beneficial choices.

Maintaining Your Identifier’s Security

Keeping your financial identifier safe is crucial in today’s world. Many individuals overlook how easily their personal information can be compromised, leading to potential fraud and identity theft. By being aware and taking specific measures, you can ensure that your details remain private and secure.

Start by utilizing strong, unique passwords for online accounts associated with your financial information. Avoid using easily guessed details like birthdays or names. Additionally, consider enabling two-factor authentication for an extra layer of protection. This way, even if someone manages to obtain your password, they will still face barriers when trying to access your accounts.

It’s also vital to regularly monitor your accounts and financial statements for any suspicious activity. If something seems amiss, address it immediately. Using credit monitoring services can provide you with real-time alerts about changes in your status. Lastly, be cautious when sharing your details, and ensure that any transactions or communications you engage in are secure.