Understanding the Concept of a Credit Note in Xero Accounting Software

In the world of finance and bookkeeping, managing transactions efficiently is crucial for any business. Sometimes, corrections or updates are needed to maintain accurate records, especially after a sale. This is where a specific type of financial adjustment comes into play, serving as a tool to amend past invoices and ensure both parties are aligned in their records.

These documents can arise for various reasons, such as returned goods, pricing errors, or customer discounts. They not only help in rectifying past discrepancies but also promote transparency and trust between businesses and their clients. Let’s explore how this particular financial instrument functions within accounting software and its significance in everyday operations.

Getting familiar with this process can make a significant difference in how smoothly your financial management runs. By leveraging such adjustments wisely, you create a straightforward approach to handling accounts, keeping everything in check and up to date.

Understanding Credit Notes in Xero

In the world of accounting, certain documents play a crucial role in managing finances and maintaining customer relationships. They help businesses address corrections or adjustments in a seamless manner. This section explores how these instruments function within a popular accounting platform, ensuring both clarity and efficiency during transactions.

When a customer returns a product or there’s an overcharge, businesses often issue these adjustments to maintain transparency. They serve as formal acknowledgments that a transaction requires alteration, ultimately leading to accurate records. By utilizing such instruments effectively, companies can enhance their credibility and foster trust among clients.

Within the mentioned platform, managing these adjustments becomes a straightforward process. Users can easily create, track, and apply them against outstanding invoices. The intuitive interface allows for quick navigation, ensuring minimal disruption to workflow. This efficiency aids in keeping financial records precise and up-to-date.

Understanding how to navigate these adjustments also means comprehending related financial implications. It’s essential for businesses to grasp how these changes influence their accounts, cash flow, and overall fiscal strategy. This knowledge empowers owners and finance teams to make informed decisions, enhancing the business’s financial health.

In summary, these adjustments not only facilitate smoother transactions but also reflect a commitment to accuracy and customer service. Embracing this process fortifies the relationship between a business and its clientele, paving the way for future interactions built on trust and reliability.

How to Create a Credit Note

Creating a financial adjustment document is a straightforward process that can help you manage transactions effectively. This action allows you to acknowledge issues with prior invoices, whether due to returns, discounts, or errors. By following a few simple steps, you can issue this document and maintain smooth accounting records.

1. Access Your Dashboard: Start by logging into your accounting software and navigating to your main dashboard. This is where you can find all the tools you need for managing your sales and purchases.

2. Locate the Relevant Transaction: Find the invoice or transaction that requires adjustment. This might involve searching through your recent invoices or using a search bar to locate specific records quickly.

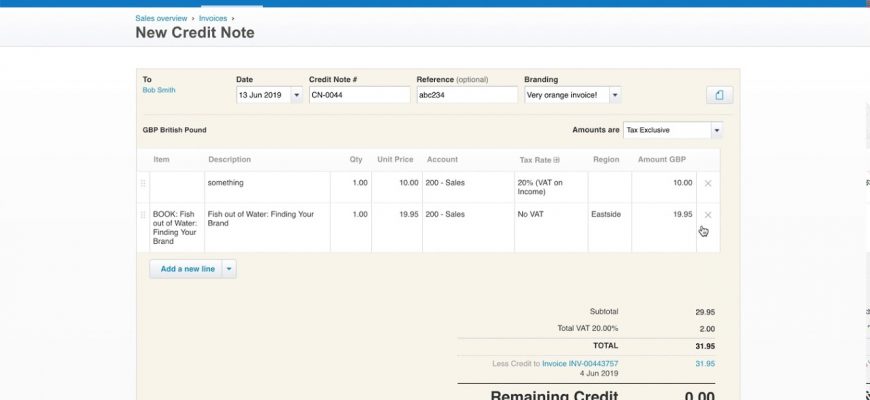

3. Initiate Document Creation: Once you have the right transaction in view, look for an option to create a financial adjustment document. This option is typically available within the transaction details or through a related actions menu.

4. Fill in the Details: Provide all the necessary information for the document. Make sure to include the date, amounts, and reasons for the adjustment. Clear and accurate details help in avoiding confusion later on.

5. Review and Save: Before finalizing, take a moment to review everything. Double-check your entries for accuracy to ensure that your records reflect the correct financial standing. Once confirmed, save the document.

6. Communicate with the Customer: If applicable, send a copy of the financial adjustment document to your customer. This step is crucial to keep them informed about any changes made to their account.

By following these steps, you can efficiently manage your transactions and ensure that your financial records remain accurate. This not only helps in maintaining good relations with customers but also streamlines your accounting processes.

Benefits of Utilizing Credit Documentations

When running a business, maintaining a smooth financial flow is essential. Utilizing specific financial documents can enhance this process, allowing for adjustments in transactions and providing flexibility for both the seller and buyer. Let’s explore some advantages of implementing these tools in your accounting practices.

- Improved Customer Relations: Offering adjustments fosters goodwill. Clients appreciate the ability to manage discrepancies seamlessly.

- Enhanced Record Keeping: These documents help maintain accurate financial records, ensuring transparency in transactions.

- Flexibility in Transactions: Adjustments allow for easy modifications in cases of returns or pricing errors, making it simpler for businesses to manage their sales.

- Accurate Financial Reporting: Integrating such documents ensures that financial reports reflect true revenue, aiding in better decision-making.

- Simplified Tax Compliance: Proper documentation can make tax preparation easier, ensuring you’re only taxed on actual sales conducted.

Incorporating these tools can truly streamline your financial operations and enhance your business interactions. Embracing these practices can lead to a more transparent and efficient approach to handling finances.

Your presence in this video is so enchanting! Every second is pure beauty!