Exploring an Example of a Credit Note and Its Practical Applications

In the world of commerce, the ability to manage financial transactions efficiently is crucial. Sometimes, situations arise that necessitate a revision of a previous sales transaction. This can occur for various reasons, such as product returns, pricing errors, or changes in the terms of the agreement. When these adjustments are made, they play an essential role in maintaining the integrity of financial statements and ensuring customer satisfaction.

One common method for effectuating these modifications involves the issuance of a special document that serves as an acknowledgment of the necessary changes. This document can help businesses clearly communicate updates to their customers, ensuring both parties remain on the same page. It also assists in keeping accurate records, which is vital for effective financial management.

By examining a real-world scenario involving this type of documentation, we can better grasp its significance and practical applications. Let’s dive deeper into how this essential tool operates and why it’s important for both vendors and clients alike.

Understanding Credit Notes in Business

In the world of commerce, there are times when a transaction doesn’t go as planned. Sometimes a client returns a product, or there’s a mistake in billing. This is where specialized documentation comes into play, playing a crucial role in maintaining healthy relationships between sellers and buyers. These documents serve as formal acknowledgments of adjustments, ensuring that all parties are on the same page.

When a business encounters a situation requiring a refund, a corrective document can be issued. This acts as a formal way to record the amount owed back to the customer while adjusting the accounting entries appropriately. Instead of simply canceling transactions, this approach allows for clarity and ensures that both parties maintain accurate financial records.

These types of documents also help in managing inventory levels effectively. When goods are returned, it’s essential to update stock counts. Utilizing this documentation ensures that products re-enter inventory accurately, helping businesses avoid any discrepancies down the line. This transparency is vital for ongoing operations and customer trust.

Moreover, this type of correspondence can also enhance customer satisfaction. When clients receive recognition for their returns or corrections, it demonstrates that the business values their concerns. This approach not only mitigates potential frustration but also reinforces loyalty, as customers appreciate a company that handles issues with integrity and promptness.

In summary, these forms serve as an essential aspect of business operations. They provide a structured way to manage transactions that require adjustments and foster positive relationships between retailers and consumers. By understanding their significance, businesses can optimize their processes and enhance customer experiences effectively.

Common Scenarios for Document Usage

There are several situations where businesses find themselves issuing a certain type of documentation to address various issues that may arise during transactions. These scenarios often arise from discrepancies, returns, or changes in services provided. Understanding these instances can really help in managing financial records effectively.

- Product Returns: When a customer returns an item, a reimbursement is often necessary. This type of document helps facilitate the process and ensures proper adjustments to accounts.

- Pricing Errors: Sometimes, mistakes occur in the pricing of goods or services sold. The issuance of a document helps in correcting the billing and maintaining transparency with the buyer.

- Service Adjustments: If a service provided does not meet the client’s expectations, adjustments may be made. This documentation can reflect changes in service agreements or fees.

- Promotional Discounts: When a customer qualifies for a discount after the initial purchase, this document serves as a way to apply the promotional pricing retroactively.

- Exchange Offers: In cases where a customer exchanges one product for another, the related paperwork ensures accurate accounting and inventory management.

Utilizing such documentation correctly can foster healthy relationships with clients and contribute to streamlined financial practices. In the long run, it enhances trust and reduces potential conflicts over billing issues.

How to Prepare a Credit Note

Creating a document to address adjustments or returns is a straightforward process that can help maintain clarity in financial dealings. This type of paperwork serves as an acknowledgment of changes in a transaction, ensuring both parties are on the same page. Let’s dive into the steps to craft this essential document effectively.

Start by laying out the basic details at the top. This includes the date when the document is issued, along with unique identifiers such as an order number or reference number. Having these details upfront not only helps in easy tracking but also establishes the context for the transaction.

Next, ensure that you clearly identify the parties involved. Include names, addresses, and other pertinent information about both the supplier and the customer. This is crucial for accountability and maintaining accurate records.

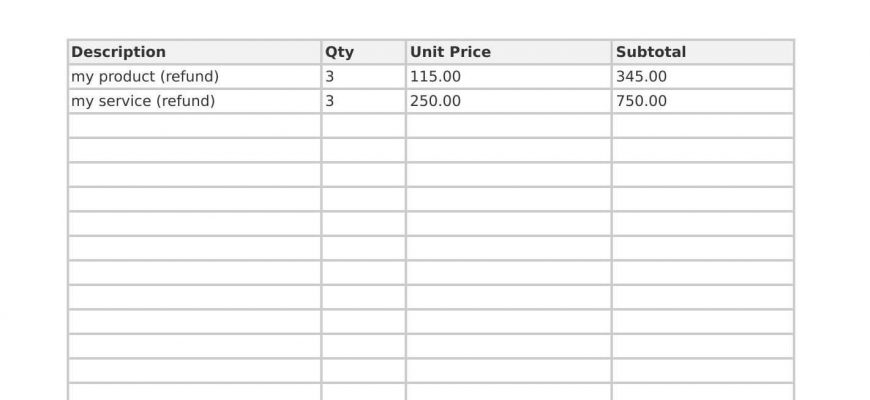

Then, list the items or services being adjusted. Provide descriptions, quantities, and the original pricing. If there are any changes–such as discounts or returned items–make sure to reflect those adjustments accurately so that both parties understand the new totals.

Lastly, wrap things up by mentioning the new total and any refund or credit that will be issued. This final section ensures transparency and helps facilitate smooth resolutions. Once everything is in place, review the document for accuracy before sending it out. An organized and precise approach can go a long way in fostering trust and clarity in your business relationships.