Understanding Credit Memos at CIBC and Their Importance in Banking Transactions

In the world of banking, there are various tools and documents that help individuals and businesses manage their finances effectively. Among these, certain forms play a crucial role in ensuring accurate transactions and proper adjustments to accounts. These instruments can sometimes be a bit puzzling, especially when navigating through the intricacies of your bank statement or account overview.

Have you ever noticed a transaction that didn’t quite add up? Perhaps you received a notification about an adjustment from your financial institution. These modifications are typically in place to rectify discrepancies, offer refunds, or even facilitate returns in a way that ensures your financial records are up to date. Understanding these adjustments can empower you to keep track of your financial health more efficiently.

In this article, we’ll explore the nuances surrounding these financial instruments, highlighting their purpose and implications. From how they come into play to their overall impact on your finances, we’ll break down everything you need to know to navigate these adjustments with confidence.

Understanding Credit Memos at CIBC

In the world of financial transactions, sometimes adjustments are necessary to ensure accuracy and fairness. This can involve reversing charges, applying refunds, or correcting errors. These adjustments help maintain clarity in accounts, allowing both customers and institutions to stay on the same page regarding their financial interactions.

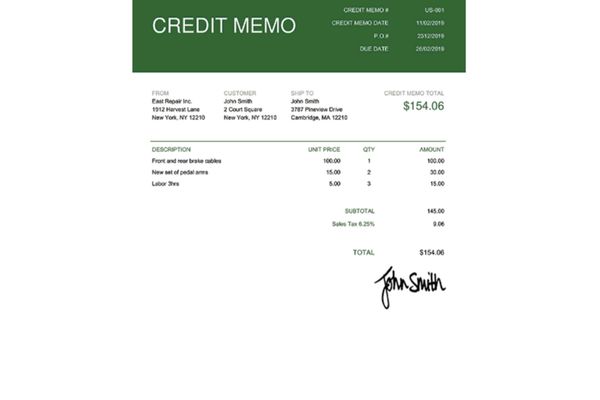

When it comes to handling these adjustments, certain documents play a crucial role. They serve as formal records that outline changes made, specifying amounts and reasons behind the alterations. These records are vital for maintaining transparency and trust in the banking relationship.

For customers managing their finances, these documents can be extremely beneficial. They provide an easy reference to understand how and why their account balances have shifted. This clarity helps in budgeting and financial planning, ensuring that there are no surprises when reviewing account statements.

In essence, these adjustments not only rectify discrepancies but also enhance the overall banking experience. Being aware of how these documents function can empower individuals to take charge of their finances more effectively and confidently.

How to Use a Credit Memo

Understanding how to effectively utilize a refund document can greatly enhance your financial management. This tool allows for adjustments in transactions, helping both businesses and customers maintain accurate records while ensuring smooth exchanges.

Review the Details: Before you proceed, take a moment to examine the particulars of the document. Check the amounts, dates, and any relevant descriptions to ensure everything aligns with your records.

Apply to Future Purchases: You can often use this document to offset future transactions. When making a new purchase, present the document at checkout to reduce your total amount due. This method helps you save money and streamlines your financial dealings.

Communicate with Vendors: If you’re dealing with a business, don’t hesitate to reach out if there are any discrepancies. Open dialogue is key to resolving issues, and businesses appreciate proactive customers who want clarity.

Keep Accurate Records: Store this document safely along with your receipts and bank statements. It’s important for effective budgeting and also helps in case of any disputes that might arise in the future.

Using this refund tool efficiently not only benefits your wallet but also fosters healthy relationships with vendors. Whether for a small purchase or significant transaction, knowing how to handle such documents is essential for informed financial decisions.

Benefits of Receiving a Credit Memo

Receiving a document that adjusts the balance on your account can be quite advantageous. It serves as a reassuring confirmation that your financial interactions are being monitored and managed properly. This not only helps in maintaining transparency but also fosters trust between you and your service provider.

One major perk is the enhancement of your financial records. Such adjustments ensure that your statements reflect accurate figures, making it easier to track your spending and plan your budget. Plus, it simplifies your accounting processes, ultimately saving you time and effort.

Another advantage lies in the potential for improved cash flow. A positive adjustment can effectively reduce your outstanding balance, allowing you to allocate funds elsewhere or settle other obligations more comfortably. This can be especially beneficial for businesses that rely on precise financial management to keep operations running smoothly.

Additionally, these documents often come with instructions on how to proceed, providing clarity and guidance. This can alleviate confusion and lead to quicker resolutions of discrepancies, ensuring that all parties remain aligned in their financial dealings.

Lastly, receiving such an adjustment can enhance your relationship with the provider. It signifies their commitment to serving you well and addressing any issues that may arise. This kind of responsiveness can lead to increased loyalty and satisfaction with their services.