Understanding the Basics of Your Credit Karma Score and Its Importance in Managing Your Finances

Understanding your financial status can feel overwhelming, but it doesn’t have to be. There’s a specific metric that helps you gauge your trustworthiness when it comes to borrowing. This measurement plays a crucial role in determining whether lenders will offer you favorable terms or even approve your applications.

Many individuals often overlook the significance of this evaluation, assuming it’s just a number that exists in the background. However, it serves a vital function in your financial journey. Being informed about it can empower you to make better decisions regarding loans, credit cards, and even housing options.

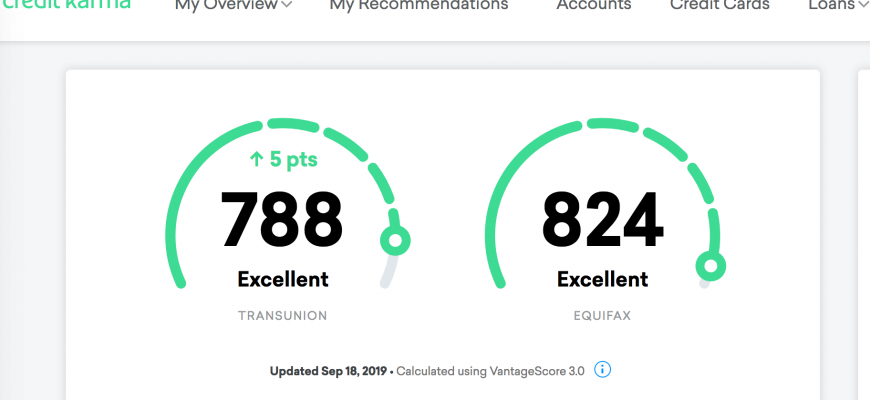

In today’s world, staying on top of this information is simpler than ever. Various platforms offer insights and tools that allow you to check and monitor this vital statistic regularly. Gaining familiarity with how it works can open doors and enhance your financial opportunities.

Understanding the Credit Karma Score

When it comes to your financial health, evaluating your borrowing potential is crucial. One of the popular tools to gauge this aspect is a numerical representation that reflects your creditworthiness, providing insights into how lenders might view you. This assessment is designed to help you manage your financial responsibilities and make informed choices.

Your rating is influenced by various factors, including payment history, total debts, the length of your credit history, new credit inquiries, and the mix of credit types. Each of these elements plays a role in shaping your overall picture, and a solid understanding of their impact can empower you to take charge of your financial journey.

Regularly checking this metric allows you to stay on top of any changes that may affect your financial prospects. It’s not just a number; it’s a tool for monitoring your progress over time. Keeping an eye on it can alert you to potential pitfalls and give you a clearer pathway toward achieving your monetary goals.

How Scores Are Calculated

Understanding how these ratings are determined can help you take control of your financial health. The evaluation process takes into account various factors that reflect your behavior in managing borrowed funds. This system aims to provide a comprehensive overview of your reliability as a borrower.

Payment history holds significant weight in this calculation. Consistently making payments on time showcases your responsibility and has a positive effect on your overall evaluation. Missing payments or defaulting can lead to severe repercussions in your assessment.

Another crucial aspect is your credit utilization ratio. This ratio compares your current outstanding debts to your total available limits. Keeping this number low is advantageous as it indicates you’re not over-relying on borrowed funds. Ideally, aiming for a utilization ratio below 30% is recommended.

The length of your borrowing history also plays a role. A longer history generally provides a better picture of your financial behavior, suggesting stability and consistency over time. However, starting to build a positive history is essential for those new to managing debts.

Additionally, the variety of accounts you have matters. A mix of different types of accounts, such as loans and credit lines, can demonstrate that you can handle various borrowing scenarios. However, it’s important to approach this with caution; opening too many accounts in a short period can backfire.

Lastly, inquiries into your borrowing activities also come into play. Each time you apply for new credit, a record is created. Too many inquiries in a short timeframe can indicate riskiness, which might adversely affect your evaluation.

Overall, knowing these key factors allows you to take proactive steps towards improving your financial profile and achieving better assessments over time.

The Importance of Monitoring Your Rating

Keeping an eye on your financial rating is essential for everyone, regardless of where they stand in their financial journey. It’s like having a regular check-up for your health; you want to know how you’re doing to make informed decisions that can lead to better outcomes in the long run.

Here are some compelling reasons why you should regularly track your evaluation:

- Identify errors: Mistakes in your financial records can occur, and catching them early can save you from future complications.

- Understand trends: Monitoring allows you to see how your financial behaviors impact your rating over time.

- Avoid surprises: Knowledge of your standing helps ensure you’re not blindsided when applying for loans or credit.

- Improve your status: Regular reviews enable you to spot areas for improvement and take action to enhance your financial credibility.

- Stay financially savvy: Awareness of your rating fosters better budgeting and spending habits.

Making this a regular practice not only provides peace of mind but also empowers you to take control of your financial future. Take charge today by being proactive about your financial standing!