Understanding Credit Karma and Its Benefits for Your Financial Journey

In today’s world, keeping track of your financial health has become essential. With a myriad of options available, individuals often search for tools that provide insights into their financial standing. These resources not only help you monitor your score but also offer guidance on improving it. It’s all about empowering yourself with the right information to make informed decisions.

Many people are curious about the various platforms that assist in managing their financial journey. These services typically offer a range of features, from tracking scores to personalized recommendations, simplifying the process of enhancing one’s financial profile. With a bit of understanding, you can take proactive steps towards better financial well-being.

As you delve deeper into these resources, you’ll discover that they provide not just numbers, but also context and strategies tailored to your unique situation. Whether you’re looking to secure a loan, rent an apartment, or simply manage personal finances better, having access to this information can prove invaluable. Embracing the power of these tools can lead you toward a more secure financial future.

Understanding Credit Karma Services

Many individuals are looking for ways to manage their financial health more effectively. A popular option that has emerged in recent years offers a range of tools designed to help users navigate their monetary profiles. These resources aim to provide valuable insights, making it easier to understand different aspects of personal finance, especially regarding borrowing options and overall fiscal management.

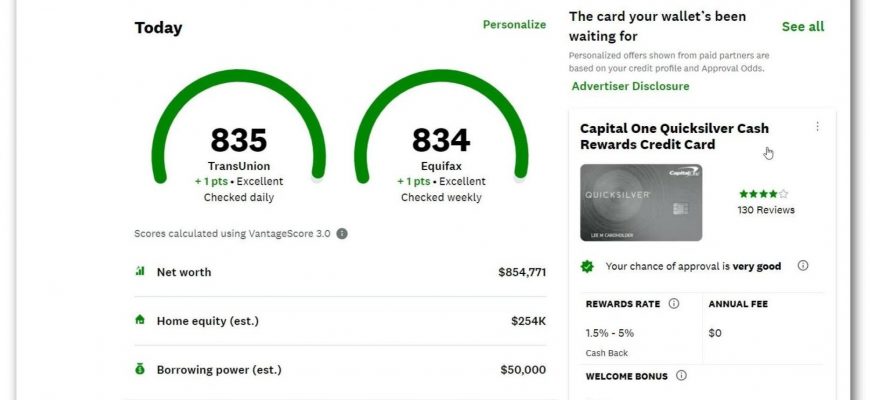

This platform typically provides users with access to their numerical rating, which can greatly influence eligibility for loans and other financial products. By regularly monitoring this figure, individuals can better position themselves for favorable terms when seeking to borrow funds. Additionally, the service often includes personalized recommendations tailored to improve one’s financial standing.

Beyond monitoring scores, users can find educational resources that shed light on various financial concepts. This knowledge empowers individuals to make informed decisions related to their assets or liabilities. With the right tools at their fingertips, modern consumers can take proactive steps towards enhancing their financial well-being.

Furthermore, these services frequently analyze trends in a user’s financial behavior, offering alerts and tips to maintain or improve standing. Such ongoing assessments encourage responsible habits while providing a snapshot of one’s economic landscape. Ultimately, this supportive environment helps users feel more confident as they tackle their financial journeys.

How Score Ratings Influence Your Finances

Your numerical rating plays a significant role in shaping your financial landscape. It can determine whether you secure that dream home, land a car loan, or even get approved for a new credit card. A higher rating typically opens doors, granting access to better interest rates and more favorable borrowing terms.

For many, it may come as a surprise how much this figure can impact everyday costs. For instance, a modest difference in your score could lead to thousands of dollars in additional expenses over the lifespan of a loan. Understanding this connection can empower you to make informed decisions and cultivate a healthier financial future.

Moreover, lenders and service providers often use these ratings as indicators of risk. A strong score can enhance your negotiating power, while a lower one might limit your options. It’s essential to monitor your standing routinely, as various factors, including payment history and debt levels, can influence it significantly.

Taking proactive steps to improve your rating can lead to a cascade of benefits, from reduced insurance premiums to better job prospects in certain industries. In the financial world, having a solid standing is indeed a cornerstone of stability and growth.

Benefits of Using Financial Monitoring Tool

Utilizing a financial management platform can significantly enhance your understanding of your financial standing. This kind of tool offers a range of advantages that empower users to take control of their financial journey. Whether you are aiming to improve your score or simply want to stay informed about your overall financial health, the benefits are substantial.

One major advantage is the ability to track your score in real-time. By having access to up-to-date information, you can quickly identify any changes and take necessary actions. This proactive approach helps you to rectify any inaccuracies and avoid potential pitfalls associated with poor financial decisions.

Moreover, many of these platforms provide personalized advice tailored to your individual circumstances. This guidance can be invaluable in making informed choices about loans, credit cards, and other financial products. With recommended steps to enhance your score, you feel more empowered to reach your financial goals.

Another benefit is the educational resources available to users. From articles to tools that explain how different factors impact your score, the knowledge gained can lead to wiser financial habits. Understanding the intricacies of your financial profile enables you to make decisions aligned with your long-term aspirations.

Lastly, the peace of mind that comes from having a handle on your finances cannot be overstated. Knowing you have the tools and information at your disposal to monitor your progress provides reassurance and confidence as you navigate the financial landscape.

You’ve set the bar so high with this one! Such a captivating and fun experience. Can’t wait to see more!