Understanding the Path of Your Credit Journey and Its Impact on Financial Health

When it comes to managing your finances, there’s a fascinating process many of us go through, often without even realizing it. This winding path intertwines our spending habits, payment histories, and financial decisions into a tapestry that defines how lenders view us. It’s not just about numbers; it reflects our relationship with money and the choices we make along the way.

Throughout this experience, various elements come into play that can either help or hinder our progress. Each step can introduce new opportunities or challenges, influencing how we navigate the world of loans and services. By recognizing these factors, we empower ourselves to make informed decisions, which can lead to favorable outcomes down the line.

By the end of this exploration, you’ll gain a better understanding of how to effectively navigate your financial voyage, demystifying the complexities along the way. With the right insights and strategies, you can chart a course that not only enhances your chances of approval but also sets you up for long-term success in managing your resources.

Understanding Scores and Their Impact

Having a solid grasp of your financial metrics is essential in today’s world. These metrics can influence various aspects of your life, from securing loans to the interest rates you may receive. By comprehending the factors that contribute to these numbers, you can take control of your financial future and make informed decisions that benefit you.

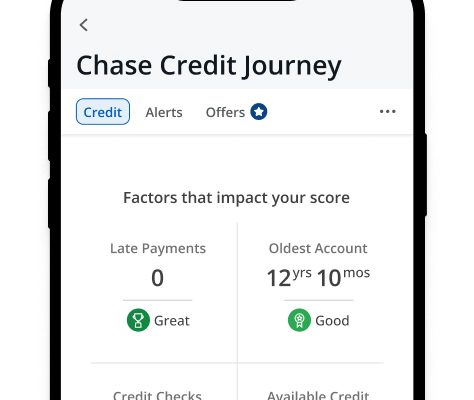

Metrics are typically derived from your financial habits, including timely payments, total outstanding balances, and the length of your financial history. Each of these elements plays a critical role in how lenders perceive your trustworthiness. A better score often means you are seen as a lower risk, which can translate to better rates and terms when you need to borrow.

The impact of maintaining a good score stretches far beyond just loans. It can affect rental agreements, insurance premiums, and even some employment opportunities. By being aware of how your financial practices influence these outcomes, you can adopt strategies to improve your standing. Simple actions like keeping your balances low and making sure bills are paid on time can make a significant difference.

In conclusion, understanding the significance of your scores and the factors that influence them empowers you to take charge of your financial life. Each decision counts, and a little knowledge can lead to better choices and ultimately a brighter financial future.

Steps to Build Your Credit History

Establishing a solid financial reputation is essential for achieving your monetary goals. It involves a series of actions that can enhance how lenders perceive you, ultimately opening doors to better opportunities. Let’s delve into some practical steps you can take to establish a robust record in the financial world.

First, consider opening a secured account. This type of account requires a deposit that acts as collateral, making it easier for you to gain approval. Use the account for small purchases and ensure timely payments each month to start building a positive track record.

Next, it’s wise to apply for a credit card or a personal loan, even if it seems daunting at first. Start with a manageable limit and make sure to pay off the balance in full each month. This practice demonstrates responsibility and helps boost your standing.

Regularly monitor your financial standing using free resources available online. Keeping track of your progress will allow you to see how your actions impact your reputation. Plus, it helps identify any errors that could negatively affect your score.

Another important step is to keep your existing accounts in good standing. Avoid closing old accounts, as they contribute to the length of your financial history, which is a critical factor in assessments. Additionally, maintaining a low ratio of borrowed amounts to your total limits shows that you use credit wisely.

Lastly, practice patience and consistency. Building a favorable reputation is not an overnight endeavor. Stick to your plan and remain mindful of your financial habits. Over time, you’ll see the results of your diligence and commitment.

Common Mistakes to Avoid in Financial Management

Managing finances can be a tricky business. With so much information out there, it’s easy to slip up and make costly errors. From overlooking important details to making hasty decisions, many pitfalls can hinder your progress toward a stable financial future. Here are some common missteps to sidestep on your path.

Ignoring Credit Reports: One of the biggest blunders people make is forgetting to regularly check their reports. This vital document contains essential details affecting your score, and missing errors can lead to significant issues down the line. Make it a habit to review it at least once a year to catch any inaccuracies early.

Missing Payments: Life can get busy, but consistently missing due dates can have dire consequences. Establish reminders or consider automatic payments to ensure that you never fall behind. A single late payment can negatively impact your standing for years.

Relying Too Much on One Source: Many individuals depend solely on one financial institution. This can limit options and potentially expose you to higher interest rates. Diversifying your accounts may provide better opportunities and help you manage your resources more effectively.

Neglecting to Budget: Without a clear budget, it’s all too easy to overspend. Take the time to create a practical plan for your income and expenses. This will empower you to track your spending and make informed choices.

Overusing Credit: Some believe that using credit is the key to building a robust profile, but overextending yourself can be detrimental. Keep your balances low and always aim to pay more than the minimum amount due. This not only helps your standing but also saves you money on interest.

Shopping Around Too Much: While it’s wise to compare offers, applying for too many accounts in a short period can trigger red flags. Limit your applications to what you genuinely need and spread them out over time to minimize the impact on your standing.

By avoiding these missteps, you’ll be better equipped to navigate the financial landscape with confidence and set yourself up for long-term success.