A Comprehensive Guide to Understanding Credit Home Loans and Their Benefits

Owning a dwelling is a dream that many aspire to achieve, yet the path to acquiring one can often feel daunting. The financial landscape offers various tools to assist individuals in making this significant leap, allowing them to secure a living space without the immediate burden of full payment. This assistance is particularly valuable for those who may not have sufficient savings or prefer to invest their resources elsewhere.

When navigating the realm of property purchases, it’s essential to grasp the fundamentals of financial agreements designed for acquiring residences. These arrangements serve as a bridge, enabling prospective homeowners to transform their aspirations into reality. They not only facilitate ownership but also shape the financial journey of the individual, impacting how they manage their funds over time.

Exploring these options can unveil a wealth of information about interest rates, repayment terms, and eligibility criteria. Understanding these elements empowers potential buyers to make informed decisions and choose solutions that align with their financial goals. As we delve into this topic, we’ll uncover the nuances of residential financing and equip you with the insights needed to navigate the process with confidence.

Understanding Credit Home Loans

When it comes to buying a residence, many people find themselves exploring various financial options to make their dream possible. This type of funding allows individuals to obtain the necessary capital to purchase a property, spreading the payments out over an extended period. It’s a practical way to enjoy the benefits of ownership without needing the entire sum upfront.

These financial products come with different terms and interest rates, tailored to fit diverse needs and circumstances. Borrowers often collaborate with lending institutions to secure terms that align with their financial capabilities, ensuring manageable monthly payments. The balance between interest rates and repayment terms can significantly impact the overall cost, making it essential to compare different offers.

Additionally, understanding factors like credit ratings and down payments can influence the amount one can borrow. A solid credit history can result in more favorable terms. Many institutions also provide various resources and guidance to help potential homeowners navigate the process smoothly.

In summary, engaging with this kind of financing can be an excellent avenue for many aspiring homeowners. With careful planning and informed decision-making, individuals can move closer to achieving their real estate aspirations.

Types of Financing Options Available

When embarking on the journey of purchasing a property, it’s essential to be aware of the various funding options at your disposal. Each type can cater to different financial situations and preferences, allowing you to choose what best aligns with your goals.

One common choice is the fixed-rate variant, where the interest rate remains constant throughout the term. This option offers stability and predictability, making budgeting simpler for many buyers.

Another popular alternative is the adjustable-rate option, which begins with a lower interest rate that may change after a set period. This can be appealing for those looking to save initially, but it’s crucial to consider how future rate adjustments might impact your finances.

For individuals seeking to buy a property with a minimal down payment, there are specialized programs available. These often cater to first-time buyers or those with limited funds, helping to make homeownership more accessible.

Additionally, for veterans, specific offerings exist, designed to honor their service. These can include favorable terms and conditions, making it easier for them to secure a place they can call home.

Understanding these various possibilities can empower you to make informed decisions on your property acquisition journey. Each option has its unique features, so it’s important to evaluate them based on your individual circumstances and long-term objectives.

Factors Affecting Approval Process

Several elements play a crucial role in determining whether an applicant will receive the green light for financing a property. Understanding these aspects can significantly enhance one’s chances and ensure a smoother experience.

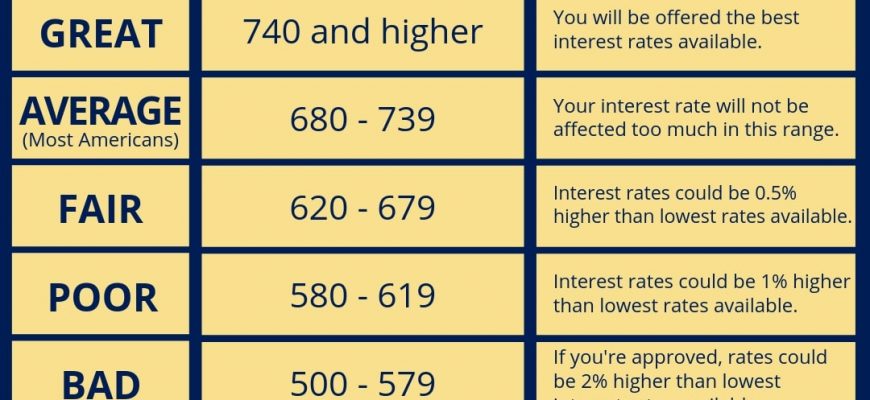

One of the primary considerations is the individual’s financial history. Lenders closely examine credit scores and reports to gauge the risk associated with extending funds. A solid track record of managing debts responsibly can lead to favorable outcomes.

Income stability is also pivotal. Regular, sufficient earnings not only demonstrate the ability to repay a sum but also reflect reliability. Lenders often look for consistent employment history, as it indicates a potential borrower’s financial security.

Another factor includes the amount of existing debt. A higher debt-to-income ratio can signal to lenders that taking on additional financial responsibilities may be challenging for the borrower. It’s crucial to maintain a balanced approach to debt management.

Additionally, the type of property in question influences decisions. Different properties may come with varying risk levels, impacting the terms of the arrangement. For instance, lenders may view primary residences differently than investment properties.

Lastly, the down payment plays a significant role. A larger upfront contribution reduces the risk for lenders and can result in better terms. It reflects the borrower’s commitment and financial discipline.