Understanding the Differences Between Credit Freezes and Credit Locks

When it comes to safeguarding personal information, individuals often find themselves navigating a complex landscape of options. In an era where identity theft is increasingly prevalent, knowing how to protect oneself is crucial. Many people are not aware that there are specific tools designed to enhance the security of sensitive data, and each has its unique characteristics.

These methods may sound similar, but they serve different purposes and offer varying levels of protection. By exploring these two approaches, you can make informed decisions about how to better shield your personal details from potential misuse. You’ll discover how each mechanism operates, enabling you to choose the best strategy for your unique situation.

No one wants to become a victim of fraud, and having the right knowledge at your disposal can be a game-changer. Understanding the distinctions between these options will empower you to take control of your personal information and enhance your overall security. It’s time to dive in and clarify these essential concepts!

Understanding Credit Freezes and Their Purpose

When it comes to safeguarding your financial identity, there are strategies available that help protect you from unauthorized access to your personal information. These approaches can act as barriers against potential fraud, ensuring that your sensitive data remains secure. It’s essential to grasp the fundamental principles behind these protective measures, as they play a crucial role in maintaining your financial well-being.

One of the primary goals of implementing these protective steps is to prevent identity thieves from acquiring loans or credit in your name. By making it more difficult for others to access your accounts or create new ones, you’re signaling to lenders and financial institutions that they need to verify the authenticity of any requests. This extra layer of security can provide peace of mind, especially in a world where identity theft is prevalent.

While these strategies may sound similar, there are key differences to be aware of. Understanding these nuances can empower you to make informed decisions based on your needs and circumstances. By taking control of your personal information, you’re not only securing your finances but also fostering a sense of confidence in your financial future.

How Credit Locks Offer Flexibility

When it comes to protecting your financial information, having control over who can access your data can make a significant difference. Unlike traditional methods, modern approaches provide a more adaptable way to manage your sensitive details. This allows you to maintain a higher level of security without sacrificing convenience.

One of the standout features of this approach is its ability to be toggled on and off at your convenience. When you see an opportunity that requires access to your information, you can easily grant permission. Conversely, when you want to ensure that your data remains safeguarded, you can quickly revert to a more secure state. This dynamic control is especially beneficial for those who may need to share their details frequently, such as when applying for loans or new accounts.

Additionally, many services offer user-friendly apps that enable instant changes. In today’s fast-paced world, having the ability to rapidly respond to changing circumstances gives users peace of mind. Instead of dealing with lengthy procedures, you can make adjustments in real-time, adapting to your needs as they arise.

This flexibility not only enhances security but also empowers individuals to take charge of their financial landscape. With the right tools at your disposal, you can enjoy the benefits of safeguarding your information while maintaining the freedom to engage with financial opportunities whenever they come your way.

Key Differences Between Freezes and Locks

When it comes to safeguarding your financial information, understanding the distinctions between different protective measures is essential. Each option offers unique features, benefits, and procedures that can greatly impact how you manage your personal data. Knowing these variations can help you decide which route aligns best with your needs.

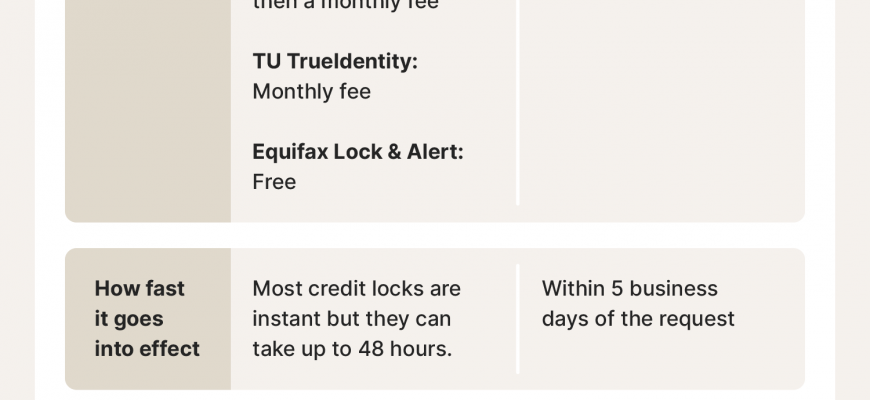

One of the primary differences lies in the level of control each option provides. While one method typically requires a more cumbersome process to implement and lift, the other may offer a quicker, more user-friendly approach. This can be particularly important for individuals who frequently engage in transactions that require flexibility while ensuring their information remains secure.

Another key point is related to accessibility. Depending on the choice you make, you may encounter different limitations when it comes to accessing your sensitive information or applying for new accounts. Some methods allow for easier management through mobile applications or online platforms, while others may necessitate direct communication with financial institutions.

Ultimately, understanding these core differences enables you to make informed decisions regarding your financial security. Whether you prioritize ease of use, control, or accessibility, knowing what each option entails can empower you to take the necessary steps to protect your identity.