Understanding the Essentials of a Credit File and Its Importance in Financial Management

In today’s world, having a solid grasp of your financial background is essential for navigating various aspects of adult life. From securing loans to renting an apartment, numerous situations require insight into your financial interactions. This knowledge not only empowers you to make informed decisions but also aids in understanding how your financial habits affect your future opportunities.

Essentially, your financial narrative is built through a series of transactions and behaviors over time. This collection of information shapes how lenders and other organizations perceive your financial reliability. It’s fascinating to see how your actions, big or small, culminate in a comprehensive portrait that plays a critical role in determining your access to resources and services.

By familiarizing yourself with the elements that contribute to this narrative, you can take significant steps toward enhancing your financial standing. Knowing what influences your financial reputation allows you to strategize effectively and foster healthier habits. In preparing for major life decisions, understanding the components of your financial history can be a game changer.

Understanding the Basics of Credit Files

When it comes to your financial health, there’s an essential component that plays a crucial role in shaping your ability to access loans, mortgages, and other forms of credit. This element is essentially a record that keeps track of your borrowing history and repayment behavior. Knowing how this record works can help you make informed decisions and understand how lenders perceive your financial reliability.

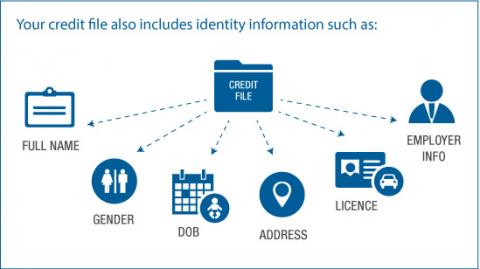

At its core, this document contains a detailed overview of your past and present financial engagements. It includes information such as your outstanding debts, payment history, and even public records like bankruptcies. The data presented contributes significantly to your overall creditworthiness, influencing how potential lenders view you. Therefore, keeping an eye on what it holds is important.

Accessing this record usually involves reaching out to specialized agencies that compile this information. They gather data from various sources, including banks and other financial institutions, which creates a comprehensive picture of your financial habits. Understanding the nuances of this documentation can empower you to manage your finances more effectively and improve your standing.

When looking to secure loans or make significant purchases, knowledge about this record can be your greatest ally. Not only does it assist in determining eligibility for financial products, but it also can guide you in making better financial choices throughout your life. Being aware of what information is based on will help you maintain a strong financial standing.

The Importance of Maintaining a Credit Report

Keeping track of your financial history is essential for various reasons. Regularly reviewing your personal records can provide insights into your overall financial health and help you make informed decisions. It’s more than just a way to access loans; it’s a window into your reliability as a borrower.

Staying informed about your standing can empower you to identify any discrepancies or inaccuracies that could affect your future financial opportunities. Mistakes can happen, and spotting them early is crucial to avoiding potential issues down the line.

Furthermore, a well-maintained record can open doors to better interest rates and more favorable terms. Lenders often assess your history to determine their risk, and demonstrating financial responsibility can lead to significant savings over time.

Lastly, being proactive about your financial documentation can help you manage your overall budget more effectively. Knowing where you stand allows you to plan ahead and work toward your financial goals with confidence.

How to Access Your Financial Records

Being aware of your financial standing is essential in today’s world. Understanding your background information can help you manage your finances better and make informed decisions. So, how can you conveniently check this vital information?

- Online Access: Many agencies offer online portals where you can easily view your details. Usually, you’ll need to create an account and verify your identity.

- Annual Reports: You are entitled to receive your reports for free once a year from various sources. Take advantage of this to review your information regularly.

- Third-party Services: Some platforms provide tools to check your standing with alerts for any changes. This can be helpful in staying updated.

- Request by Mail: If you prefer the traditional way, you can request your information through postal services. Just ensure to follow the guidelines provided by the agency.

Always remember to check for accuracy and report any discrepancies you find. Taking these steps will help you stay informed and in control of your finances.