Understanding the Importance and Details of Your FICO Credit Score

In today’s world, the way you manage your finances can significantly impact various aspects of your life. From buying a home to securing a car loan, the way lenders evaluate your trustworthiness is crucial. This evaluation is often expressed as a numerical representation, reflecting your financial habits and choices.

Each time you make a payment, take on new debt, or settle an old obligation, you contribute to a larger picture that potential lenders consider. This numerical depiction encapsulates your financial journey, from timely payments to the amount of debt you carry. Knowing how this system works can empower you to make informed decisions that enhance your financial standing.

Understanding this numerical evaluation is essential for anyone looking to navigate the complexities of borrowing and lending. Whether you’re planning to make a large purchase or simply want to understand your financial health, recognizing the factors that influence this rating can help you pave the way to a more secure financial future.

Understanding the Basics of FICO Scores

When it comes to navigating the world of personal finances, having a solid understanding of numeric evaluations that gauge a borrower’s reliability can be incredibly beneficial. These assessments play a crucial role in the decision-making processes of lenders and can significantly impact one’s financial opportunities.

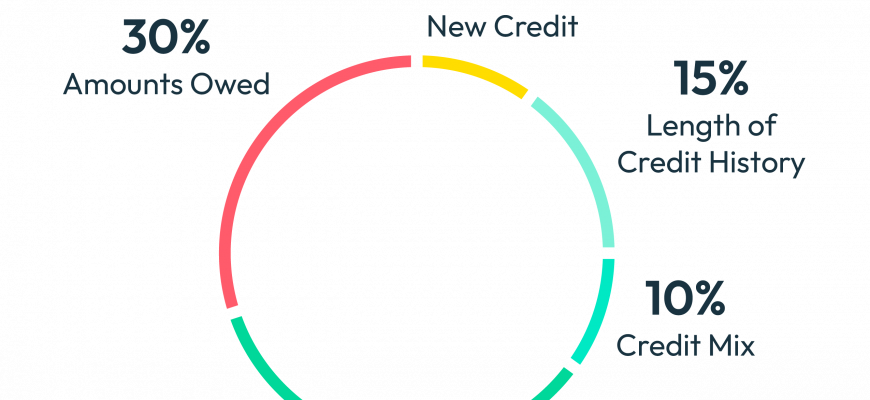

Evaluating financial behavior is at the heart of these ratings. They utilize various factors from an individual’s credit history, including payment punctuality, total outstanding debts, length of credit accounts, and the mix of different types of credit. Each component contributes to the overall figure, reflecting how responsibly one manages borrowed funds.

Moreover, these figures can influence everything from loan terms to insurance premiums. A higher rating usually leads to better options, allowing borrowers to secure funds with more favorable conditions. In contrast, a lower evaluation might result in higher interest rates or even rejection of applications.

Understanding this numeric tool is essential not just for preparing to apply for loans but also for maintaining a healthy financial profile over time. Regularly monitoring and managing your credit behavior can lead to improved ratings, ultimately enhancing financial well-being and opening doors to new opportunities.

The Impact of FICO Scores on Finances

Understanding the digits that represent your financial reputation is crucial. These numbers can greatly influence various aspects of your monetary dealings. When you apply for a loan, lease an apartment, or even seek a new job, these figures often come into play, affecting your options and terms.

Your numerical assessment reflects how responsibly you manage borrowed funds. Lenders and service providers use it to gauge the likelihood of timely repayments. A higher rating typically opens the door to more favorable interest rates, which can lead to significant savings over time. Conversely, a lower rating may result in higher costs and limited access to financial products.

Moreover, the implications extend beyond just loans or mortgages. Insurers might consider your rating when determining premium amounts, while some employers could check it as part of their hiring process. It’s clear that maintaining a positive rating is vital in today’s economy.

Regularly reviewing your financial standing helps identify areas for improvement. Taking proactive steps, such as paying bills on time and keeping balances low, can elevate your standing over time. Understanding how your actions impact this crucial number empowers you to make informed decisions and manage your finances effectively.

How to Enhance Your FICO Score

Boosting that all-important numerical representation of your financial health can feel overwhelming, but it doesn’t have to be! There are practical steps you can take to improve your standing and make yourself a more attractive candidate for lenders. Let’s explore some effective strategies to elevate your rating.

Pay Your Bills on Time: This one is key. Consistently meeting payment deadlines shows you’re responsible and reliable. Set up reminders or automate payments if you tend to forget.

Reduce Your Utilization Ratio: Aim to keep your balances low relative to your total credit limit. Ideally, try to use less than 30% of your available credit. This demonstrates that you can manage your finances well without maxing out your cards.

Build a Mix of Credit: Having different types of credit, such as retail accounts, loans, or mortgages, can positively influence your standing. However, don’t open accounts you don’t need just for the sake of variety.

Regularly Check Your Reports: Mistakes can happen, and inaccuracies can drag down your rating. Request your reports annually and scrutinize them for errors. If you find any discrepancies, report them immediately to have them corrected.

Avoid Opening Too Many Accounts at Once: When you apply for a bunch of loans or cards in a short time, it can raise red flags. Limit your applications and space them out to show that you’re not desperate for credit.

Keep Old Accounts Active: The length of your credit history matters. If you have old accounts that are in good standing, try to keep them open and occasionally use them. This can help bolster your overall profile.

Implementing these strategies can create positive changes over time. Remember, improvement is a marathon, not a sprint, and each small step counts towards achieving your financial goals.