Understanding the Concept and Functionality of a Credit Engine

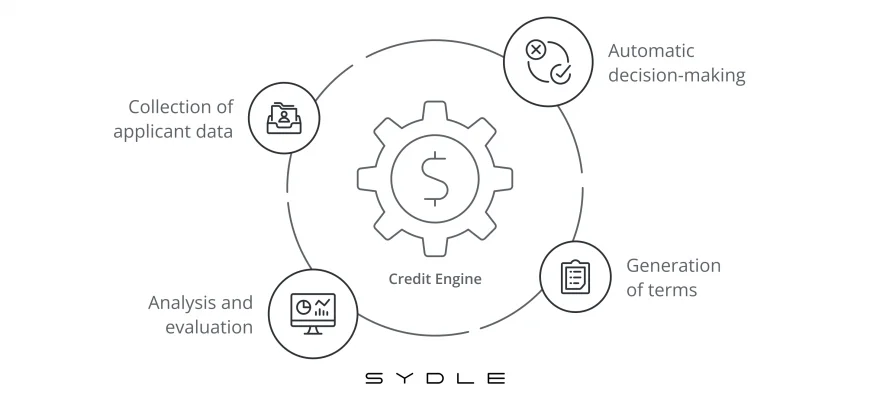

In the intricate world of finance, there exists a sophisticated mechanism designed to analyze and determine an individual’s or a business’s eligibility for various monetary opportunities. This system plays a crucial role, acting as a bridge between consumers seeking funds and institutions offering financial products. By utilizing complex algorithms and extensive data, it enables lenders to make informed decisions efficiently.

At its core, this technological tool synthesizes vast amounts of information, ranging from payment histories to overall financial behaviors. The insights drawn from this data help institutions gauge risk levels and craft reasonable offers tailored to specific clients. This dynamic process not only streamlines approval times but also enhances accessibility to financial services for a wider audience.

As we delve deeper into this fascinating subject, we will explore how these assessment systems function, their significance in today’s economy, and the impact they have on both borrowers and lenders alike. Understanding this technology is essential for anyone looking to navigate the financial landscape successfully.

Understanding the Functionality of Credit Engines

When we talk about the mechanisms behind lending decisions, it’s fascinating to see how they work seamlessly to support various financial transactions. These systems analyze a multitude of data points to assess the eligibility of individuals or businesses seeking financial support. It’s like a sophisticated matchmaking service that aligns potential borrowers with lenders based on various parameters.

At its core, this mechanism leverages extensive algorithms designed to evaluate risk. By taking into account factors such as repayment history, income levels, and overall financial behavior, it constructs a comprehensive profile of the applicant. This allows financial institutions to make informed decisions quickly and efficiently rather than relying on outdated methods that could lead to inaccuracies.

Moreover, technological advancements have made these systems more accessible and user-friendly. Many platforms now offer real-time assessments, providing immediate feedback to users. This improved accessibility allows a wider audience to engage in financial activities confidently, knowing they have support based on thorough analysis.

In addition, transparency has become a key feature. Users can often view their profiles and understand what influences their scores. This empowers individuals to manage their financial health proactively, promoting better habits and responsible borrowing.Ultimately, the goal is not just about facilitating loans but enhancing the overall financial ecosystem. By ensuring that lenders minimize risks while giving opportunities to borrowers, these systems play a crucial role in fostering trust and stability in financial markets.

The Role of Credit Engines in Finance

In today’s financial landscape, sophisticated systems play a crucial role in assessing risk and facilitating decision-making. These systems harness data to evaluate borrowers and transactions, making processes more streamlined and efficient. By utilizing advanced algorithms, they help financial institutions gain deeper insights into potential lending scenarios.

One of the key functions of these technological solutions is to provide accurate evaluations based on a myriad of factors. They analyze historical data, individual behaviors, and broader economic trends to predict outcomes. This capability not only enhances the speed of operations but also improves accuracy, reducing the likelihood of errors that can be costly for both lenders and borrowers.

Furthermore, these systems empower organizations to customize their offerings. By tailoring their services to match the unique profiles of clients, they can enhance customer satisfaction and foster lasting relationships. This adaptability is vital in a world where consumer needs are constantly evolving.

In summary, these advanced tools are integral to the financial ecosystem, driving innovation and ensuring that the processes involved in lending and borrowing remain robust and efficient. Their influence extends beyond mere transactions, shaping the future of financial interactions.

Benefits of Utilizing Financial Evaluation Technology

In today’s fast-paced financial landscape, leveraging advanced technology for assessing individual and business creditworthiness brings a multitude of advantages. This innovative approach streamlines the entire process, making it more efficient and accessible for both lenders and borrowers. By harnessing sophisticated algorithms and real-time data analysis, financial organizations can make informed decisions faster than ever before.

One of the standout perks is the enhanced accuracy in risk assessment. With automated systems handling large volumes of data, there’s a significant reduction in human error. This leads to smarter lending practices and more precise evaluation of borrowers’ capabilities. Additionally, the rapid processing times mean that customers experience quicker approvals, improving overall satisfaction.

Another key benefit is the impressive scalability these technologies provide. Financial institutions can easily adapt to varying demands, catering to more clients without compromising on service quality. This flexibility not only boosts productivity but also helps organizations stay competitive in a crowded market.

Moreover, using such advanced systems can result in a reduction of operational costs. Automation of manual tasks reduces the need for extensive human resources, allowing institutions to allocate funds to more strategic activities. Overall, embracing this kind of technology fosters not only growth but also sustainability in the financial sector.