Understanding Credit Disputes and Their Importance in Financial Management

In today’s world, managing your finances can sometimes feel like navigating a maze. It’s not uncommon for individuals to encounter situations where their financial standing is questioned due to various factors. These instances can lead to misunderstandings that require attention and rectification. It’s crucial to know that there are processes in place to address these concerns effectively.

When issues arise concerning your financial statements, it’s important to confront them head-on. Taking a proactive approach can help you maintain a strong financial reputation. Knowing how to approach these matters and understanding the mechanisms available for resolution are vital steps for anyone looking to safeguard their financial future.

Ultimately, being informed about these processes not only empowers you but also ensures that your financial records accurately reflect your situation. This knowledge can make all the difference in achieving your financial goals and maintaining peace of mind.

Understanding Credit Disputes and Their Importance

When it comes to managing your financial history, clarity is crucial. Mistakes can happen, and sometimes your records don’t accurately reflect your situation. These inaccuracies can lead to significant implications, affecting your ability to secure loans or obtain favorable rates on financing. Thus, the process of addressing these errors becomes essential, as it empowers individuals to take control of their financial narratives.

Engaging in this corrective journey allows borrowers to challenge incorrect information that could hinder their financial opportunities. By initiating a review, you not only seek to rectify any misunderstandings but also enhance your credibility in the eyes of lenders. This proactive step can pave the way for a more favorable financial future, ensuring that your history reflects the truth of your financial behaviors.

Furthermore, knowing the ins and outs of this process can greatly benefit anyone wanting to safeguard their financial well-being. Being informed means you are better equipped to navigate potential pitfalls and emerge with a more accurate portrayal of your financial standing. Ultimately, understanding how to manage disputes contributes to greater confidence in financial decisions, instilling a sense of empowerment in the realm of personal finance.

Common Reasons for Initiating a Disagreement

Sometimes, individuals find themselves facing inaccuracies or unexpected entries in their financial records that necessitate action. Whether it’s a minor error or a significant oversight, many people choose to challenge these entries to ensure their financial history reflects the truth. Let’s explore some prevalent motivations behind this process.

One major reason is the presence of incorrect personal information. A simple typo in your name, address, or social security number can lead to larger complications. People often initiate a challenge when they spot these discrepancies, aiming to get them corrected promptly.

Another frequent cause is unauthorized accounts or transactions. If someone notices an account they didn’t open or a charge they didn’t make, it’s crucial to take steps to investigate and rectify the situation. Protecting oneself from potential fraud is a top priority.

Errors in payment history can also trigger a response. A missed payment or outdated balance might appear, impacting creditworthiness. Many take action when they find such inaccuracies, believing it’s essential to have an accurate portrayal of their financial responsibility.

Finally, differences in reporting by creditors can lead individuals to take steps to reconcile their records. When lenders report conflicting information, it can cause confusion and potential financial repercussions, prompting individuals to seek clarification and correction.

Navigating the Credit Dispute Process

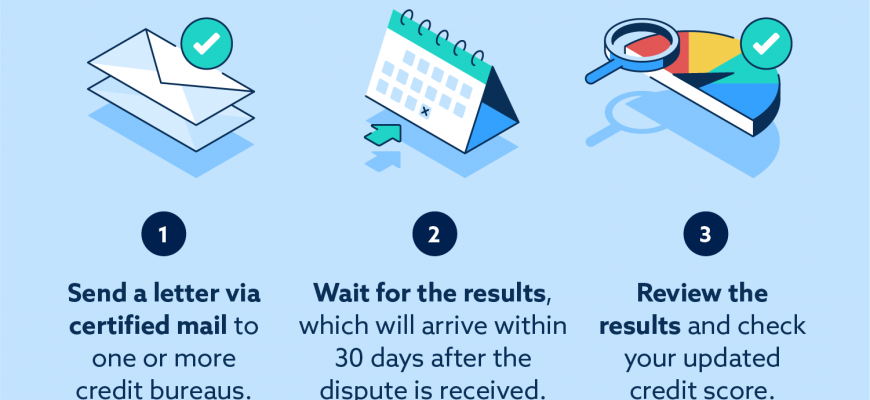

Understanding the journey to resolve inaccuracies on your financial record can feel overwhelming, but it doesn’t have to be. It’s crucial to tackle any discrepancies that may harm your financial health. Knowing the right steps can help streamline the process, making it less daunting and more accessible.

First, gathering all necessary documentation is vital. This includes statements, letters, and any other relevant communication that supports your claims. Organizing this information will help you present a strong case when reaching out to the agencies involved.

Next, reaching out to the pertinent institutions is essential. You’ll need to provide them with the gathered documentation and clearly articulate your concerns. Most organizations appreciate when you remain calm and composed, as this can facilitate a more productive dialogue.

After submitting your request for correction, it’s important to keep track of the timeline. Regulators usually have a set period to investigate your claim. Staying informed will help you know when to follow up and ensure your concerns are being addressed promptly.

Lastly, once the investigation concludes, reviewing the results is crucial. If your claims are validated, you should see changes made to your report. If not, you may want to consider additional steps, such as seeking advice from professionals who specialize in financial matters. Taking charge of your financial narrative is empowering and can lead to a brighter future.