Understanding the Concept of Credit and Its Definition in Finance

In the realm of finance, engaging in borrowing creates pathways for individuals and businesses to access resources they may otherwise find beyond their reach. This practice is rooted in trust and the expectation of future reimbursement, allowing for opportunities to invest in important ventures, whether it’s a home, education, or innovative business ideas.

Understanding the intricacies of attaining funds involves not only the mechanics of obtaining money but also the implications that come with the responsibility of repayment. The dynamics of this financial practice shape how personal and corporate economies function and thrive over time.

At its core, this process revolves around the idea of leveraging today’s potential for tomorrow’s gain. It fosters economic growth and stimulates various markets, illustrating the delicate balance between risk and reward. By exploring the nuances of this financial transaction, we open up a dialogue about accountability, trust, and the broader impacts on our financial landscape.

Understanding the Concept of Credit

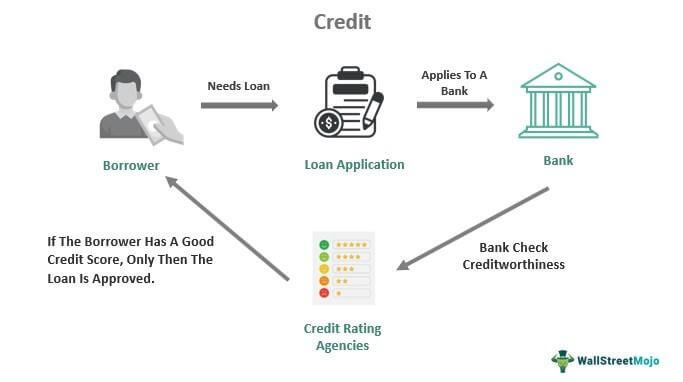

In today’s financial landscape, the idea of borrowing and lending plays a crucial role in both personal and business environments. It’s essential to grasp how this system operates to make informed decisions, whether you’re considering a loan for a new car or planning to finance your company’s growth.

At its core, this system revolves around trust and the ability to repay. It allows individuals and organizations to obtain resources they might not immediately have. Here are some key points to consider:

- Trust: Lenders assess the reliability of borrowers based on their history and financial behavior.

- Terms: Each agreement comes with its own conditions, including interest rates and repayment schedules.

- Impact: How one manages these obligations can significantly affect financial standing and future borrowing capacity.

Understanding the nuances of this financial tool can empower you to navigate various options, leading to smarter choices and better financial health. Remember, knowledge is key when engaging with these systems, as they can open doors to opportunities or lead to challenges if mismanaged.

The Role of Credit in Financial Systems

In modern economies, the function of borrowed funds is crucial for facilitating transactions and investments. These financial tools allow individuals and businesses to access necessary resources, enabling them to make purchases or expand operations even when immediate cash flow is lacking. This mechanism is woven into the very fabric of economic growth and stability.

Access to funds is a fundamental aspect of any financial framework. It empowers consumers to acquire goods and services that they might not be able to afford upfront. For businesses, these resources are essential for launching new projects or improving existing ones, ultimately leading to job creation and innovation.

Moreover, the circulation of borrowed funds helps to maintain liquidity within the financial markets. It ensures that money flows smoothly, contributing to overall economic health. Additionally, the relationship between lenders and borrowers fosters a sense of responsibility and encourages disciplined financial management.

However, it’s important to acknowledge that with such benefits come challenges. Over-reliance on borrowed funds can lead to financial strain for individuals and organizations alike. Hence, understanding how to navigate these waters becomes vital for achieving long-term financial wellbeing.

In summary, the integration of borrowed resources within financial systems plays a transformative role, not only enhancing individual opportunities but also propelling collective economic advancement.

Types of Financial Avenues Available to Consumers

When it comes to borrowing, consumers have a variety of options to choose from. Each method serves different purposes and comes with its own set of terms and conditions. Understanding these types can help individuals make informed choices based on their financial needs.

One common avenue is the personal loan, which is typically unsecured and can be used for anything from home improvements to consolidating debts. Interest rates can vary greatly, so it’s wise to shop around for the best deal.

Another popular option is revolving accounts, often seen with credit cards. This allows individuals to borrow up to a specified limit and pay it back over time while having the flexibility to borrow again as needed.

For those looking to finance a significant purchase, installment loans may be the right fit. These are structured payments spread out over a set period, ensuring predictable monthly expenses.

Some might consider a home equity line, which taps into the equity built up in property. This can be an attractive choice due to generally lower interest rates compared to other options, yet it does come with the risk of losing the home if payments are missed.

Lastly, payday advances offer quick access to cash but often come with high fees and should be approached with caution. While useful in emergencies, they can lead to a cycle of borrowing that is hard to escape.

In summary, understanding the various avenues available empowers consumers to select the best financial tools suitable for their situations. Each option has its merits and drawbacks, so careful consideration is essential.