Understanding the Essentials of a Credit Application and Its Importance in Your Financial Journey

When it comes to obtaining financial support, whether for a new home, a vehicle, or other personal needs, there is a structured approach that many lenders utilize. This process is crucial for both the lender and the borrower, as it helps establish a clear understanding of the applicant’s needs and their ability to manage new obligations. By taking a closer look at the necessary steps, we can demystify this essential aspect of financial transactions.

At its core, this procedure involves a series of inquiries and evaluations that allow institutions to assess risk. Individuals seeking assistance must present specific details that reflect their financial history and current situation. This information not only aids in determining suitability but also fosters transparency between both parties. It’s a mutual exchange that plays a key role in the lending landscape.

While the requirements can vary significantly depending on the institution and the type of assistance sought, familiarity with the common elements can empower individuals as they navigate their options. Understanding what to expect can streamline the experience, making it less daunting and more manageable. So, let’s dive deeper into the components that characterize this fundamental process.

Understanding the Financing Request Process

The journey of seeking a loan or financial assistance can sometimes feel overwhelming, but it’s crucial to grasp how it all works. This process involves multiple steps that allow lenders to assess your financial situation, helping them decide whether to provide the funds you need. By familiarizing yourself with each stage, you can navigate this path with greater ease and confidence.

First things first, gathering your financial documents is essential. Lenders often require a range of information to evaluate your personal circumstances. You’ll typically need details about your income, expenses, and any existing debts. By presenting a clear picture of your financial health, you boost your chances of receiving favorable terms.

Next, accurately filling out the necessary forms is vital. Pay attention to every detail, as inaccuracies can lead to delays or even rejections. Take your time, and ensure that all information reflects your current situation. This is also where honesty plays a crucial role; being upfront about your finances can lead to a smoother process.

Finally, after submission, patience is key. Lenders will review your request, which may involve background checks and deliberations. While you wait, it’s a good idea to stay informed and perhaps explore other financing options, just in case. Overall, understanding this entire process can empower you, making the experience feel less daunting and more manageable.

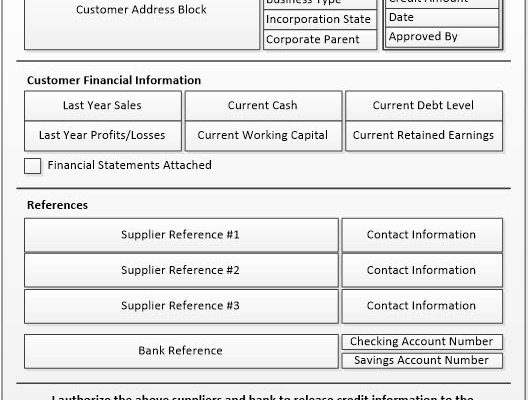

Essential Information Required for Applications

When seeking a financial product or service, there’s a crucial set of details that you need to provide to ensure a smooth process. This information not only helps institutions understand your situation but also allows them to make informed decisions tailored to your needs. Being prepared with the right data can significantly streamline the journey.

Firstly, identifying personal particulars is fundamental. This includes your full name, address, date of birth, and contact details. Such information verifies your identity and establishes a reliable line of communication.

Next up, financial history plays a pivotal role. Institutions often request details about your income, employment status, and current financial obligations. This background assists them in evaluating your ability to meet future commitments and ensuring that their offerings align with your financial circumstances.

Additionally, it’s essential to provide documentation regarding any existing debts or current accounts you hold. This transparency helps institutions assess your financial health and risk level accurately. If you’ve had past experiences with similar services, sharing those can also be beneficial.

Lastly, having your identification documentation ready, such as a passport or driver’s license, aids in confirming your identity. This can expedite the verification process and pave the way for a more efficient outcome.

In summation, gathering and presenting comprehensive and accurate information not only enhances your chance of securing the desired service but also fosters a collaborative relationship with financial providers.

Common Mistakes to Avoid When Applying

Many individuals encounter pitfalls during the process of seeking funds or financial support. It’s essential to navigate this journey with care to enhance your chances of approval. Here are some frequent blunders to steer clear of when pursuing financial assistance.

First and foremost, always ensure that you provide complete and accurate information. Omitting details or including inaccuracies can raise red flags and lead to denial. Review your submission thoroughly before sending it off; a second glance can catch simple errors that might otherwise jeopardize your chances.

Another common misstep is not doing enough research on the institution you’re dealing with. Each lender or provider has unique criteria and preferences. Tailoring your request to meet their requirements can make a significant difference in the outcome.

Additionally, avoid oversharing personal information that isn’t relevant to your inquiry. While transparency is crucial, excessive detail can confuse or overwhelm the reviewer. Stay focused on pertinent data that supports your case.

Lastly, don’t underestimate the importance of a strong credit history. Even if you believe you’re prepared, lenders often scrutinize this aspect closely. Take the time to understand your financial background and work on improving it if needed before seeking assistance.