Understanding the Types of Income That Make You Eligible for Financial Aid

Navigating the complexities of financing education can be overwhelming, especially when it comes to understanding the various factors that influence eligibility for support programs. Many might wonder what specific criteria are taken into account when assessing requests for help. The landscape can seem daunting, but grasping a few essential concepts can make the process more manageable.

Various financial elements play a critical role in ascertaining who can receive support. Different organizations and institutions establish their own guidelines, resulting in a diverse array of requirements. Understanding these aspects is crucial for prospective students and their families as they prepare to seek out opportunities.

When diving into the details, it is important to examine the nuances regarding personal community resources and overall economic standing. Recognizing how these elements interplay can significantly impact one’s chances of receiving the assistance they need. Let’s unravel this topic together and highlight key points to consider when determining eligibility.

Understanding Financial Aid Eligibility Criteria

Navigating the landscape of educational support can be tricky, especially when it comes to determining what factors come into play. There are various elements that institutions and organizations consider when evaluating applicants for assistance. It’s essential to understand these components to effectively gauge your eligibility for available resources.

First and foremost, the assessment typically revolves around personal circumstances, including family dynamics and dependents, which can significantly influence the amount of support one might receive. Additionally, the nature of previous academic achievements and current enrollment status can also play a pivotal role in this evaluation process.

Another crucial aspect is the timing of applications and specific requirements set by schools or funding bodies. Each program may have different criteria, so staying informed about these can elevate your chances of success. Overall, grasping these nuances allows individuals to better position themselves for opportunities that can alleviate the financial burdens of education.

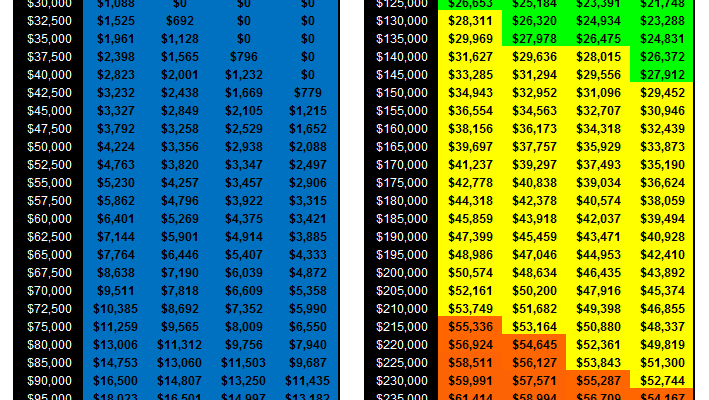

Types of Income Considered for Assistance

Understanding which earnings are taken into account when applying for support can be a bit tricky. Different sources of revenue contribute to the overall picture of an applicant’s financial situation. Here’s a breakdown of various categories that typically come into play.

- Wages and Salaries

- Self-Employment Earnings

- Rental Income

- Interest and Dividends

- Pensions and Annuities

- Social Security Benefits

- Unemployment Compensation

- Child Support Payments

- Gifts and Inheritances

Each of these categories carries its own significance and can impact the overall assessment. It’s essential to keep thorough records and be transparent about all sources of funding when applying.

How Earnings Affect Assistance Programs

Understanding the relationship between your earnings and the support you might receive can often feel overwhelming. It’s essential to recognize that various sources of revenue play a significant role in determining the level of help available to individuals and families. Each program has its criteria, and grasping these nuances is vital for navigating the process effectively.

Typically, these resources are assessed to create a comprehensive picture of your financial standing. This can encompass salaries, bonuses, investment returns, and even certain forms of government assistance. All of these components contribute to a broader evaluation of your situation and can influence the extent of aid you might receive. Moreover, different institutions may have unique thresholds and methodologies for calculating your eligibility, making it crucial to stay informed.

Additionally, not all earnings are treated the same way. Some forms of revenue might be exempt from consideration, while others could significantly impact the support amount. This variation means it’s important to dig deeper and understand how different streams of wealth interact with assistance opportunities. Ultimately, being aware of these factors can significantly enhance your chances of accessing the resources needed for your educational or personal pursuits.