Exploring Options When Your Financial Aid Falls Short

Life can throw some curveballs our way, especially when it comes to managing expenses associated with education. Many individuals find themselves in a position where the resources available to them are insufficient to cover all necessary costs. It’s a common scenario, and understanding your options can make a significant difference.

Imagine you’ve mapped out a budget, but reality hits hard and those plans don’t quite match up to the actual expenses. This situation can feel daunting, but there are various strategies you can explore to bridge the gap. Whether it’s seeking out alternative funding, considering part-time work, or exploring cost-cutting measures, there’s potential to find your footing.

Staying proactive and exploring different avenues can open doors to opportunities you might not have considered before. When traditional support mechanisms fall short, it doesn’t mean you have to face the struggle alone. Let’s delve into practical solutions and strategies that can help you navigate through the challenges.

Exploring Additional Funding Options

When the resources you have seem insufficient, it’s time to consider a variety of alternative sources to bridge that gap. Many avenues exist that can provide the support needed to keep you on track with your goals. Understanding what options are available can empower you to make informed decisions that ensure you have the means to pursue your dreams.

Diving into scholarships can be a great start. Numerous organizations offer funds based on academics, talents, or even specific hobbies. They can be a quick and rewarding way to supplement your current resources. Look for local opportunities or niche grants that align with your skills and interests.

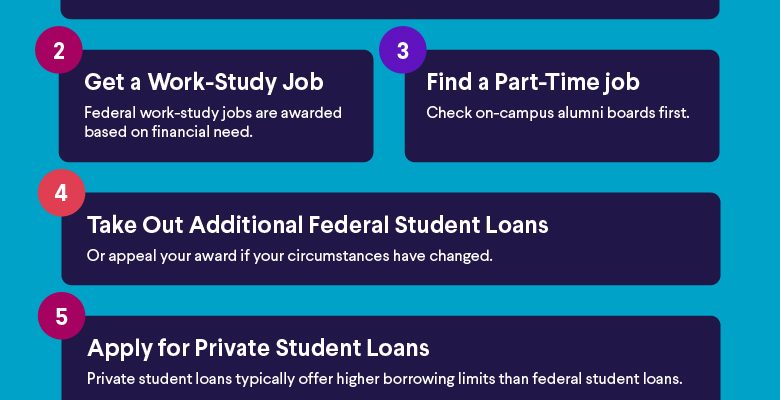

Another option is pursuing part-time employment. Juggling a job while studying can be a challenge, but it also brings valuable experience and additional income. There are flexible positions that cater specifically to students, allowing you to earn while focusing on your education.

Additionally, consider reaching out to your institution. They often have emergency funds, grants, or connections to resources that may not be widely advertised. A conversation with a financial counselor can open doors to programs designed to assist in your circumstances.

Lastly, crowdfunding has gained traction in recent years. Platforms exist where you can share your story and goals with others, potentially receiving help from those who resonate with your journey. It’s a modern twist on pooling resources that could lead to unexpected support from your community.

Strategies to Minimize Educational Expenses

Managing the costs of education can feel overwhelming, but there are plenty of ways to ease the financial burden. By being proactive and exploring various options, students can significantly reduce their overall expenses while still achieving their academic goals.

1. Create a Budget: Start by tracking your spending. This will help you identify where your money goes and where you can cut back. A clear budget can help you prioritize essential expenses, making it easier to allocate your funds wisely.

2. Apply for Scholarships: Scholarships are a fantastic option for reducing tuition fees. Spend time researching and applying for various scholarships that match your profile and interests. Every little bit counts, and there are numerous opportunities available.

3. Consider Community Colleges: Attending a community college for the first two years can save a significant amount of money. After completing an associate degree, you can transfer to a four-year institution while enjoying a more affordable tuition rate.

4. Utilize Open Educational Resources: Many courses offer free or low-cost textbooks and learning materials. Explore digital libraries and educational websites that provide quality resources to eliminate or minimize textbook costs.

5. Look for Part-Time Work: Finding a part-time job while studying can help cover daily expenses and reduce the need for loans. Many universities even offer positions specifically for students that align with their schedules.

6. Share Living Expenses: Consider roommates to split rent and utility costs. Grouping together can create a more affordable living situation, allowing you to save more money during your educational journey.

7. Take Advantage of Discounts: Many businesses offer discounts to students, from retail stores to public transportation. Always inquire about student discounts to save on necessary purchases.

By implementing these strategies, students can navigate their educational experience with more ease and financial stability. A little planning goes a long way in making higher education more accessible and manageable.

Understanding Loan and Scholarship Alternatives

When you find yourself in a tight spot regarding funding your education, exploring various options can open new doors. There are numerous resources available that can help fill the gap left by traditional support paths. Tackling this challenge means looking beyond what’s readily available and considering different strategies to finance your studies.

Loans can provide immediate relief, allowing you to cover tuition and living expenses. However, it’s essential to be cautious. Research the terms and conditions carefully to avoid overwhelming debt in the future. Federal loans usually offer lower interest rates and flexible repayment options, making them a popular choice among students.

On the other hand, scholarships represent a fantastic opportunity to fund your education without the burden of repayment. There’s a vast array of scholarships available based on various criteria, including merit, need, or specific talents. Be proactive in seeking out these chances, as many students overlook lesser-known scholarships that could provide significant support.

Additionally, consider the option of grants, which are often awarded based on need and do not require repayment, just like scholarships. They can be offered by the government, your institution, or private organizations. Taking the time to research and apply for these resources could substantially ease your financial load.

As you navigate these alternatives, staying organized and informed will be crucial. Set up a plan to keep track of different applications, deadlines, and requirements. Each step you take towards exploring loan and scholarship alternatives can serve as a vital move toward achieving your educational goals.