Exploring Options When Financial Aid Falls Short of Your Needs

Many students and families assume that the support provided by institutions or programs will be sufficient to cover all educational expenses. However, the reality can be quite different. As costs rise and resources are stretched thin, it’s common to face financial barriers that leave individuals seeking further solutions.

In an ideal world, the resources available would seamlessly align with tuition, books, and living expenses. Unfortunately, this isn’t always the case. For some, a lack of comprehensive backing leads to tough choices and uncertainty about the future. When trying to navigate the complexities of higher education, understanding alternative avenues for assistance can be crucial.

Exploring supplemental avenues, creative budgeting strategies, and understanding eligibility criteria can empower individuals to overcome challenges. By embracing a proactive approach and seeking out various resources, it becomes possible to bridge the gap between aspirations and reality.

Exploring Alternative Funding Options

Sometimes, the available resources just don’t cut it when it comes to covering expenses. Fortunately, there are various creative routes to secure the necessary support. Whether it’s for education, projects, or personal initiatives, looking beyond conventional sources can open up new possibilities.

Scholarships are often overlooked gems. Many organizations, foundations, and even businesses offer them based on specific criteria. A little research can reveal numerous opportunities tailored to diverse backgrounds, talents, or interests.

Grants also present a fantastic avenue. Unlike loans, these funds do not require repayment, making them an attractive option for those looking to pursue their goals without added stress. Various institutions grant funding based on project proposals, research, or other qualifying factors.

Additionally, crowdfunding has gained popularity in recent years. Platforms allow individuals to share their stories and attract backers who resonate with their mission. This method cultivates community support and can create a network of like-minded individuals passionate about a common cause.

Part-time work can offer flexibility and financial relief simultaneously. Many students or aspiring professionals take on jobs that align with their schedules, providing both experience and some extra cash flow.

Negotiating payment plans with service providers can also ease the burden. Many institutions understand the financial strain and are willing to create manageable installment plans that make larger expenses feel less overwhelming.

Finally, donations from family, friends, or community members can provide a much-needed boost. Don’t shy away from sharing your goals and asking for support; you’d be surprised how many people want to help you achieve your dreams.

Strategies for Managing Financial Shortfalls

When resources fall short of what’s expected, it can feel overwhelming. However, there are effective ways to navigate these challenges. Adapting your approach and finding creative solutions can make a significant difference in sustaining your goals.

1. Create a Detailed Budget

Start by outlining all your income sources and expenses. A clear budget will help identify areas where you can cut costs. Prioritizing necessities over luxuries ensures that your most important needs are met.

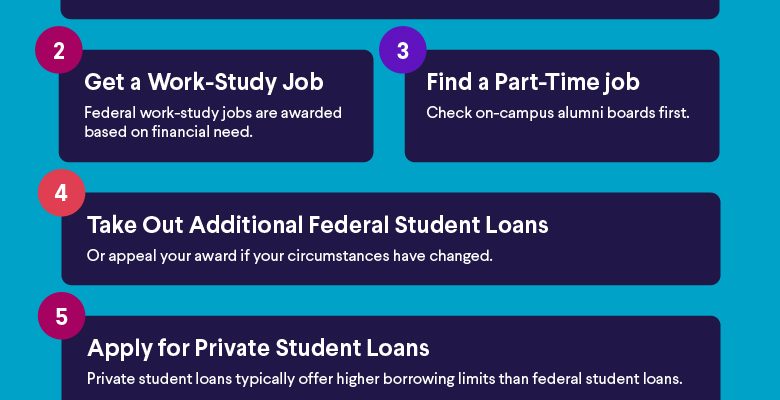

2. Explore Alternative Funding Sources

Don’t hesitate to look beyond traditional options. Consider scholarships, community grants, or even crowdfunding campaigns. Every little bit helps, and you might uncover opportunities you hadn’t thought of before.

3. Increase Your Income

If possible, consider picking up a part-time job or freelancing. Even small gigs can provide a helpful boost to your finances and ease some of the burden during tough times.

4. Connect with Advisors

Reaching out to financial consultants or campus advisors can provide valuable insights. They may suggest resources or strategies that you hadn’t considered, which can lead to new solutions.

5. Build an Emergency Fund

As you work through your financial journey, try to set aside a small amount regularly. An emergency stash can cushion you against unexpected expenses and provide peace of mind.

6. Reassess Plans Regularly

Stay adaptable. Regularly reviewing your goals and progress can help you pivot if necessary. Adaptability and foresight are key to maintaining a steady course in challenging situations.

By implementing these strategies, navigating through tight spots can become more manageable, allowing you to focus on achieving your aspirations without as much stress.

Long-term Solutions and Planning Ahead

It’s essential to think beyond immediate resources when facing tuition challenges. Embracing a proactive approach can make a significant difference in navigating educational expenses. By assessing various strategies and options available, individuals can build a robust framework for their financial journey.

One effective method is to explore scholarships and grants that may align with your academic or extracurricular strengths. Investing time in researching opportunities can uncover valuable funding sources. Additionally, considering part-time work or internships related to your field of study can provide both financial support and valuable experience.

Budgeting plays a critical role in long-term planning. Establishing a clear financial plan helps track expenses and prioritize needs. It’s worthwhile to evaluate daily spending habits and identify areas for potential savings. Using tools like apps or spreadsheets can make this process more manageable.

Engaging with financial advisors or school counselors can provide personalized insights and guidance. They can help create tailored plans that consider individual goals and circumstances. Networking with peers who have successfully navigated similar paths can also offer practical tips and encouragement.

Finally, cultivating a mindset of adaptability and resilience is vital. Circumstances may change, and being open to reassessing plans can lead to newfound opportunities. By considering various avenues and staying informed, the journey ahead can become much more manageable and fulfilling.