Exploring the Various Types of Financial Aid Available for College Students

Embarking on the journey of higher education is an exciting yet daunting experience, especially when it comes to managing expenses. Many individuals find themselves pondering the various forms of assistance available to help ease the financial burden of their academic pursuits. Understanding these options is crucial for planning a successful and stress-free learning experience.

There’s a wealth of possibilities out there, including grants, scholarships, and other resources that can significantly reduce costs. By diving into this topic, students can uncover a variety of opportunities tailored to their specific needs, making it easier to navigate the often-complex world of funding. It’s all about finding the right tools to support your ambitions and ensure a brighter future.

No matter your background or aspirations, there is a vast network of resources designed to empower you on your academic path. From merit-based awards to need-based support, the landscape is rich with possibilities awaiting those willing to explore and take action. Let’s take a closer look at what’s available and how you can make the most of these resources.

Types of Support for Students

When it comes to pursuing higher education, understanding the different forms of assistance available can lighten the financial burden. Various options exist to help students cover their expenses, making the journey toward a degree more achievable. Each category of support plays a unique role in providing resources that can significantly impact your schooling experience.

The first category revolves around grants, which are sums of money awarded based on need or specific criteria. Unlike loans, these do not require repayment, making them an excellent choice for those seeking to minimize debt.

Another important option is scholarships, which recognize academic or extracurricular excellence. These awards can come from institutions, private organizations, or community groups and vary in amount.

Loans offer yet another route, allowing students to borrow funds with the understanding that they will repay them later, typically with interest. While these can sometimes be necessary, it’s vital to approach them with caution and an understanding of repayment terms.

Additionally, work-study programs present an opportunity for students to earn money while balancing their studies. These positions, often tied to campus-based employment, not only provide income but also valuable experience.

Lastly, relatives or guardians may provide support in the form of personal funds or educational savings plans. This approach can be beneficial in covering some of the overall expenses associated with schooling.

In summary, a variety of support mechanisms are available to assist students in navigating their academic costs. By exploring all options, you can find the perfect combination that works for your unique situation.

How to Apply for Scholarships

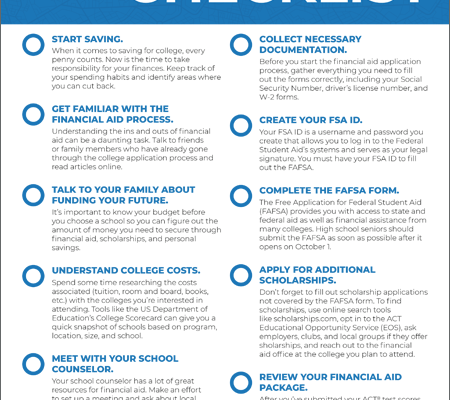

Embarking on the journey to secure funding is an essential step towards achieving your academic aspirations. Understanding the process can make all the difference in accessing valuable resources that lighten the financial load. With some clarity on how to approach these opportunities, you can position yourself for success.

Research is Key: Begin by exploring various organizations, schools, and community groups that offer monetary support. Make a list of potential scholarships that resonate with your background, interests, or specific talents. The more tailored your search, the better your chances of finding a suitable match.

Prepare Your Documents: As you gather necessary materials, ensure that your resume, transcripts, and recommendation letters are up to date. A well-crafted personal statement that highlights your achievements and goals can significantly enhance your application. Take the time to articulate what makes you a strong candidate.

Follow Instructions Carefully: Each opportunity will come with its unique requirements and guidelines. Always adhere to the criteria provided. Pay close attention to application deadlines, formats, and submission methods to avoid disqualifying yourself due to simple oversights.

Seek Feedback: Before submitting your applications, consider asking a mentor or teacher to review your documents. Their insights can help refine your approach and highlight any areas for improvement. A fresh perspective can make all the difference.

Stay Organized: Create a timeline that tracks deadlines, required documents, and submission dates. This will help you manage your time effectively and ensure that you don’t miss any opportunities. Staying organized can alleviate stress as you navigate the application process.

Keep Applying: Do not limit yourself to just one or two submissions. The more applications you complete, the greater your chances of success. Persistence is crucial, so stay motivated and keep seeking out opportunities that align with your goals.

By following these steps, you’ll develop a solid foundation for your scholarship applications, opening doors to support that can help you realize your educational ambitions.

Understanding Student Loan Options

Diving into the world of educational financing can feel overwhelming, but knowing your choices makes the journey much easier. There are various paths one can explore to fund their academic endeavors, each with its own set of advantages and responsibilities. It’s essential to grasp the basics of these alternatives to make informed decisions about your future.

Student loans are typically classified into two main categories: federal and private. Federal loans are backed by the government and often come with favorable terms, such as lower interest rates and flexible repayment plans. On the other hand, private loans are offered by banks or other financial institutions, and their conditions can vary significantly based on the lender’s policies and your credit history.

Among federal loans, you’ll encounter subsidized and unsubsidized options. With subsidized loans, the government covers interest costs while you’re in school, providing some relief as you complete your studies. Unsubsidized loans start accruing interest right away, meaning you’ll need to manage that cost once you graduate.

Private loans can be a helpful solution if federal options don’t fully meet your needs. However, it’s crucial to shop around and compare interest rates, repayment terms, and any associated fees. Understanding how these aspects impact your long-term financial picture will equip you to choose the right path.

Take the time to research and gather information about the different types of loans available. Each choice has implications, and being well-informed will empower you to tackle your educational financing with confidence.