Understanding the Concept and Benefits of an Equity Line of Credit

Have you ever thought about leveraging the value of your home to access funds? Many homeowners turn to a popular financial mechanism that allows them to do just that. This option often provides a flexible way to tap into the wealth accumulated in your property, making it an attractive choice for those looking to finance various expenses.

Instead of going through the lengthy process of securing a traditional loan, this alternative offers a streamlined approach. With this financial product, individuals can borrow against their property’s value, gaining access to a lump sum or ongoing funds as needed. It’s a convenient way to use an asset that may otherwise sit untouched, providing potential opportunities for everything from home improvements to debt consolidation.

As you explore this avenue, it’s essential to understand its mechanics and implications fully. Many find it a valuable resource, but like any financial decision, it comes with its own set of considerations. Let’s dive deeper into how this beneficial tool works and what you should keep in mind before making a move.

Understanding Home Equity Lines of Credit

Have you ever thought about tapping into the financial potential of your home? Many homeowners are unaware that they can leverage the value of their property to access funds. This article will explore how you can use what you’ve built up in your home to finance various personal needs, from renovations to unexpected expenses.

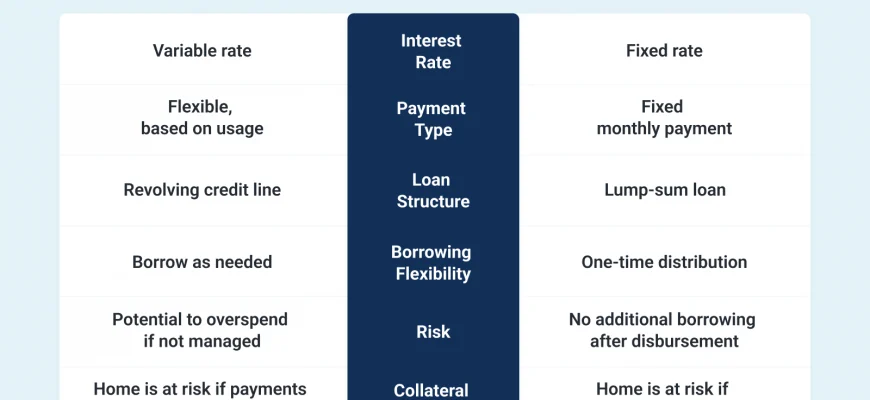

A home equity arrangement allows you to borrow against the amount your property has appreciated over time. It essentially provides you with a flexible borrowing option, giving you the ability to withdraw money as needed instead of receiving a lump sum all at once. This can be particularly advantageous for managing finances in a dynamic way.

One of the primary benefits of this borrowing option is the lower interest rates compared to traditional loans. This means you can save money and pay off debt more efficiently. You may even find that you can consolidate higher-interest debts into a single, more manageable payment.

However, it’s essential to recognize that using your home as collateral comes with risks. If you’re unable to make payments, your property could be at stake. Therefore, careful planning and budgeting are crucial before proceeding with such financial decisions.

In summary, understanding the intricacies of accessing funds through your property’s value can provide you with a great financial tool. Just be sure to weigh the possibilities and risks to make informed choices that align with your long-term goals.

Benefits of Using an Equity Line

Diving into a flexible financial resource can significantly enhance your ability to manage expenses and seize opportunities. This tool offers a way to tap into your property’s potential while providing various advantages that can meet your needs.

- Accessibility: Having a readily available source means you can cover unexpected costs or make important investments without delay.

- Interest Rates: Typically, the rates associated with this financial product are lower than those on personal loans or credit cards, making it a cost-effective option for borrowing.

- Flexibility: You can withdraw as much or as little as you need, only paying interest on the amount you actually use, giving you control over your finances.

- Potential Tax Benefits: In some cases, the interest paid might be tax-deductible, providing additional savings for homeowners.

- Encourages Financial Planning: Having this tool at your disposal can motivate you to budget wisely, as it encourages strategic thinking about your finances.

Overall, utilizing this resource can empower you to navigate both planned and unexpected situations with greater ease, ultimately leading to a more secure financial future.

Application Process for HELOC

Navigating the journey to access additional funds through your home can be an exciting yet daunting task. The method involves a series of straightforward steps designed to help you unlock financial possibilities. Understanding what to expect can make the experience smoother and less intimidating.

The first step in the process typically involves gathering essential documents. Lenders will want to review your financial situation, which might include pay stubs, tax returns, and a comprehensive list of debts. Being prepared with these documents can significantly speed up the application.

Next up is the pre-approval stage. During this phase, lenders assess your financial health to determine how much money you can potentially borrow. They will consider your credit score, income, and the value of your property. A strong financial status means better offers, so keep that in mind as you proceed.

Once pre-approval is granted, the formal application begins. This is where you’ll submit all required information and documents to the lender for review. Precision is vital here; ensuring that all details are accurate can help avoid delays.

After submitting your application, the lender will conduct a thorough assessment. This includes an appraisal of your home, which determines its current market value. Once the appraisal is complete and everything checks out, you’ll receive the final offer detailing the borrowing terms.

Finally, it’s time to review and finalize your agreement. Make sure to read everything carefully, as the conditions can vary significantly from one lender to another. Once you’re satisfied, you’ll complete the necessary paperwork, and the funds will become available for your use. This final step marks the beginning of exciting financial opportunities!