Understanding the Implications of a Student Aid Index Rating of Zero

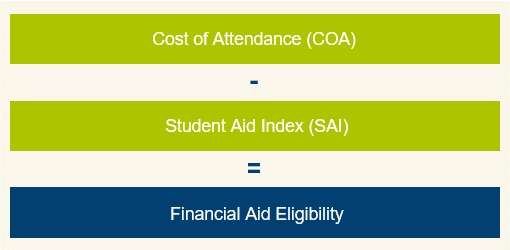

When navigating the complex landscape of financing education, clarity around various assessments can greatly impact one’s decisions. Among these metrics, a score of zero plays a pivotal role, prompting important questions about its implications. This figure often sparks curiosity and even confusion, as it reflects nuances in the overall evaluation process.

Having a zero in this context may indicate a variety of considerations, shedding light on financial eligibility and available resources. It’s essential to delve deeper into what such a score entails and how it influences opportunities for support. Understanding this aspect not only empowers individuals but also enables better planning for their academic journeys.

In the following sections, we will explore the factors contributing to a zero score and what it signifies for aspiring learners. You may find that this situation is not as daunting as it appears, and there are pathways available for those seeking educational funding.

Understanding the Student Aid Index

In the world of educational financing, certain concepts can greatly influence how resources are allocated to learners. One such notion is associated with a numerical value that indicates eligibility for financial support. A figure like zero can carry significant implications, shaping opportunities for applicants and determining the level of assistance they might receive. This can affect both the students’ perspective on funding and the strategies institutions employ to distribute their resources.

Having a score that registers as nil suggests that the individual may not qualify for traditional forms of financial help. However, it’s essential to recognize that this does not imply a lack of need. Many factors contribute to the overall assessment, and a zero may reflect unusual circumstances or unique financial backgrounds. It’s crucial to interpret this indicator holistically, considering all aspects of a learner’s life and their potential for success.

The concept behind this evaluation system serves as a way to streamline the distribution of monetary support, allowing those with the greatest need to receive assistance first. For some, a zero score may prompt the exploration of alternative funding options, such as scholarships or work-study programs. Regardless of the implications, understanding these metrics is vital for both aspiring scholars and educators alike in navigating the financial landscape of higher education.

Implications of a Zero Financial Assistance Metric

When a financial assistance evaluation comes back with a score of zero, it carries significant meaning for individuals seeking educational funding. This outcome suggests that one may not qualify for federal grants, scholarships, or other forms of need-based financial support typically available to students. Understanding its impact is essential for future plans and decision-making.

A zero score often indicates sufficient resources or income levels that disqualify someone from receiving additional financial help. This can lead to a range of consequences, from needing to rely solely on personal savings or parental support to taking on student loans to cover educational expenses. For many, this represents a considerable financial burden that could affect their educational journey.

Moreover, this situation can also lead to a reevaluation of the chosen institution. Tuition fees can vary dramatically among different colleges and universities, and some may offer more generous scholarships or merit-based funding opportunities. Exploring alternatives could help alleviate the financial strain resulting from a zero score.

It’s also important to note that a zero evaluation doesn’t mean that all hope for assistance is lost. Students should consider appealing the decision if they believe their financial circumstances have not been accurately represented. Engaging with financial aid offices can provide avenues for exploring other funding sources or understanding additional options available.

How to Enhance Financial Assistance Eligibility

Improving your chances for financial support can make a significant difference in managing educational expenses. Many factors influence eligibility, and understanding how to optimize these elements can lead to better funding opportunities. Here are some effective strategies to consider.

First, keep your financial records organized. Having accurate documentation for income, savings, and other assets is crucial. This ensures that your application reflects your actual situation, which can help in presenting a strong case for assistance.

Additionally, be mindful of deadlines. Keep track of all important dates related to applications and renewals. Submitting your forms on time can greatly enhance your chances of receiving support.

Don’t hesitate to explore all available options. Look into scholarships, grants, and other programs that cater to your unique situation. Research is key; many lesser-known opportunities exist beyond the mainstream options.

Furthermore, consider appealing a financial decision if necessary. If your circumstances change significantly or if you believe your application was unfairly assessed, reaching out to the reviewing office can sometimes yield positive results.

Lastly, keep your academic performance in focus. Institutions often take grades into account when assessing need. Striving for excellence can contribute to both your financial aid possibilities and your educational journey overall.