Understanding the Implications of Having a Low Credit Score and Its Impact on Your Financial Future

In the world of personal finance, the level of trustworthiness that a consumer holds is often assessed by various factors. This evaluation plays a crucial role in determining an individual’s ability to secure loans, obtain credit cards, or even rent a home. When these evaluations yield less than desirable outcomes, it can pose significant challenges in managing financial goals and obligations.

For many individuals, encountering unfavorable ratings can feel overwhelming. It signifies potential hurdles in accessing essential financial services, often leading to higher interest rates or outright denial of applications. However, understanding the implications of such evaluations is the first step towards taking control and improving one’s financial situation.

With a grasp of this complex landscape, individuals can navigate their finances more effectively. Learning about the factors that contribute to these evaluations can empower people to make informed decisions and work towards enhancing their financial profiles. Ultimately, knowledge is the key to unlocking better opportunities in the financial realm.

Understanding the Impact of Low Credit Scores

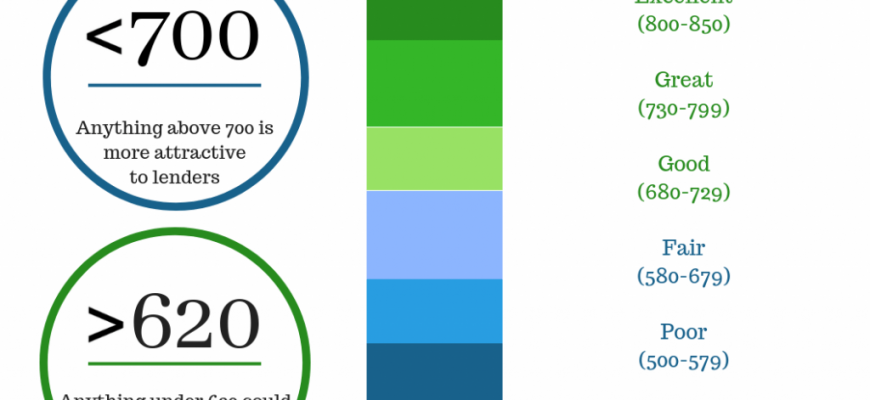

Having a diminished financial rating can significantly affect one’s life. It often leads to challenges when applying for loans, rental agreements, or even employment opportunities. A low rating signals to lenders that there may be risks associated with extending credit, ultimately restricting access to essential financial resources.

The consequences can be far-reaching. Individuals may face higher interest rates, increased insurance premiums, or limited choices when it comes to housing. Even basic utilities might require a deposit due to concerns about timely payments. Such restrictions can create a cycle that hampers financial well-being and growth.

Additionally, navigating daily life with a questionable financial footprint can be stressful. It may impact one’s ability to confidently make big purchases, plan for the future, or even secure a reliable vehicle. Understanding this situation is crucial for anyone looking to improve their circumstances.

However, it’s important to know that there are pathways to recovery. Awareness of one’s financial health and taking proactive steps can lead to improvement over time. Building a solid foundation for future financial endeavors ultimately fosters a more secure and empowering lifestyle.

Factors Contributing to a Low Credit Rating

Understanding the elements that can negatively impact your financial reputation is essential. Many aspects of your financial habits and history can lead to a less favorable assessment. By recognizing these influences, you can work toward improving your standing.

- Payment History: Missing payments or consistently paying late sends a red flag to lenders. Staying current is crucial.

- Credit Utilization: Using a high percentage of your available funds can signal risk. Ideally, keep this below 30%.

- Length of Credit History: A shorter track record can limit your appeal to lenders. Building credit over time is beneficial.

- Types of Credit: A lack of variety in your accounts, such as not having a mix of revolving and installment loans, may hinder your rating.

- Recent Inquiries: Too many hard inquiries within a short timeframe can indicate financial distress. Limit these requests to maintain a healthy profile.

Addressing these areas can lead to significant improvements in your financial standing. Being proactive and aware is key to a stronger ranking.

Steps to Improve Your Credit Rating

Building a strong financial reputation takes time and effort, but it’s definitely worth it. By implementing certain strategies, you can enhance your standing and open doors to better opportunities. Let’s dive into some effective ways to boost your financial credibility.

First, keep an eye on your financial reports. Regularly reviewing them allows you to spot any inaccuracies or fraudulent activities that could harm your standing. If you find any discrepancies, address them promptly with the reporting agency.

Next, ensure you make all your payments on time. Late payments can significantly impact your standing, so setting up reminders or automatic payments can help you stay on track.

Another important step is managing your credit usage wisely. Aim to use a small percentage of your available limits. Keeping your utilization low demonstrates responsible usage and can positively influence your rating.

Diversifying your credit types can also be beneficial. Having a mix of accounts, such as loans and credit cards, shows lenders that you can handle different kinds of financial responsibilities.

Finally, avoid opening too many new accounts at once. While it can be tempting to seek multiple credit lines, frequent inquiries can raise concerns for lenders. Instead, focus on gradually improving your existing accounts over time.