Understanding the Components and Structure of a Financial Aid Package

Diving into the world of funding for education can be both exciting and overwhelming. As students and families seek ways to make learning more accessible, a variety of resources become available, tailored to meet diverse needs. Navigating through this abundance of options helps individuals grasp the financial landscape and discover the opportunities that await.

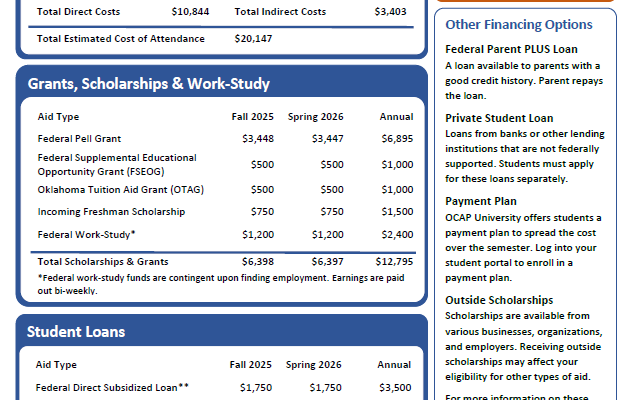

The journey typically begins with a comprehensive overview of available resources aimed at easing the burden of educational expenses. This breakdown includes grants, loans, and scholarships that serve different purposes, yet all contribute towards one common goal: making education attainable for everyone. Each component plays a vital role in shaping the overall support, and understanding their distinct characteristics can empower students to make informed decisions.

When examining these resources, it’s crucial to comprehend how they interrelate and influence one another. The nuances of eligibility requirements, repayment terms, and potential benefits may vary widely, yet their collective impact becomes clearer as one delves deeper. With a clear vision of financial options, individuals can better assess how these elements fit into their broader educational journey, ultimately leading to a more secure and successful future.

Components of a Financial Assistance Offering

When exploring options for support in educational pursuits, it’s essential to understand the various elements that come together to form a comprehensive support strategy. Each piece plays a crucial role in helping students manage their expenses while pursuing their academic goals. Let’s delve into these vital components and see how they contribute to a student’s journey.

One of the primary elements includes grants or scholarships, often awarded based on financial need or academic merit. These are essentially free funds, meaning they do not require repayment, making them highly valuable for reducing overall debt. Another important aspect is loans, which provide funding but must be repaid with interest after graduation. This factor is critical to consider when planning your financial future.

Additionally, work-study programs are frequently included, allowing students to earn money through part-time jobs while studying. This not only helps cover living costs but also offers valuable work experience. Moreover, some institutions may offer institutional aid, which stems from the school itself, tailored to assist students who demonstrate potential and merit.

Lastly, understanding the eligibility criteria for each component is vital for maximizing these resources. By recognizing the distinct parts of an assistance offering, students can make informed decisions and seek out the right support to enhance their educational experience.

Types of Support Available

When it comes to funding your education, there are several options to consider that can make a real difference. Schools, governments, and private organizations often provide various forms of assistance to help students manage the costs of their studies. Understanding the different types can help you navigate the landscape of educational financing more effectively.

Grants are typically awarded based on need and do not require repayment, making them a favorable option for many. Scholarships, on the other hand, are often merit-based and can come from numerous sources, including high schools, colleges, and private entities. These can recognize academic excellence, special talents, or contributions to the community.

Loans are another common solution, allowing students to borrow funds to cover expenses. Unlike grants and scholarships, loans do require repayment with interest, so it’s important to borrow wisely. Work-study programs also provide an opportunity to earn money while gaining valuable experience, as they allow students to work part-time in positions related to their field of study or campus needs.

Finally, fellowships and assistantships cater to graduate students, offering stipends or tuition waivers in exchange for teaching or research responsibilities. Each of these options comes with its unique benefits and considerations, and being aware of them can empower you to make informed choices about financing your education.

Understanding Your Financial Aid Award Letter

Receiving a letter detailing the assistance available for your education can be both exciting and overwhelming. This document is crucial as it outlines the resources you can tap into to help cover your tuition and other expenses. Grasping the information within is essential for making informed choices about your academic journey.

Typically, this letter will include a variety of support types, such as grants, scholarships, loans, and work-study opportunities. Each component has specific conditions and implications, so it’s important to examine each closely. Understanding the distinctions between free money, which you won’t need to repay, and loans, which you will, can significantly impact your financial planning.

Additionally, the letter may specify the total amount you’re eligible for, along with any required actions to secure these funds. Reading carefully can reveal opportunities that you might not have considered before. Familiarizing yourself with terms and conditions is vital, as it ensures you’re on solid footing as you move forward with your studies.

Ultimately, this document serves as a roadmap to navigating your funding options. Don’t hesitate to reach out to your school’s financial services office if you have questions or need clarification. Understanding this crucial information empowers you to take charge of your educational expenses and minimize any unforeseen financial burdens.