Understanding the Implications of Financial Aid Overpayment and Its Consequences for Students

Many students rely on assistance to help manage the costs of education. However, sometimes the amount received can exceed the actual needs, leading to a situation that can be quite confusing. Navigating through these excess funds can be challenging, particularly when figuring out what steps to take next and how it may impact future benefits.

When you receive more help than anticipated, it’s essential to know the implications. This surplus can arise from various sources, including changes in enrollment status or adjustments in eligibility. Understanding the nuances of these situations can prevent unnecessary stress and complications down the line.

In this article, we will explore the concept of excess support, shedding light on its causes, effects, and how to address it. Grasping this information can empower you to take control of your academic funding and make informed decisions for your financial future.

Understanding Financial Aid Overpayment

Navigating the world of educational assistance can sometimes feel like a complex maze. It’s not uncommon for students to find themselves in a situation where they receive more resources than they were eligible for. This can lead to some unexpected consequences that may affect their future. Grasping the nuances of these circumstances is crucial for anyone relying on such support to finance their studies.

When individuals receive excess funds, it often stems from various factors, such as changes in enrollment status, unreported income, or errors in the application process. These situations can create a ripple effect, impacting not just current resources, but also future eligibility. Understanding the implications of these financial discrepancies is vital for maintaining good standing and ensuring responsible management of one’s educational journey.

Addressing any surplus requires prompt communication with the relevant authorities to rectify the situation. Ignoring it can lead to complications like repayment demands or a reduction in future support, which can be a burden during one’s studies. Staying informed and proactive safeguards against such challenges and helps students make the most of their educational investments.

Common Causes of Overpayment Issues

When it comes to receiving support for education-related expenses, clients may occasionally find themselves dealing with excess funds. Understanding the most frequent reasons behind these situations is crucial for avoiding potential pitfalls in the future.

- Incorrect Information: Mistakes in paperwork can lead to discrepancies. This includes errors in reported income, enrollment status, or family size.

- Changes in Circumstances: Sudden changes such as job loss or family emergencies might not be updated in a timely manner, affecting eligibility.

- Miscommunication: Lack of clear communication between students and funding bodies can result in misunderstandings about award amounts or required actions.

- School Policies: Some institutions have their own guidelines that may cause unexpected surpluses if not properly formatted with external funding.

- Volunteer Work or Scholarships: Accepting unreported scholarships or engaging in volunteer positions that offer educational credits can lead to funding discrepancies.

Being aware of these factors helps in taking proactive measures to ensure a smoother experience. Keeping in touch with funding sources and maintaining accurate records can make a significant difference.

Consequences of Receiving Excess Funds

Receiving more money than intended in the context of educational assistance can lead to various complications. While it may seem like a fortunate circumstance at first, there are many implications that can arise from this situation. Understanding these effects is crucial for anyone involved in funding their education.

One of the primary concerns is the obligation to repay the surplus amount. If an institution realizes that a student has received too much support, they will typically require repayment of the excess. This unexpected financial burden can create stress, especially if the student has already allocated those funds towards living expenses or tuition.

Furthermore, having an improper amount can affect future funding opportunities. Institutions may flag students for improper payments, which could lead to delays in receiving assistance in subsequent terms or years. This situation may also impact eligibility for other programs or scholarships, putting additional restrictions on a student’s financial planning.

Additionally, dealing with excess funds can result in complications with tax obligations. Depending on the amount of the overpayment, students may have to report this money as income, which can change their tax situation significantly. It’s essential to stay informed about these potential repercussions to avoid any surprises when tax season arrives.

Lastly, the emotional toll of managing excess funds should not be underestimated. Navigating the complexities of repayment and potential ramifications on one’s academic journey can lead to anxiety and uncertainty. It’s always best to understand the full scope of any assistance received to prevent these adverse effects.

How to Resolve Overpayment Cases

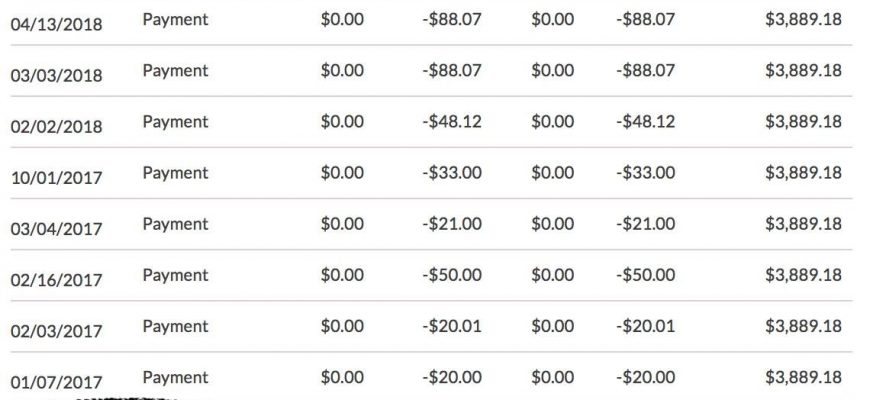

When you find yourself in a situation where you’ve received more assistance than intended, it’s essential to take action. The first step is to review your account statements and communications to understand the extent of the discrepancy. You want to ensure that you have a clear picture before proceeding. Being informed will help you navigate the resolution process smoothly.

Next, reach out to the relevant office or department responsible for handling these matters. This may be the financial services or student affairs office at your institution. It’s crucial to communicate openly and provide any documentation that may support your case. Remember to keep copies of everything you send or receive.

After reporting the issue, you may be asked to complete specific forms or provide additional information. Don’t hesitate to ask questions if something isn’t clear. Clarifying doubts early can save time and prevent misunderstandings that could prolong the process.

Stay patient throughout this journey. Resolving these situations can sometimes take longer than expected. Keep track of all communications and responses. If you feel the situation isn’t progressing, consider following up regularly. Persistence can play a critical role in reaching a satisfactory resolution.

Finally, once the issue is resolved, take steps to prevent future occurrences. This can involve keeping better records of your assistance, regularly checking your balances, and staying updated on any changes in guidelines or policies related to support. Being proactive is essential for smooth sailing ahead.