Understanding the Meaning of “Fin Aid Off” as Discussed on Reddit

In the ever-evolving world of student support and funding, it can be a bit overwhelming to navigate the various terms and phrases that pop up. Many students and families find themselves sifting through discussions and explanations to fully grasp what each term signifies. One such phrase often surfaces in conversations among those exploring financial options for education.

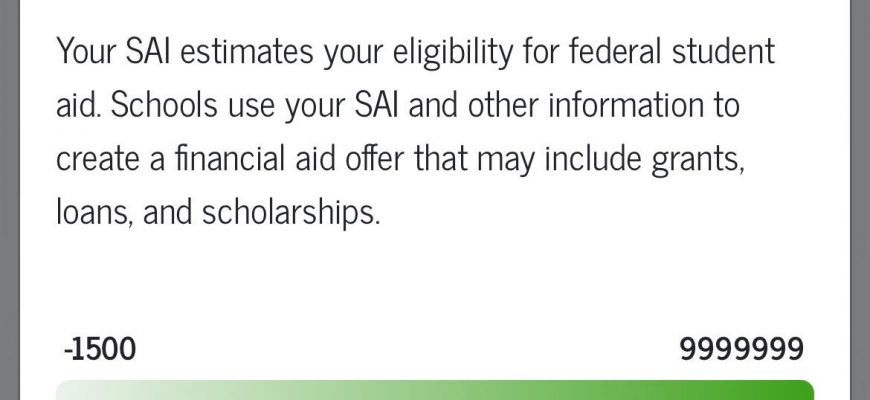

This particular expression refers to a specific scenario within the realm of monetary support that students seek. It encapsulates the notion of benefits or perks that could potentially lighten the financial burden associated with educational costs. With so much information circulating, especially on platforms where individuals share their experiences, clarifying these concepts becomes essential.

As we delve deeper into this topic, it’s important to consider the implications and nuances that come with it. Grasping the subtleties of these terms helps students make more informed decisions regarding their financial futures, ensuring they utilize available resources effectively. So, let’s break it down and shed some light on what this phrase entails in the grand tapestry of educational financing.

Understanding Financial Aid Offers

Navigating the landscape of financial assistance can feel overwhelming, especially for students stepping into higher education. These offers can significantly impact your educational journey, making it crucial to grasp their components and implications. In this section, we’ll break down the essentials to help you make informed decisions about your funding options.

At their core, these proposals outline the support available to students, which may range from scholarships to loans and grants. It’s not just about the numbers; understanding the fine print is vital. You’ll want to pay close attention to the terms and conditions surrounding each type of support, as some can be more beneficial than others.

Common Elements you will encounter include direct funding sources like merit-based scholarships, need-based assistance, and work-study opportunities. Each of these has its own criteria, eligibility requirements, and repayment expectations. It’s wise to evaluate the long-term effects of loans, especially if they come with interest accumulations.

Moreover, many institutions provide a net price calculator, helping you estimate your actual costs after financial support is applied. This tool can give a clearer picture of your financial commitment and help you compare different options.

Lastly, don’t hesitate to seek advice from financial advisors or school counselors. Engaging in discussions can uncover additional resources or strategies that might work best for your unique situation.

Key Components of Financial Support Packages

When it comes to funding education, understanding the essential elements that make up financial support can be quite enlightening. These packages often include various types of assistance designed to ease the financial burden on students and their families. Let’s dive into the core aspects that commonly appear in these offerings and what they might mean for students navigating their educational journey.

First off, grants often take center stage in these packages. They are essentially free money provided to students based on need or merit, and they don’t require repayment. This feature makes them especially appealing, as they can significantly lower overall expenses. Next, scholarships play a similar role, yet they typically reward academic achievements or other specific talents, also not requiring reimbursement.

In addition to that, loans are another significant piece of the puzzle. Unlike grants and scholarships, loans must be repaid with interest, which means students should carefully consider their options before borrowing. It’s crucial to understand the terms, interest rates, and repayment plans of any loans included in an overall financial support strategy.

Moreover, work-study programs offer an interesting alternative. They provide students with an opportunity to earn money through part-time employment, often related to their field of study. This not only helps offset educational costs but also fosters valuable work experience.

Finally, understanding the distinctions between these components can empower students to make informed decisions that align with their financial situations and academic goals. By evaluating the various elements involved, students can create a strategic approach to financing their education effectively.

Navigating Financial Assistance Discussions

Engaging in online forums about monetary support can be a bit overwhelming. It’s a space filled with individuals sharing personal experiences, advice, and a myriad of opinions. The key is understanding the various perspectives and finding useful insights that resonate with your unique situation. Whether you’re seeking guidance on funding options or looking to share your own journey, these platforms can be incredibly valuable.

Understanding the Community is essential. Each thread tends to have its own vibe, with users ranging from seasoned veterans to newcomers trying to find their footing. Don’t hesitate to ask questions! Most participants are eager to help and share their knowledge.

Reading between the lines is also crucial. Sometimes, phrases used might have specific meanings within the community. Context matters, and it’s always a good idea to look up unfamiliar terms or acronyms to ensure you’re fully grasping the conversation.

Lastly, remember that everyone’s financial journey is unique. Advice that works for one person may not work for another. Take the time to analyze different viewpoints and trust your instincts to make informed decisions. Happy browsing!